The US market is torn apart: the seven giants of the stock market are leading the way, and long and short-term bonds are going their separate ways!

2025-08-06 15:35:17

Bond market split: Short-term and long-term bonds have different views

Short-term bonds are driven by the Federal Reserve and are volatile

The bond market's divergence was fully ignited on August 5th. On the one hand, the latest US jobs data, unexpectedly weak, signaled cracks in the labor market. On the other hand, President Trump's abrupt dismissal of the senior official responsible for compiling statistics caught the market off guard. This double blow sent the two-year Treasury yield plummeting 25 basis points last Friday, its largest single-day drop in a year. More strikingly, the yield curve between the two-year and 30-year Treasury bonds steepened by 20 basis points, the most significant move in two and a half years.

The sharp drop in short-term bond yields reflects rapidly growing investor concerns about the economic outlook. Once the labor market showed signs of hindering economic growth, market concerns about "fiscal laxity" seemed to vanish. So-called "bond vigilantes" (investors hypersensitive to government deficits) also failed to stir much of a stir. Surprisingly, the market did not experience a significant correction on Monday, and short-term bond prices actually climbed further, pushing the two-year Treasury yield to 3.66%, a new low since May. This strong performance in short-term bonds highlights investors' strong bets on a Federal Reserve rate cut.

Hidden concerns about long-term bonds: fiscal deficit and inflationary pressure

Compared to the sharp fluctuations in short-term bonds, long-term Treasury yields also fell, but to a much lesser extent. This resulted in a significant widening of the yield spread between two-year and 30-year bonds, bringing the yield curve steepness to its highest point in more than three years, surpassed only by the brief turmoil caused by tariffs in April. Long-term Treasury bonds are more sensitive to the United States' rising federal debt and fiscal deficit, and investor concerns about their outlook remain persistent. Even with market expectations of a possible Federal Reserve rate cut, the appeal of long-term Treasury bonds remains constrained by fiscal and inflationary factors.

This diverging narrative between short-term and long-term bonds reflects the dilemma facing investors in a complex economic environment. On the one hand, short-term bonds are highly sought after due to their sensitivity to Federal Reserve policy; on the other hand, concerns about fiscal sustainability have left investors hesitant about long-term bonds. This parallel investment mentality is not new, but the current divergence between short-term and long-term bonds has caused unprecedented market volatility.

Stock market polarization: The balance between the Big Seven and the “others” is unbalanced

The seven giants dominate the market, with unprecedented concentration

If the fragmentation of the bond market is striking, the trend toward concentration in the stock market is even more astonishing. In recent years, the "Big Seven"—represented by Meta, Microsoft, and Apple—as well as other tech and AI-focused giants, have consistently dominated the US stock market. In particular, the impressive earnings reports of these tech giants over the past few days have further boosted their stock prices, igniting a heated debate in the market over concentration risks, bubbles, and the long-term benefits of AI.

According to Bank of America, a handful of large technology companies now account for 40% of the total US stock market capitalization, a historically rare proportion. Even more astonishingly, the valuation of technology stocks relative to the overall S&P 500 index has surpassed its peak during the dot-com bubble. This surge in concentration has not only heightened investor concerns about a market bubble, but has also led to a growing indifference to the performance of companies outside the "Big Seven."

The struggles of other companies: Overshadowed by the giants

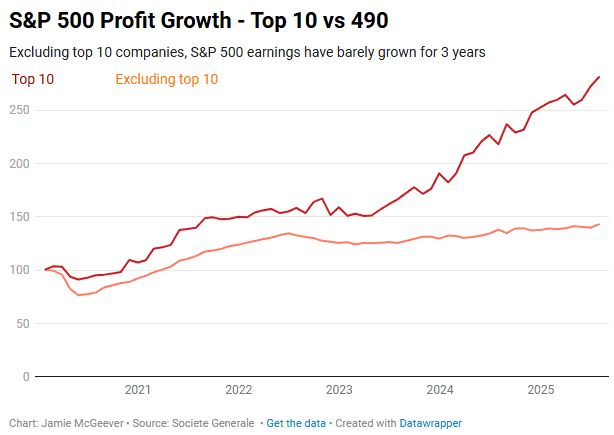

In stark contrast to the dazzling performance of the Big Seven, the rest of the S&P 500 has generally underperformed. This divergence is not new, but this year's concentration has reached unprecedented levels. Investors' frenzy for technology and artificial intelligence has virtually marginalized companies in other sectors. This imbalance in market structure not only increases systemic risk but also creates a dilemma for investors between the pursuit of high returns and risk aversion.

(Comparison of earnings growth of the top 10 companies in the S&P 500 and the remaining 490 companies)

Where is the future of this fragmented market?

Investors' dilemma

The US market currently stands at a delicate crossroads. In the stock market, Wall Street indices hover near record highs, but concentration risks loom large. The strong performance of the Big Seven is hard to ignore, but their lofty valuations also raise concerns about a bubble. In the bond market, short-term bonds are favored due to the potential for easing Federal Reserve policy, while long-term bonds face a bleak outlook due to fiscal deficits and inflationary pressures. Further complicating matters, uncertain economic data and political pressures are intertwined, leaving investors wavering between short-term and long-term bonds.

Flexibility is key <br/>In such a divided market environment, future trends are fraught with uncertainty. These divergences could suddenly converge at a certain trigger point, or they could continue to widen over an extended period. No crystal ball can accurately predict when the market will revert to the mean, but one thing is certain: maintaining a flexible investment strategy will be key to navigating the current situation. Whether it's diversifying to mitigate concentration risk or striking a balance between short-term and long-term bonds, flexibility will be a crucial tool for investors to achieve returns in this volatile market.

Analysis of the impact on gold prices and the US dollar

Impact on the US dollar

The sharp drop in short-term bond yields (e.g., the two-year Treasury yield fell to 3.66%) reflects strong market expectations of a Federal Reserve rate cut, which typically puts downward pressure on the US dollar as low interest rates reduce the appeal of US dollar assets. Long-term Treasury yields have remained relatively stable, albeit influenced by fiscal deficit concerns, and this may partially offset the negative impact of rate cut expectations on the dollar. However, the strong performance of the "Big Seven" in the stock market and market concentration risks may trigger risk aversion. If global investors reduce their risk exposure due to volatility in US stocks, the US dollar, as a safe-haven currency, may find short-term support. Overall, the US dollar is likely to face pressure in the short term, but if safe-haven demand increases, the US dollar may experience fluctuations or partial rebounds.

Impact on gold prices

Gold prices typically exhibit a negative correlation with the US dollar and real interest rates. Falling short-term bond yields and increasing expectations of rate cuts reduce the opportunity cost of holding gold, positive for gold prices. Meanwhile, stock market concentration risks and fiscal deficit concerns could exacerbate market uncertainty, driving safe-haven flows into gold. However, if long-term Treasury yields rise due to inflation or deficit concerns, real interest rates could limit gold's upside. In the short term, gold prices could rise on expectations of rate cuts and risk aversion, but the extent of this increase will likely be constrained by fluctuations in long-term bond yields and the US dollar.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.