The data is not amazing, but the volatility is amplified: the next step of the US dollar depends on these three things

2025-09-11 21:37:58

Prior to the announcement, the market consensus was: overall CPI would rise 2.9% year-on-year, up from 2.7% in July; the monthly rate was expected to be 0.3%; core CPI would rise 3.1% year-on-year and 0.3% monthly. Regarding interest rates, CME FedWatch showed that the market was pricing in a 25bp rate cut next week at approximately 92%, and the probability of a 75bp cumulative rate cut this year was approximately 70%.

The macroeconomic narrative focuses on two key points: whether tariff-driven commodity inflation will resurface; and whether employment growth will see a marginal decline, which will determine the extent of interest rate cuts this year. At the time of the announcement, the US dollar index had weakened slightly, reaching 97.75 at the time of the news release, down approximately 0.06%.

Data presentation and interpretation

The overall CPI rose 2.9% year-on-year in August, in line with expectations and higher than July's 2.7%. The monthly rate was 0.4%, faster than July's 0.2%. The core CPI rose 3.1% year-on-year, in line with July and the forecast. The housing index rose 0.4% month-on-month, contributing the most to the overall increase. The food index rose 0.5% month-on-month, with "food at home" rising 0.6% and "dining out" rising 0.3%. The energy index rose 0.7% month-on-month, with gasoline prices up 1.9%. This data suggests two key implications: First, upward pressure persists on the commodity side for energy and some durable goods, consistent with the logic of "gradual tariff pass-through" and cost repatriation. Second, the stickiness of core services remains, with the housing sector unlikely to decline in the near term. The higher-than-expected monthly rate of 0.3% makes the upward trend in overall inflation more sustainable. Overall, the combination of a stagnant core inflation and a rising overall inflation rate poses a challenge to the urgency of further significant interest rate cuts this year.

Labor Market: Marginal Signals from Initial Claims

Initial jobless claims, released the same day, came in at 263,000, up from the previous reading of 236,000 (revised from 237,000) and below market expectations of 235,000. The seasonally adjusted continuing claims figure was 1.939 million, unchanged from the previous month. The seasonally adjusted insured unemployment rate was 1.3%. This suggests a moderate cooling of the labor market, but not a sharp weakening. Juxtaposing the rebound in monthly inflation with the weakening in initial jobless claims, creates a complex picture of cooling growth indicators and relatively resilient price indicators, reinforcing the path-dependence of a 25 basis point decline in September, with the pace of the year still dependent on new data.

Official Statements and Policy Framework

Before the quiet period, officials' views diverged significantly. Goolsbee believed inflation could rebound; Kashkari emphasized that tariffs were causing rising commodity inflation, but whether this would be sustained remained to be seen. Daly, in contrast, judged the tariff-induced price increases to be more of a "one-off shock," while Waller was more direct, viewing them as a "transient blip," predicting inflation would return to a trajectory close to 2% in about six months. Overall, the committee is closer to a consensus of "cutting the rate one notch first and then watching the data," but whether the cumulative rate will fall to 50 or 75 basis points this year depends crucially on whether the core monthly rate can fall back to around 0.2% in the coming months.

Immediate market reaction

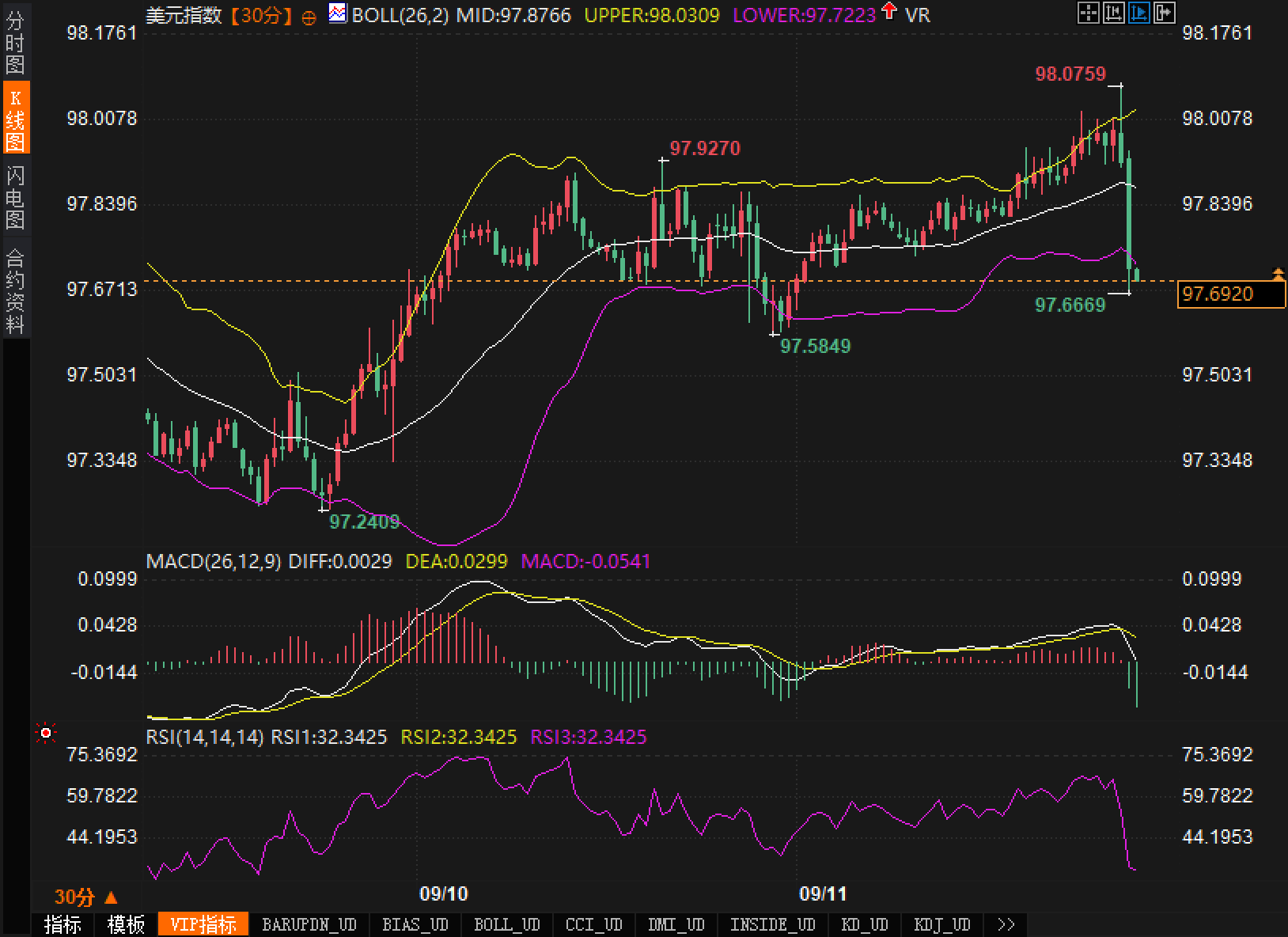

1) US Dollar Index: From a technical perspective, the 30-minute chart shows that the US Dollar Index retreated from a high of 98.0759, forming a long, real-body bearish candlestick after the release. The Bollinger Bands' middle line is 97.8766, the upper line is 98.0309, and the lower line is 97.7223. The price is trading close to the lower band, indicating a short-term bearish bias. The RSI (14) reading is 32.3425, approaching the edge of the weak zone; the MACD histogram has turned green and expanded downward, indicating a bearish momentum. Logically, inflation is in line with expectations, but the higher monthly rate offsets the weaker initial jobless claims, making the US dollar's "first down, then volatile" reaction a reasonable one.

2) US Treasury yields: The 0.4% monthly rate of return makes it difficult for the long end to fully align with a dovish trajectory, but the deterioration in initial claims provides a safe-haven bid. The expected curve initially reacts to a "front-end downturn and long-end range," but a sustainable upward trend in the nominal long end still requires confirmation from subsequent core monthly rates.

3) Gold: The decline of the US dollar and the hesitation of nominal interest rates are conducive to the strengthening of gold prices in the short term; however, if core inflation remains resilient in subsequent data, real interest rates will be difficult to decline quickly, and the upward elasticity of gold prices will be limited.

4) Equity market: If the "strong monthly inflation rate" and "weakened initial claims" are added together, the style of the equity market may tend to be a defensive configuration of "high quality and stable profits"; but for the growth sector, if the long-term interest rate remains in the range, the valuation pressure can be controlled.

5) Exchange Rate: For major non-US currencies, short-term drivers remain US macroeconomic factors, rather than counterparty fundamentals. The struggle for the US dollar within the 97.5-98.0 range will serve as the anchor for foreign exchange fluctuations over the next one to two days.

Divergence between institutional and retail investors’ views

Institutions are more concerned about "when core services, especially housing, will decline significantly." Given a 92% probability given by FedWatch, their judgment on whether the cumulative rate will be 50bp or 75bp this year will revolve around the core monthly rate falling back to the 0.2% threshold. Retail investors are more focused on the impact of "oil prices and gasoline" on daily costs, tending to attribute the 0.4% rebound in the total item that month to energy, which has temporarily increased their preference for gold, but there are greater differences in views on the US dollar. Futures pricing shows that if the core monthly rate is lower than 0.3% in the next two months, the scenario of a cumulative decline to 75bp this year is more likely to be reiterated; conversely, if the monthly rate continues to hover between 0.3% and 0.4%, the market may tilt towards a cumulative 50bp.

Market outlook and risks

There are three key observation points: first, whether core services can show a widespread slowdown in September and October, especially the high-frequency rental indicators of residential items; second, the re-verification of employment and demand side - initial claims have shown signs, and if the subsequent employment report and retail sales slow down simultaneously, it will open up space for a deeper interest rate cut path; third, whether the price transmission of tariff-related commodities will continue.

The risk is that if oil and food prices continue to push the aggregate monthly rate to within the 0.3%-0.4% range, while the core rate decline continues to fall short of expectations, the market will adjust its bets on the cumulative extent of rate cuts this year, potentially limiting the dollar's time below 97.7. Conversely, if the core rate falls rapidly and initial and continuing claims rise simultaneously, the front end of the curve will continue to decline, positive for gold and long-term bonds, and the dollar could retreat to near the lows of 97.5849 and 97.2409.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.