Data alarm bells ring! UK stagflation watch

2025-09-12 20:41:18

This data picture also lays the key foreshadowing for subsequent fiscal policy formulation, monetary authorities' decisions and the direction of the pound sterling exchange rate.

This article discusses the economic challenges facing the UK. It outlines the short-term causes, the political context, the government's response, and ultimately points traders should monitor and their impact on the British pound.

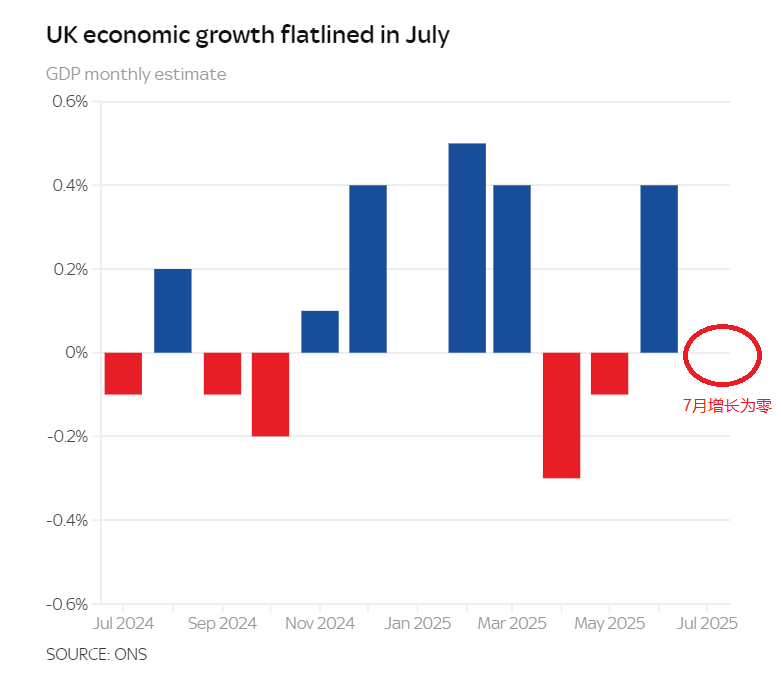

Official data showed that the UK economy "continued to slow", with zero growth in July, dragged down significantly by the manufacturing sector. The data released by the UK National Statistics Office showed that the economy grew by 0.4% in June and -0.1% in May.

(Histogram of UK GDP monthly growth)

In the April-June quarter of this year, the UK's total economic output grew by 0.3%, a significant decline from the 0.7% growth rate in the first quarter of 2025. The latest data raises concerns: Combined with the ONS's August 20th release of a 3.8% year-on-year increase in the UK Consumer Price Index (CPI) for July, this higher-than-expected figure and an 18-month high, re-establishes the UK as the world's fastest-growing major developed economy. With a cooling labor market, high inflation, and the continued suppression of demand from the US trade war, the UK economy is expected to face increasing pressure in the coming months.

(UK CPI trend chart)

The decline in industrial output was the main drag, with diverging industry performances.

Speaking about economic activity in July, Liz McKeon, director of economic statistics at the UK National Statistics Office, said that the decline in industrial output has offset the slight growth in the service and construction industries. In the past three months, the overall economic growth slowdown has continued. Although the growth of the service industry has been maintained, industrial output has further declined.

Within the service industry, medical, computer programming and office support services all performed steadily; while the core reason for the decline in industrial output was the general weakness in all areas of manufacturing, which created an overall drag.

The government's room for maneuver is constrained by economic growth, and tax increases may exacerbate employment and inflationary pressures.

When the Labour government came to power last summer, it made boosting economic growth a key priority, but the chancellor admitted this week that the economy was now "stagnant."

This year's US trade war has significantly dragged down global economic activity, and since taking office, Rachel Reeves has been accused of "actively putting the brakes" on economic growth by massively enriching the private sector (damaging investment and employment in the process).

Faced with a £40 billion budget tax increase, employers are cutting jobs and passing on the rising costs to consumers. UK inflation is currently approaching double the Bank of England's 2% target, casting a shadow over the prospects for future interest rate cuts. Data released by the Bank of England last week showed that employer layoffs are now at their fastest pace since 2021.

Budget focus: £30-40 billion fiscal gap, tax targets cause disagreements

Attention from all walks of life is rapidly focusing on the next budget to be released on November 26. Market concerns about the uncertainty of subsequent policy measures are continuing to suppress market sentiment.

Reeves is under pressure to raise taxes to plug a gap in public finances estimated at between £30bn and £40bn.

The chancellor again explicitly ruled out raising income tax, employee national insurance contributions and VAT – measures she has consistently stressed would directly harm “working people”.

Potential tax targets may include high-income groups, and banks are worried that their profits will become "tax targets."

But the chief executive of the Confederation of British Industry (CBI) told the Guardian earlier this week that Reeves should now break his promise not to tax working people.

Ryan Newton-Smith believes that additional taxes on businesses will further inhibit economic growth and employment, and will indirectly harm the interests of the working class in the process.

The Confederation of British Industry wants to push for measures such as business tax rate reform and lowering the VAT threshold - the private sector is currently bearing an increasingly heavy tax burden.

Newton-Smith added: "The situation is different now than when Labour drafted its manifesto. The facts have changed and policy solutions should adapt accordingly."

Government split: Treasury highlights progress, shadow chancellor criticizes policy failures

In response to the ONS data, a UK Treasury spokesman said: "We know that more needs to be done to boost economic growth - while our economy has not collapsed, it has stagnated, a result of years of underinvestment, which we are determined to reverse through our Plan for Change."

He also said: "We are making progress: the UK's economic growth rate this year ranks first among the G7; interest rates have been cut five times since the general election, and real wage growth has exceeded that of the previous government. We still need to do more to build an economic system that serves working people and allows working people to get rewards .

That’s why we’re cutting unnecessary bureaucracy, reforming our planning system to boost Britain’s infrastructure , and investing billions of pounds in affordable homes, Sizewell C nuclear power station, and local transport projects across the country.”

Shadow Chancellor Mel Stride responded: "As this government struggles to cope with scandal after scandal, borrowing costs (long-term government bond yields) have recently risen to a 27-year high – a strong signal of distrust in the Labour Party and a clear sign that significant tax increases are almost certain. "

“It’s no surprise that Starmer (Labour leader) has stripped Reeves of control over the Budget. But marginalising her is not enough – he must also abandon her failed economic strategy, which has left Britain even poorer.”

Policy Responses and Industry Warnings: Plans to Relax Business Barriers Raise Concerns for Retailers on Closure Risk

The chancellor has responded by planning to relax some barriers to doing business as part of his efforts to boost economic growth.

The UK Treasury is considering a comprehensive overhaul of small business tax relief rules to remove the so-called "cliff" penalty faced by companies when they open a second site (a penalty mechanism that sees tax rates jump sharply as their business expands).

The British Retail Consortium issued a separate warning on Friday that 400 of the country's largest stores could be at risk of closure if such premises are included in the proposed higher business rates band.

The association said the shops were already under immense pressure from soaring employment and tax costs, with 1,000 of the large stores having closed in the past five years.

Observation points for the UK Monetary Authority and its impact on the British pound

Despite a 25 basis point rate cut to 4.0% in August 2025, the Bank of England held rates steady at its September meeting by an 8-1 majority, highlighting concerns about sticky inflation. Market expectations are for another rate cut before the end of 2025, but the timing depends on inflation data (such as whether the CPI rises to 4% in September as expected) and economic performance.

Inflation path assessment: If core inflation (especially service sector inflation) falls less than expected, the central bank may postpone interest rate cuts or even restart rate hikes, supporting the pound; conversely, if the risk of economic contraction intensifies (such as negative GDP growth for two consecutive quarters in Q3), expectations of interest rate cuts will strengthen, suppressing the pound.

Divergence from the Fed's policy: If the Fed cuts interest rates first and the Bank of England maintains high interest rates, the narrowing interest rate gap may attract capital inflows and boost the pound in the short term; but if the weak UK economy forces the central bank to cut interest rates simultaneously, the pound may depreciate due to deteriorating growth expectations.

At present, the monthly line of the British pound against the US dollar is in an upward channel. In the context of the United States possibly opening the channel for interest rate cuts, if the UK does not solve the problems of domestic economic growth and inflation, it may face a situation where the currency appreciates against the US but depreciates against the cross currency.

(Weekly chart of GBP/USD, source: Yihuitong)

At 20:33 Beijing time, the British pound was trading at 1.3542/41 against the US dollar.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.