Gold bulls are on full fire! Next week's gold trading outlook!

2025-09-12 21:57:56

The weakening of the US dollar and the expectation of a Fed rate cut are the core factors affecting the short-term trend of gold prices.

Data released by the U.S. Department of Labor late Thursday showed that the August Consumer Price Index (CPI) rose roughly in line with market expectations, paving the way for the Federal Reserve to cut interest rates by 25 basis points next week and at least one more rate cut before the end of the year. The current 2-year Treasury yield also implies a cumulative rate cut of 125 basis points. Both of these factors indicate a structural weakening of the U.S. dollar and a downward trend in U.S. interest rates.

The Federal Reserve is expected to cut interest rates by at least 75 basis points in 2025, potentially turning real interest rates (nominal interest rate minus inflation) negative, reducing the cost of holding gold. Even with short-term interest rate fluctuations, gold's low correlation with US Treasuries (the correlation coefficient was only 0.12 in 2025) makes it a stabilizer for long-term asset allocation. Historical data shows that for every 1% drop in real interest rates, gold's average annual return increases by 8-10%, a pattern that is particularly pronounced during interest rate cuts.

Meanwhile, foreign media reports indicate that US mortgage rates saw their largest decline of the year this week, directly driving a surge in demand for mortgage refinancing. Freddie Mac data shows that the average rate on a 30-year fixed-rate mortgage fell to 6.35% from 6.5% the previous week. Last Friday's weak non-farm payroll data further increased the likelihood of further Federal Reserve rate cuts, pushing borrowing costs lower again. According to Texas-based mortgage technology provider OptimalBlue, as of Monday, consumers could lock in a 30-year mortgage rate of 6.27%, the lowest in nearly a year. This suggests that weakening US employment and demand are reinforcing medium-term expectations of a structurally weaker US dollar.

Gold ETFs maintain a continuous inflow trend, providing short-term momentum

According to the latest data from the World Gold Council, net inflows into gold ETFs reached $5.5 billion in August 2025, primarily from North America ($4.1 billion) and Europe ($1.9 billion), while outflows occurred in Asia and other regions. Global physical gold ETFs saw inflows of $3.2 billion in July 2025.

Technology companies increase sales and improve market risk appetite

With Oracle's stock price surging 33% after announcing its results, proving that the technology narrative is supported by real demand, the three major U.S. stock indexes all set new historical highs on Thursday, led by U.S. technology stocks.

The growing demand for AI-related applications (such as data center cooling materials) has boosted gold prices. The simultaneous rise in gold and stock prices suggests a high level of risk appetite, which also impacts gold prices. While shifting risk appetite can suppress gold prices, currently, it is directly boosting them.

India-US trade conflict supports gold prices

On Thursday (September 11), Sergio Gore, the U.S. ambassador to India nominated by U.S. President Trump, revealed that the United States and India are close to reaching a consensus on resolving differences in the trade agreement.

Gore's statement came during his confirmation hearing in the US Senate on Thursday. However, India's continued purchase of Russian oil remains a core point of contention in the bilateral relationship, and the US has explicitly demanded that India cease such purchases. The US claims that India's purchases of Russian oil effectively provide financial support to Russian President Vladimir Putin's military campaign in Ukraine, and the US has retaliated by imposing tariffs on India.

The Indian government has been directing capital flows into the precious metals market by increasing its gold reserves (reaching 880 tons by July 2025) and reducing its holdings of U.S. Treasuries. This policy orientation has further boosted local gold demand.

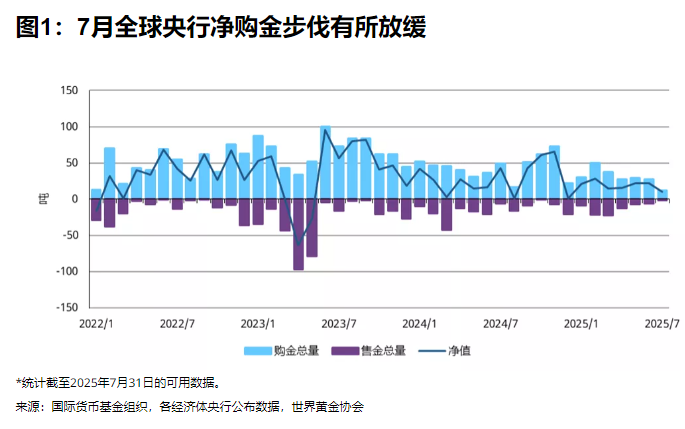

The central bank's gold purchasing strategy has long supported gold prices

The latest data from the World Gold Council shows that global central banks' net gold purchases in August were 32 tons, a 60% drop from the monthly average of 80 tons in the previous seven months, but still an increase of 22 tons from the net gold purchases in July. Although the People's Bank of China has increased its gold reserves for 10 consecutive months, the monthly increase has plummeted from 18 tons at the beginning of the year to 5 tons in September, and the pace of gold purchases has slowed to the lowest level since 2023.

(Central Bank Gold Purchase Trend Chart)

This is primarily due to the fact that once the gold price surpassed $3,600, central banks' gold purchase costs rose by 45% compared to the same period in 2024, putting increased pressure on the foreign exchange reserves of some emerging market countries. The Russian Central Bank announced a suspension of gold purchases and increased its holdings of RMB assets, signaling a shift in its currency diversification strategy amid geopolitical tensions.

A Goldman Sachs model shows that if the gold price breaks through $3,700, global central banks may jointly sell 500 tons of gold to stabilize the exchange rate. This scenario is highly similar to the central bank's behavior before the "taper tantrum" in 2013.

Central bank gold purchases are a long-term strategic move aimed at reducing reliance on US dollar-denominated assets (such as US Treasuries) and enhancing the diversification of reserve assets. Central banks remain a core pillar of global demand, and the slowdown in gold purchases represents a mere adjustment in pace, not a reversal of the trend. This trend will not be reversed by short-term gold price fluctuations, especially amidst increasing global geopolitical and economic uncertainty, as gold's role as a "crisis insurance" continues to strengthen.

The Israeli-Palestinian war and the Russia-Ukraine conflict support the long-term trend of gold prices

As the conflict between Ukraine and Russia continues to escalate, Poland, a NATO member, took unprecedented military action on Wednesday (September 10) by shooting down a suspected Russian drone. This marked the first time the Western military alliance had directly engaged in combat during the Ukrainian-Russian conflict, drawing widespread international attention.

On the evening of the 9th local time, Hamas issued a statement strongly condemning Israel's air strike in Doha, the capital of Qatar, which attempted to assassinate the leader of the Hamas negotiation delegation, calling it a "heinous crime" and a "flagrant violation of international law." The statement pointed out that the attack was not only an attack on Qatar's sovereignty, but also undermined the important role played by Qatar and Egypt in mediating a ceasefire and personnel exchanges between Palestine and Israel, and further exposed the possibility of the Israeli government deliberately sabotaging any agreement. The statement confirmed that five members of Hamas died in the Israeli air strike, including the son of senior Hamas official Khalil Haya and his office director. Another member of the Qatari security forces died. Khalil Haya himself was not assassinated and the battle situation remained tense.

Technical Analysis:

The aforementioned Goldman Sachs gold price model and technically measured increases all point to 3,700 for gold prices. Currently, KDJ, RSI, and moving averages all suggest that gold prices are under the control of bulls. Currently, gold prices are consolidating below 3,700. As long as the above-mentioned reasons supporting gold prices are not falsified, gold prices are expected to challenge 3,700 next week, or even higher.

Since the Federal Reserve's interest rate decision remains the biggest factor influencing gold prices in the short term, September 17th could be a crucial time for significant profit-taking, given the Fed's announcement in the early morning hours of September 18th. However, long-term support for gold prices will ensure strong buying during any significant pullback.

(Spot gold daily chart, source: Yihuitong)

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.