Gold surges for the sixth time in seven weeks, repeatedly breaking all-time highs. Wall Street calls for "buy, buy, buy," but retail investors are collectively putting the brakes on buying?

2025-09-14 10:39:36

On Tuesday (September 10), spot gold hit a record high of $3,674.36 per ounce before maintaining a high and volatile trend, closing at $3,643.21 per ounce. This week's gain was approximately 1.56%, with six of the past seven weeks showing positive trends. Despite stubborn inflation in the United States, the report was within expectations. What surprised the market was the change in initial jobless claims, which was the worst in nearly four years.

Professional investors on Wall Street remain confident and see it as a "sure-fire pick," while ordinary retail investors on Main Street are a little cautious after the recent surge and are awaiting the final statement from the Federal Reserve.

Wall Street vs. Main Street: The divergence of bullish sentiment and the underlying psychological game

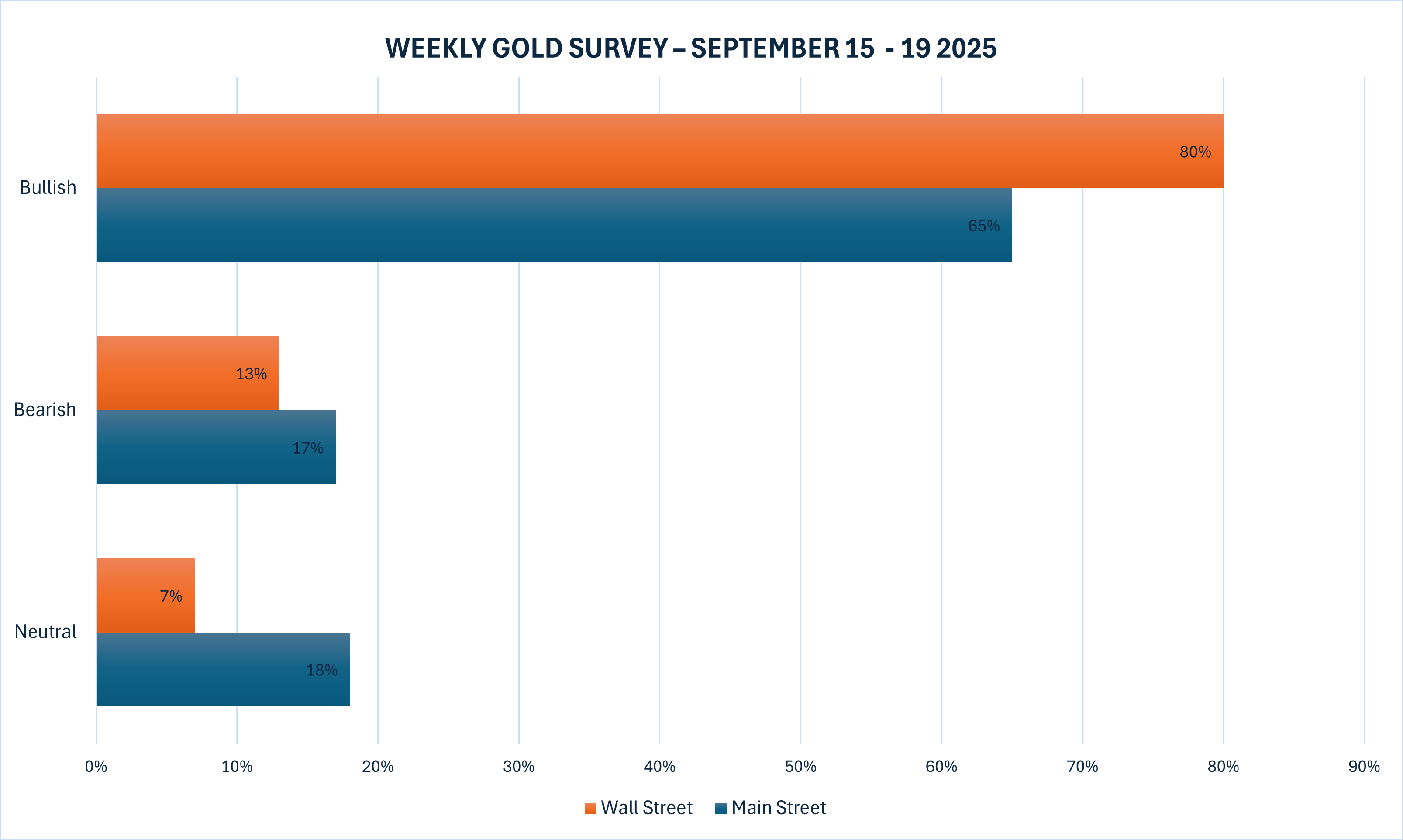

Behind the strong gold price, market sentiment reveals a stark contrast. Kitco News' weekly gold survey reveals this divergence: 80% (12) of 15 Wall Street analysts are firmly bullish on price increases next week, while only 13% (2) predict a decline, and the remaining 7% (1) predicts sideways movement. This overwhelming bullish momentum stems from professional investors' deep understanding of Federal Reserve policy, who view gold as both an inflation hedge and a safe haven against geopolitical risks.

In contrast, the 268 retail investors on Main Street were more cautious: 65% (174 people) still bet on an increase, but 17% (46 people) were worried about a pullback, and 18% (48 people) chose to wait and see. This caution is not groundless, but a natural reaction after the recent surge - retail investors chose to tighten their positions before the Federal Reserve's "black swan" event, avoiding the potential trap of "buying rumors and selling facts."

This divergence in sentiment reflects the differing perspectives of market participants. Wall Street's optimism stems from its grasp of macroeconomic trends: global turmoil persists, central banks continue to hoard gold, and the Federal Reserve's dual mandate (controlling inflation and supporting employment) is forcing it to adopt a dovish stance. Main Street's caution is more a product of short-term noise: overbought signals loom, and the temptation to take profits grows. Nevertheless, this contrast underscores the maturity of the gold market—the interplay between professional and retail investors is driving prices in a healthier direction.

Experts criticize: From "chaotic policies" to "debt spirals", the multiple logics behind gold's rise

Wall Street's bullish consensus isn't blindly inflated, but rather endorsed by a number of leading analysts. Darin Newsom, senior market analyst at Barchart, puts it bluntly: "It's rising because the global situation hasn't changed, and chaos remains the policy of choice." This comment directly points to the enduring impact of geopolitics, from the chaos in the Middle East to the US-EU trade friction, which are injecting a safe-haven premium into gold.

Rich Checkan, president of Asset Strategies International, is more focused on the Federal Reserve's variables: "It is likely to rise. If the market's expectations of a rate cut next week come true, gold will rise; but if the FOMC unexpectedly remains on hold, profit-taking may trigger a sell-off." His view balances optimism and risk, reminding investors that the Fed's "surprise" may overturn everything.

Adrian Day, president of Adrian Day Asset Management, was concise and powerful: "New buyers are pouring into the gold market as the market rises." This reflects the resurgence of institutional funds, while Michael Brown, senior research strategist at Pepperstone, is bearish, becoming a minority voice: "The market's expectations for a dovish Fed are too high, and a correction may occur next week."

Despite this, his concerns haven't shaken the overall situation. James Stanley, senior market strategist at Forex.com, firmly defended the trend: "A reversal now would be pointless. Sellers haven't yet taken hold, especially before the Fed, which is determined to dominate the upward momentum." Daniel Pavilonis, senior commodities broker at RJO Futures, offered the most detailed analysis, starting with economic data: "Consumer confidence, the Michigan Index, and the labor market all tell a story of sporadic inflation and weak employment. The Fed's dual mandate compels them to cut rates, and they've excelled at 'communicating expectations' since the Bernanke era. With such dire data revisions, three consecutive rate cuts by the end of the year aren't ruled out."

Pavilonis further analyzed the underlying logic of gold: "The market sees it as a hedge against stubborn inflation, but interest rate cuts to support employment could trigger future waves of inflation. From central banks to the average person on the street, gold is seen as the ultimate safe haven." He particularly emphasized the debt spiral: "Historically, governments have often inflated their way out of debt. Central banks have increased their gold holdings, and retail investors have followed suit."

Furthermore, financial innovation is fueling the rally: "ETFs, options, and even zero-day options are amplifying physical supply, driving prices up like a perfect storm." He even made a bold prediction: "I'm bullish on all commodities, and gold could hit $4,000 by the end of the year, just like the inflation bonanza of the 1970s."

Marc Chandler, managing director of Bannockburn Global Forex, added: "Gold has risen six times in the past seven weeks, reaching a record high. Central banks such as the PBOC continue to buy gold and relax import and export rules; Poland is even surpassing China in gold purchases. Momentum is overbought, but support is stronger, and buying on dips is obvious."

Adam Button, Head of Currency Strategy at Forexlive, offered a geopolitical perspective: "Last week saw a textbook breakout, and this week saw strong global support—the French Prime Minister stepped down, the Japanese Prime Minister resigned, hopes for peace between Russia and Ukraine were dashed, and US G7 sanctions were delayed. Safe-haven currencies are declining, with rising Japanese yields, uncertainty in Europe, the threat of negative interest rates in Switzerland, and turmoil in the US. The root cause is the erosion of American values: open borders, trade, and democracy are all in tatters. The charts show that everything leads to gold."

He expects the Fed's 25 basis point rate cut to keep the party going, unless Powell takes a tough stance against inflation, but the probability is low. "$4,000 by the end of the year, with a favorable seasonal trend in January; if the Fed remains indifferent, $3,500 is a positive buying point."

FxPro senior market analyst Alex Kuptsikevich's warning of a pullback adds to the tension: "Gold is geopolitically sensitive, reaching new highs for four consecutive weeks. The US-European economic war may prompt central banks to accelerate gold purchases to de-dollarize. However, the short-term is overbought, and the RSI is falling. After 10/11 signals in the past six years, it is now correcting. Wednesday's interest rate cut may trigger a 'buy the rumor, sell the fact' trend."

CPM Group analysts issued a buy recommendation on Thursday, with a target of $3,710 for gold futures on September 19th, with a stop-loss at $3,650. "Prices remain stable above $3,650, despite near record levels. Financial, economic, and political concerns remain, and investor interest is strong. However, the risk of profit-taking is high, and a break below support could result in a $50-100 drop, making it unlikely that a short-term trap will materialize before the weekend."

Kitco senior analyst Jim Wyckoff technical summary: "Bulls dominate gold futures, targeting $3,750 resistance; bears need to break $3,550 support. First resistance is 3,700-3,715, and first support is 3,667-3,650."

The economic storm is coming next week: the Federal Reserve is the focus, and multiple central banks will make decisions simultaneously

Looking ahead to next week, the economic calendar promises to be a "super week," with multiple major events poised to sway gold prices. Monday will see the release of the New York manufacturing survey, highlighting the regional economic dynamics; Tuesday's August retail sales report will test consumer resilience. Wednesday will see the release of August housing starts and building permits data, closely followed by the Bank of Canada's monetary policy decision. All eyes will be on Washington, where the Federal Reserve's interest rate announcement and Powell's press conference will determine the extent of the rate cut and the tone of its dovish stance. Thursday will be followed by the Bank of England's policy decision, followed by the US weekly unemployment benefits and the Philadelphia Fed's manufacturing survey; and Friday will see the Bank of Japan's decision. This series of events will not only test the Fed's employment bias but also potentially amplify expectations of global liquidity, driving gold prices higher.

Against this backdrop, the fate of gold hangs on the Fed's whim. If a 25 basis point rate cut is accompanied by a signal prioritizing employment, the rally could continue; if the Fed's stance is unexpectedly hawkish, concerns about a correction could surface. However, the current consensus suggests the market is leaning towards "buying on dips," viewing next week as a period of accumulation rather than a turning point.

Summary: The gold bull market is not over, but we need to be wary of fluctuations

Overall, the gold market remains strong, supported by multiple positive factors. Wall Street is generally bullish, and Main Street, while cautious, is not without optimism. The Federal Reserve's interest rate decision will be a key catalyst in the near term, determining whether gold prices can reach new highs.

However, investors should also be wary of technical pullbacks and shifts in market sentiment. Gold's upward trajectory is not without resistance, especially given its historically high prices. Investors are advised to closely monitor economic data, central bank policy trends, and market sentiment, adjusting their strategies flexibly to seize opportunities while managing risks.

(Spot gold daily chart, source: Yihuitong)

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.