USD/JPY fluctuated within a range as the market focused on the Federal Reserve and Bank of Japan decisions

2025-09-15 09:36:04

Recent unexpected economic data from both the US and Japan has limited the Federal Reserve's room for policy easing while opening up the possibility of a Bank of Japan rate hike. The market is currently fully pricing in a rate cut from Washington this week and a rate hike in Tokyo in October. Given the uncertainty surrounding both the Fed and the Bank of Japan's policies, any deviation from expectations could ultimately be the catalyst that pushes USD/JPY beyond its traditional trading range of 147-149.

The dominance of US interest rates continues to strengthen

US interest rates remain the core driver of USD/JPY movements, particularly at the short end of the interest rate curve, which is most influenced by central bank policy expectations. This trend is clearly demonstrated in the chart below, which uses a 10-day rolling correlation analysis of the currency pair with historical drivers.

With the market pricing in Fed rate cuts until June 2026 (red line), the correlation coefficient has strengthened to -0.87, indicating that USD/JPY has been moving almost inversely to each other over the past two weeks .

When interest rate expectations rise, the exchange rate typically falls, and vice versa. This pattern is clearly demonstrated on the left side of the chart: the upper window shows the USD/JPY trend, while the lower window shows market pricing – the current pricing of 109 basis points implies more than four full 25 basis point rate cuts.

Unsurprisingly, USD/JPY's positive correlation with the long-end US yield curve has also strengthened: correlations with the two-year (blue), ten-year (grey), and thirty-year yields (purple) have all strengthened during this period, as have the spreads between the two-year and ten-year US and Japanese yields (green and black).

Further confirming the dominance of interest rates, the correlation between USD/JPY and expected volatility in US stocks has been negligible over the past two weeks, suggesting that risk appetite is not the key driver at the moment .

Interest rate decisions of the US and Japanese central banks are attracting much attention

With the Federal Reserve and Bank of Japan set to announce their interest rate decisions this week, the correlation analysis suggests that a policy surprise may be needed to break out of the narrow range in which USD/JPY has traded since early August.

In fact, unless there are major shocks from US retail sales and Japanese inflation data, the market focus this week will be entirely on the central bank's policy statement and its guidance on the interest rate outlook .

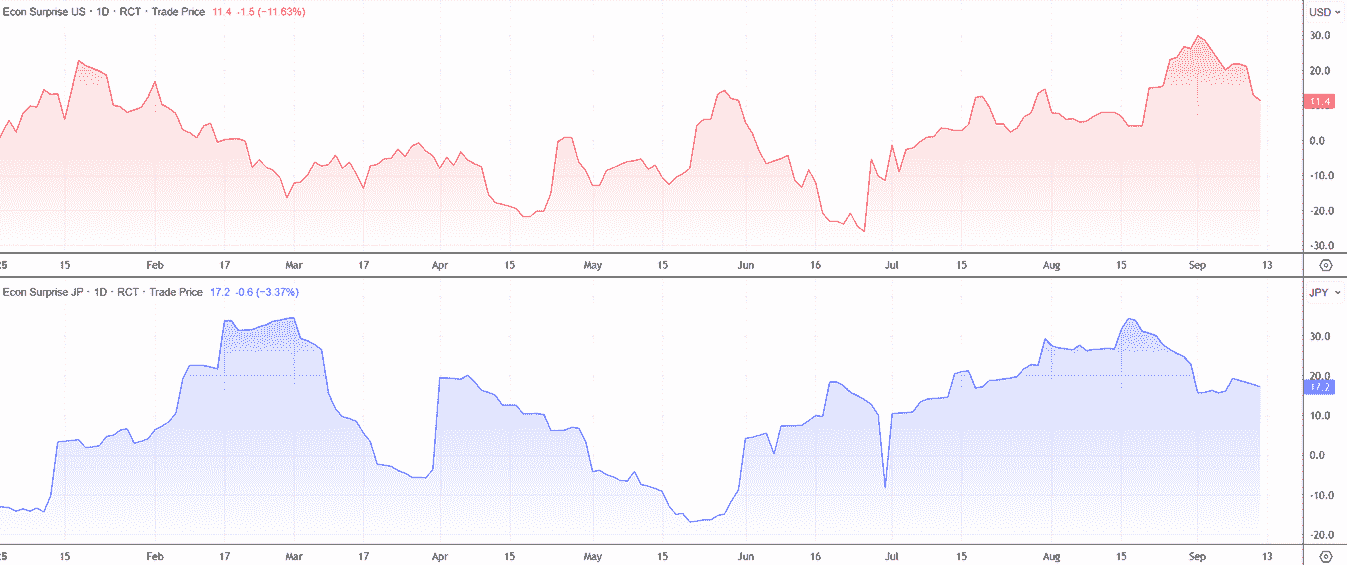

Before examining the policies of the Federal Reserve and the Bank of Japan separately, it is worth noting that economic activity in both countries has remained resilient recently - a trend clearly demonstrated by the Citi Economic Surprise Index, as shown in the figure below.

The positive index value indicates that slightly more than half of the economic data showed an upward surprise, which both limits the market's expectations for the extent of the Federal Reserve's easing policy and maintains the possibility of further interest rate hikes by the Bank of Japan .

Fed interest rate outlook in focus

The market generally expects the Federal Reserve to implement a 25 basis point rate cut, bringing the federal funds rate to a range of 4%-4.25%. There is also the possibility of a smaller 50 basis point rate cut. If the latter scenario occurs, given its low probability, it is likely to trigger a significant decline in the USD/JPY exchange rate.

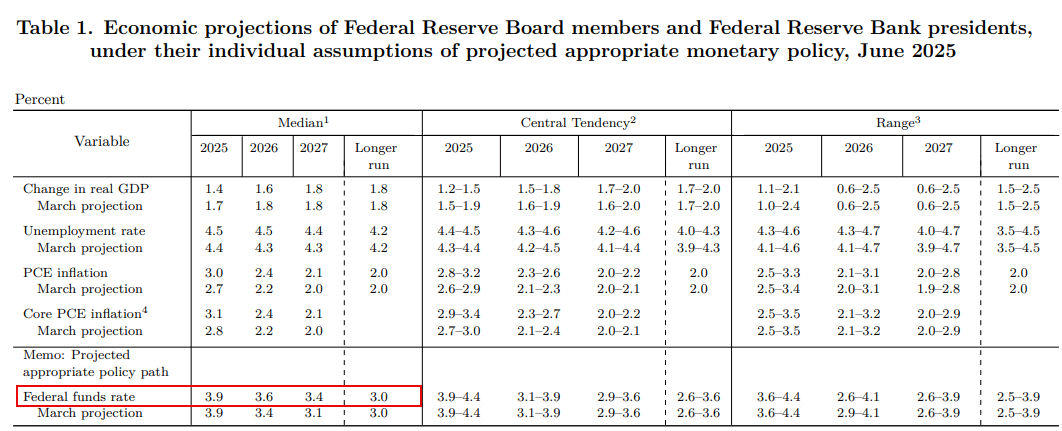

If the Fed only cuts by 25 basis points, the market reaction will depend primarily on the median forecast of the federal funds rate by FOMC members for this year and next, as well as the estimated neutral interest rate level implied by their long-term forecasts. The so-called "neutral interest rate" refers to the theoretical equilibrium interest rate level that neither suppresses nor stimulates economic activity.

The median forecast three months ago indicated two 25 basis point rate cuts in 2025 and one in 2026, with the long-term neutral rate forecast remaining at 3%. The Fed is likely to add two more rate cuts at this meeting, which would bring the federal funds rate to a range of 3%-3.25% by the end of 2026 – roughly in line with market pricing before the update .

If the median forecast remains unchanged or falls below its level three months ago, USD/JPY is likely to strengthen. A Fed signal that six or more rate cuts over the next 15 months could trigger a counter-trend, particularly as this would signal the need for interest rates to enter a stimulative range. Such a signal could heighten concerns about the economic trajectory, making it less likely that they would actually be implemented.

In addition to the updated interest rate dot plot, the labor market language in the policy statement and Powell's comments at the press conference are likely to be more dovish than at the last FOMC meeting. A split vote could also have an impact, especially given the risk that some members could support a 50 basis point rate cut while others would prefer to keep it unchanged.

Bank of Japan signals guide market reaction

While the Fed meeting still needs to be fully digested, the Bank of Japan meeting appeared more dovish – the market is almost certain that the key overnight rate will remain unchanged at 0.5%. As this meeting does not include an updated economic outlook or policy summary, market direction will depend on the policy statement and Kazuo Ueda's press conference.

As uncertainty surrounding US-Japan bilateral trade emerges, a key market concern is whether the Bank of Japan's tone is sufficient to justify current market pricing . Markets currently anticipate nearly 50 basis points of cumulative rate hikes by July of next year, with a roughly two-thirds probability of a hike before the end of 2025. The Bank of Japan is known for its deliberate ambiguity, a tendency often interpreted as a dovish signal and boosting the dollar against the yen. Ueda, known for his dovish stance, could trigger a more hawkish market reaction.

USD/JPY remains in a narrow range

USD/JPY remained range-bound ahead of an important central bank meeting. The pair encountered selling pressure as it approached the 200-day moving average (148.67) resistance level, while buying was lurking below the 147.00 support level.

This pattern has been in effect for more than a month. Unless there is an unexpected market shock, it is unlikely to change before the policy decision is made.

There are no clear directional risk signals on the daily and weekly charts, and price momentum has no significant bias - the RSI (14) and MACD indicators are flat.

If the current range is broken, the key upside levels to watch are 151.00 and 152.40, while the downside support levels should focus on 146.00 (April rising trend line), 144.40 and 142.42.

(USD/JPY daily chart, source: Yihuitong)

At 9:35 Beijing time, the US dollar was trading at 147.55/56 against the Japanese yen.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.