Gold prices remain high ahead of the Fed's interest rate decision

2025-09-17 13:40:39

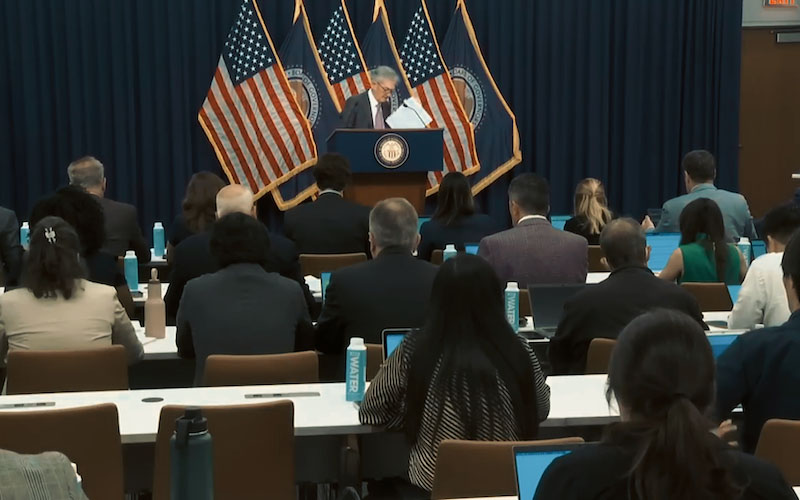

Despite this, the market still expects the Fed to cut interest rates by at least 25 basis points after the two-day meeting, and may cut interest rates twice more before the end of the year. Investors are waiting for Powell's press conference after the meeting and economic forecasts (dot plot) to provide more guidance, which will affect the US dollar and indirectly support gold.

The U.S. Census Bureau reported that retail sales rose 0.6% month-on-month in August, showing that U.S. consumer spending remains resilient despite a slowing economy, persistent inflation and a weakening labor market.

However, the market is almost certain that the Federal Reserve will adopt an accommodative policy to support the softening labor market, which also provides support for non-yielding assets such as gold.

Meanwhile, geopolitical tensions continued to provide safe-haven support for gold. Ukraine launched an attack on a major Russian oil refinery, and Russia seized control of the village of Novomykolaivka near Donetsk. Israel launched a ground offensive in the Gaza Strip, penetrating deep into the urban core. These tensions and cautious market sentiment limited further declines in gold prices.

From a technical perspective, the daily support level is around $3,645 (this week's flag pattern breakthrough support) and $3,633. If it falls below, it may fall to $3,610-3,600. Further support is in the $3,562-3,560 area, and the psychological level of $3,500 still has a defensive role.

The upper resistance level of $3,700 is the key short-term resistance level. After breaking through, the bulls may continue the upward trend; slightly above the recent high is the next pressure zone.

The daily RSI remains overbought, prompting short-term profit-taking; a weekly flag breakout still suggests a pullback could be a buying opportunity. Price remains above its short- and medium-term moving averages, indicating a bullish trend and limited potential for a pullback.

Overall, the short-term pullback in gold is due to profit-taking, and the support is solid, so it can still be seen as a buying opportunity on dips, but we need to pay attention to the immediate impact of the Federal Reserve’s statement and geopolitical events on the market.

Editor's opinion:

In the short term, gold has seen a technical decline due to the rebound of the US dollar and profit-taking, but expectations of a Fed rate cut and safe-haven demand remain the main support: the Fed's dovish policy expectations limit further strengthening of the US dollar, which is conducive to maintaining the high level of non-yielding asset gold; geopolitical tensions provide safe-haven buying support for gold, curbing its downside.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.