The gold bull market continues! A storm is brewing, and silver may see a rebound.

2025-09-17 14:34:41

Jesse Colombo, an independent precious metals analyst and founder of The Bubble Report, said interest rates will have to go lower given the two-year bond yield, which will eventually push gold prices to $4,000 an ounce.

He added that market questions about the Fed's political independence are fueling expectations that the central bank may overreact to disappointing economic data.

“ The loss of Fed independence means we could see much looser policy than necessary, and all this dislocation will continue to support gold prices higher ,” he said.

However, beyond the recent price action driven by the Federal Reserve, Colombo said he sees a storm brewing that could push gold prices significantly higher. He said he sees signs of contracting market volatility , with fear measured by the Volatility Index (VIX) falling to its lowest level since the beginning of the year.

“Historically, when we see volatility drop to unusually low levels, it signals big moves , and I think we could see another strong directional breakout soon,” he said.

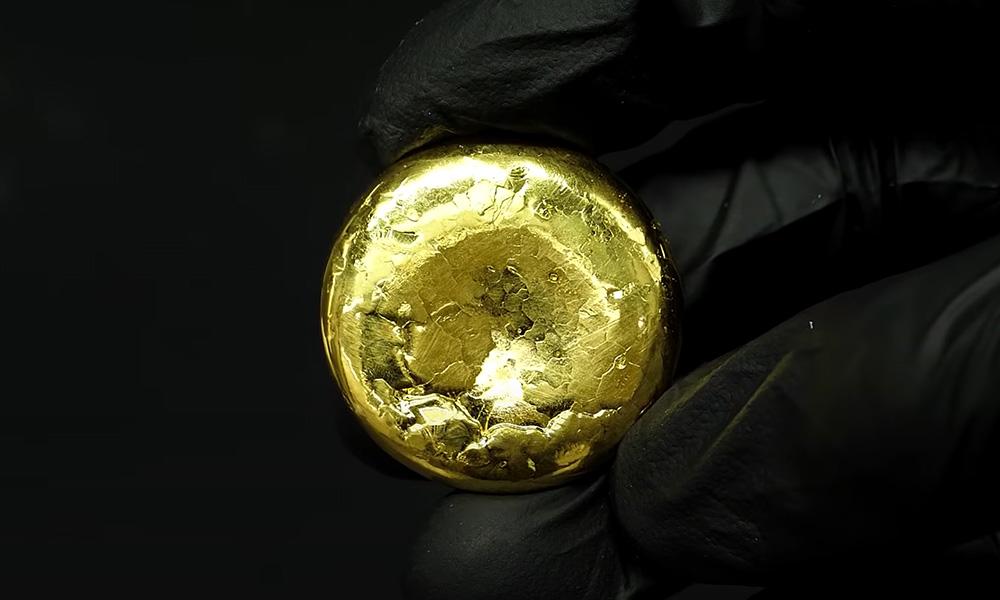

Colombo noted that throughout the summer, when gold was trading around $3,300 an ounce, there was a similar compression in volatility in the precious metals sector, and once that compression was released, gold prices surged. Spot gold prices not only hit a new all-time high of $3,702.93 on Tuesday (September 16), but also recorded their best monthly performance since March, when the market was first hit by global trade and geopolitical uncertainty.

Colombo said he believes U.S. stocks and the dollar are forming opposing patterns. He noted that both benefit from compressed volatility, and if that breaks down, prices could fall sharply .

"There's a lot of dislocation in the market and everyone is waiting to see what's going to happen, what the Fed is going to do," he said. " Once there's some clarity, I'd lean towards some further dollar weakness, which would support gold prices higher later in the year, but given the momentum we have, we could still see $4,000 an ounce by the end of the year , which is the kind of momentum we expect to see in a bull market."

In addition to $4,000 gold, Colombo also expects it is only a matter of time before investment demand drives silver prices back to $50 an ounce.

Silver has even outperformed gold, with prices up about 46% this year to around $42 an ounce. But he noted that compared to gold, silver is still very cheap.

He added that rising gold prices, coupled with increased market uncertainty and volatility, will continue to drive more investors into the silver market.

“People are looking for diversification, they’re looking for relatively uncorrelated assets, and gold and silver fit that description very well,” he said. “Now is their time to shine.”

Spot gold daily chart Source: Yihuitong

At 14:22 Beijing time on September 17, spot gold was quoted at $3678.82 per ounce.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.