September 18th Financial Breakfast: Gold prices fell from their historical highs, the Federal Reserve cut interest rates as expected, and Milan cast the only dissenting vote in its first Fed meeting.

2025-09-18 07:26:36

Focus on the day

stock market

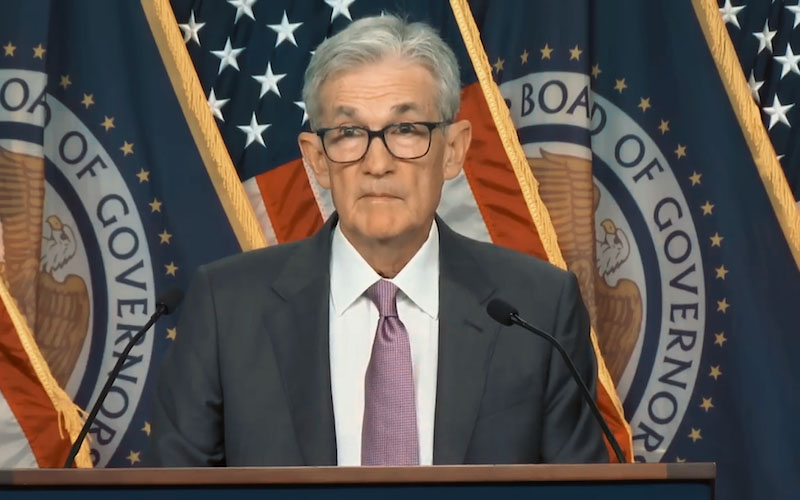

The Nasdaq and S&P 500 closed lower on Wednesday after the Federal Reserve cut interest rates by 25 basis points as expected and Fed Chairman Powell pointed out the weakness in the job market. The Dow Jones Industrial Average closed higher after fluctuating during Powell's speech.

The Federal Reserve signaled it would steadily cut interest rates through the rest of the year as policymakers expressed concern about a slack labor market. The Fed forecast two more quarter-point rate cuts this year.

At the press conference, Powell talked about the growing downside risks in employment, which deserve more attention than inflation, but he also stressed that inflation risks still need to be assessed and managed.

Investors have already priced in the rate cut, according to data compiled by the London Stock Exchange Group.

“Powell tempered the market’s initial enthusiasm for a more aggressive path of easing. He noted labor market slack but said deeper rate cuts would be reserved for more severe economic conditions,” said Michael Rosen, chief investment officer at Angeles Investments. “The Fed also raised its inflation forecasts, highlighting the delicate balance in setting monetary policy between addressing weak employment and controlling inflation,” he added.

The Dow Jones Industrial Average rose 0.57% to 46,018.32, the S&P 500 fell 0.10% to 6,600.35 and the Nasdaq fell 0.32% to 22,261.33.

Financial stocks such as American Express helped boost the Dow. The Fed's decision and outlook will test Wall Street's recent rally, which has been supported by expectations of rate cuts and renewed enthusiasm for artificial intelligence-related stocks.

Powell also addressed several questions about the Fed's independence from the executive branch. On Tuesday, White House economic adviser Milan was sworn in as a member of the Federal Reserve Board, the same day an appeals court rejected President Trump's attempt to remove Fed Governor Tim Cook.

Nvidia dragged down the Nasdaq, with its shares falling 2.6%, while shares of human resources software provider Workday rose 7.2% after reports that activist investor Elliott Management had built a stake of more than $2 billion in the company.

Gold Market

Gold prices settled down nearly 1% on Wednesday, retreating from a record high hit earlier in the session, as market participants interpreted comments from Federal Reserve Chairman Jerome Powell.

Spot gold fell 0.9% to $3,658.25 an ounce, having earlier hit a record high of $3,707.40. It has risen nearly 6% so far this month. U.S. gold futures for December delivery settled down 0.2% at $3,717.80 an ounce.

The Fed announced a 25 basis point rate cut and said it would steadily lower borrowing costs for the rest of the year. Speaking about the outlook for interest rates, Powell said the Fed would make decisions "meeting by meeting."

"The Fed signaled uncertainty, with Powell calling it a 'risk-managed rate cut,' which triggered some completely understandable profit-taking," said Tai Wong, an independent metals trader. "A pullback, or at least consolidation, is a healthy development; I don't foresee a particularly deep pullback. Unless gold breaks below major technical support at $3,550, the short-term uptrend should remain intact."

This was the Fed's first rate cut this year, after it had kept policy unchanged since 2024, following three cuts. Gold generally becomes more attractive when interest rates fall because low yields reduce the opportunity cost of holding non-yielding bullion. Gold, a traditional hedge against uncertainty, has risen 39% so far this year.

Deutsche Bank raised its gold price forecast for next year to $4,000 per ounce, from its previous forecast of $3,700. Among other precious metals, spot silver fell 2.4% to $41.51 per ounce, platinum fell 2.2% to $1,360 per ounce, and palladium fell 2.6% to $1,145.44 per ounce.

Oil Market

Oil prices fell on Wednesday after data showing a build in U.S. diesel inventories stoked concerns about demand and after the Federal Reserve cut interest rates as expected. Brent crude futures settled down 0.76% at $68.22 a barrel, while U.S. crude futures fell 0.73% to $64.05.

The U.S. Energy Information Administration (IEA) said on Wednesday that U.S. crude oil inventories fell sharply last week, with exports surging and imports plummeting. However, analysts said a build in distillate inventories exacerbated demand concerns and depressed prices. "It looks like the market is reacting to diesel, which has been the weak spot for the entire oil product market," said Phil Flynn, senior analyst at Price Futures Group.

The Federal Reserve cut interest rates by a quarter percentage point on Wednesday, as expected, and said it would steadily lower borrowing costs through the rest of the year to address concerns about a weak job market.

On the supply side, Kazakhstan resumed oil supplies through the Baku-Tbilisi-Ceyhan pipeline on September 13, state energy company Kazmunaygaz said on Wednesday. The supply was suspended last month due to contamination concerns.

Risks to Russia's oil supply have also come into focus in recent weeks as Ukrainian attacks on Russian energy infrastructure have intensified.

Russia's oil pipeline company Transneft has warned producers they may have to cut output after Ukraine attacked key export ports and refineries with drones, three industry sources said.

foreign exchange market

The dollar fell to a four-year low against the euro after the Federal Reserve cut interest rates by a quarter percentage point, before reversing course and trading higher for the day. The rate cut, along with forecasts for another quarter-point reduction at each of the two remaining policy meetings this year, suggests Fed officials have begun to downplay the risk that the administration's trade policies will spark persistent inflation.

Blair Shwedo, head of investment-grade sales and trading at Bank of America, said the Fed's 25 basis point rate cut "appears to be a catalyst for risk assets and U.S. Treasuries to focus on expectations of two more rate cuts this year." Fed officials have gradually shifted toward the view that Trump's tariffs will have only a temporary impact on inflation, and the latest forecasts align with that view.

The rate cut, the first by the policy-setting Federal Open Market Committee (FOMC) since December, lowered the policy rate to a range of 4.00% to 4.25%. The quarter-point reduction was widely expected despite U.S. President Donald Trump’s call on Monday for a “larger” cut in the benchmark rate.

The dollar received some support after Federal Reserve Chairman Jerome Powell said the Fed was in "meeting-by-meeting mode" on the outlook for interest rates and characterized Wednesday's move as a risk-management rate cut, adding that he did not see the need for quick action on rates.

A more consistent pace of rate cuts was supported by Fed Governor Waller and Vice Chairman for Supervision Bowman, both Trump appointees who dissented from the policy decision in late July to hold rates steady.

The euro fell 0.3% against the dollar to $1.18305, having risen as high as $1.19185 in early trading, its strongest since June 2021. The dollar index, which measures the greenback against six other currencies, was at 96.926, up 0.3%.

Data earlier in the day showed that U.S. single-family homebuilding and permits for future construction fell in August amid a glut of unsold new homes and a weak labor market, offsetting the impact of falling mortgage rates.

With the Federal Reserve finally set to cut interest rates again, many market participants believe the dollar will fall further, but analysts say that is far from inevitable.

“To some extent, the reason I don’t think the dollar will necessarily fall completely is because you have to consider what’s happening outside the U.S. and what’s happening in global growth,” said Juan Perez, head of trading at Monex USA in Washington. “The overall narrative for global growth is not positive. It’s not like every other country is doing exceptionally well.”

The Canadian dollar fell about 0.2% against its U.S. counterpart on Wednesday after the Bank of Canada cut its key policy rate by 25 basis points to a three-year low of 2.5%, in line with expectations, citing a slack job market and reduced concerns about underlying pressures for inflation.

UK inflation data was in line with expectations, sending the British pound up 0.08% on the day to $1.36575, not far from a two-and-a-half-month high. USD/JPY rose 0.1% to 146.655 yen ahead of the Bank of Japan's policy meeting on Friday, where it is expected to keep interest rates unchanged.

The focus will be on the October 4 vote, in which the ruling Liberal Democratic Party will choose a new leader to succeed outgoing Prime Minister Shigeru Ishiba.

International News

The probability of the Federal Reserve cutting interest rates by 25 basis points in October is 87.7%.

According to CME's "Fed Watch," the probability of the Fed keeping interest rates unchanged in October is 12.3%, and the probability of a 25 basis point rate cut is 87.7%. The probability of the Fed keeping interest rates unchanged in December is 1.1%, the probability of a cumulative 25 basis point rate cut is 19.0%, and the probability of a cumulative 50 basis point rate cut is 79.9%.

Milan Fed's first meeting: cast the only dissenting vote

Federal Reserve Governor Stephen Milan, who had been in office for just 24 hours, was the lone dissenter from the Fed's September 25 basis point rate cut, voting in favor of a larger 50 basis point cut. Analysts had speculated that Trump-appointed Fed Governors Waller and Bowman might also have dissented from the larger cut, but both chose to support the majority's 25 basis point move. Despite being skeptical of rate cuts in recent months, hawkish Kansas City Fed President Schmid also voted in favor of a 25 basis point cut.

Japan will formulate an AI basic plan this year

The Japanese government recently held the inaugural meeting of the "Artificial Intelligence (AI) Strategy Headquarters" at the Prime Minister's Office, officially launching national AI strategic planning. The meeting clarified the goal of completing the "AI Basic Plan" within the year, with the goal of becoming "the country most accessible to the development and application of AI globally." The meeting also emphasized the need to vigorously support the development of reliable "domestic AI" under government guidance, while also reviewing and adjusting existing institutional and regulatory frameworks to remove obstacles to the widespread adoption of AI.

Trump's policies sparked dissent within the Republican Party, with Johnson delaying a vote on tariffs until next year.

Anxiety within the Republican Party over Trump's trade policies surfaced openly in the House of Representatives this week, with a small group of lawmakers attempting to push back against the president's signature foreign economic strategy and demanding a greater say in tariff setting. While the dissent was brief, it exposed rifts within the party over tariffs, the economic impact of which could become a central issue in next year's midterm elections. While Congress legally holds the power to set tariffs, Trump has unilaterally imposed tariffs on dozens of trading partners in recent years through the use of emergency powers, and the House Republican leadership's unwavering deference to Trump has made it more difficult for the opposition to mount a vote to challenge the tariffs. On Tuesday, House Speaker Mike Johnson quickly quelled the protests of a small number of Republican lawmakers, delaying a head-on confrontation over the legality of Trump's tariffs until at least the end of January. The vote is likely to coincide with the holiday shopping season, when consumer sentiment on tariffs will likely be a key factor for lawmakers.

Argentina's central bank denies peso breaches trading range ceiling, citing technical factors

Argentina's central bank denied on Wednesday that the peso had breached the upper limit of its trading band, stating that its calculations differed slightly from those based on a publicly disclosed formula. According to an agreement reached between Argentina and the International Monetary Fund (IMF) in April, the upper and lower limits of the trading band are gradually widened by 1% per month, evenly distributed daily. Using this calculation method, the peso reached 1,474.5 per dollar on Wednesday, exceeding the upper limit of 1,474.345. However, Argentina's official trading system only allows quotes in 50-cent increments, so in practice, the central bank rounds off the upper limit in its calculations. In other words, the central bank's use of 1,474.5 as the upper limit means that, from its perspective, the peso has not breached the band. Under the $20 billion agreement signed between Argentina and the IMF, the central bank, led by President Milley, can intervene directly in the market to sell dollars if the upper limit is breached.

Zelensky meets with the President of the European Parliament to discuss EU accession process and other issues

On the 17th local time, Ukrainian President Volodymyr Zelenskyy met with European Parliament President Roberta Metsora and attended a joint press conference. This was Metsora's fourth visit to Ukraine during the Russia-Ukraine conflict. Zelenskyy posted on social media that the two sides had in-depth discussions on key issues between Ukraine and European institutions, including supporting Ukraine's EU accession negotiations and emphasizing the importance of launching the first "cluster" negotiations as soon as possible. They also discussed sanctions against Russia.

Israel's finance minister calls Gaza a "real estate bonanza" and is negotiating with the US on a post-war division of the region.

Israeli Finance Minister Smotrich said on the 17th that the Gaza Strip is a "real estate bonanza" and that he is negotiating with the United States on how to divide the strip after the war. The far-right minister said at a real estate conference in Tel Aviv that the Gaza Strip "has a real estate boom and can be self-sufficient" and that he has begun negotiations with the Americans.

German Chancellor urges citizens to prepare for reforms

German Chancellor Angela Merz delivered a speech to the Bundestag on the 17th, urging the public to prepare for reforms that are crucial to "Germany's future." The Bundestag held its general debate that day. In her speech, Merz stated that Germany needs to make major decisions, focusing on resolving "very fundamental issues," and that Germany must choose the right path. Merz urged the German people to have "greater confidence" in their country. Deutsche Presse-Agentur reported that Merz urged the public to understand the necessary reforms, but did not elaborate on the specifics, including the public's concern about whether Germany's welfare system would be drastically altered.

Domestic News

China and ASEAN countries launch joint innovation action on meteorological AI model application

On September 17, the 4th China-ASEAN Meteorological Cooperation Forum, themed "Digital Intelligence Empowers Meteorological Cooperation, Early Warning and Benefits the People's Livelihood", opened in Nanning, Guangxi. Representatives from the meteorological and hydrological departments of China and ASEAN countries, the World Meteorological Organization, relevant universities and enterprises discussed regional meteorological cooperation and development. At the meeting, representatives from China and ASEAN countries jointly launched the China-ASEAN Joint Innovation Action on Meteorological AI Model Application. It is understood that this joint innovation action focuses on four aspects: joint innovation, data integration, joint talent cultivation, and building a home together, to jointly promote the digital transformation and development of meteorology in China and ASEAN countries. The parties will build a "China-ASEAN Meteorological House" that is jointly built, shared and used, and establish a cooperation platform that integrates a "physical space" for "face-to-face" discussions and exchanges and an "end-to-end" open and integrated "digital space" to build a regional meteorological disaster warning network and contribute to regional sustainable development. (Xinhua News Agency)

KPMG China: China's automotive industry is focusing on "AI+automotive" technological breakthroughs

On September 17th, KPMG China held the "2025 KPMG China Automotive Industry Summit and the 8th Automotive Technology 50 List Release Conference" in Shanghai. Yang Jie, Chief Partner of KPMG China's East and West China regions, stated that the Chinese automotive industry is focusing on breakthroughs in "AI + Automotive" technology to build core competitiveness. Yang Jie further stated that the Chinese automotive industry must fully respond to the national "Artificial Intelligence +" initiative and truly integrate AI technology into core scenarios such as intelligent driving, intelligent cockpits, and vehicle energy management. More importantly, it is necessary to avoid falling into the trap of technological "homogenization," increase R&D investment, and actively collaborate with AI companies and research institutions to build collaborative platforms, transforming intelligent connectivity capabilities into a unique and differentiated advantage. KPMG China will continue to leverage its expertise and work with all parties to contribute to the prosperity and development of the automotive industry.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.