Comparison of the Fed's two recent decisions: There are major differences within the decision-making level, and Powell said that employment risks are tilted to the downside.

2025-09-18 07:54:47

Only Milan, who took office on Tuesday, dissented, favoring a 50 basis point rate cut. Milan, currently on vacation and chair of the White House Council of Economic Advisers, is currently on vacation. Comparing the full texts of the two recent interest rate decisions reveals a major shift: this one repeatedly mentions increased downside risks to employment. Furthermore, the voting pattern reflects significant divisions within the Federal Reserve.

The following is the full text of the statement released by the Federal Open Market Committee (FOMC) of the U.S. Federal Reserve (Fed) following its monetary policy meeting on September 16-17:

Recent indicators suggest that economic activity growth moderated in the first half of the year. Job gains slowed, and the unemployment rate rose slightly but remained low. Inflation rose but remained at a moderately elevated level.

The Committee seeks to achieve maximum employment and 2 percent inflation over the longer run. Uncertainty about the economic outlook remains elevated. The Committee is aware of risks to both sides of its dual policy mandate and judges that downside risks to employment have increased somewhat.

To support its goals, the Committee decided to lower the target range for the federal funds rate by 25 basis points to 4% to 4.25%. In considering further adjustments to the target range for the federal funds rate, the Committee will carefully assess incoming data, the evolving outlook, and the balance of risks. The Committee will continue to reduce its holdings of U.S. Treasury bonds, agency bonds, and agency mortgage-backed securities (MBS). The Committee remains strongly committed to supporting maximum employment and returning inflation to its 2% objective.

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee will be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the achievement of the Committee's objectives. The Committee's assessment will take into account a wide range of information, including indicators of labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

The FOMC members who voted in favor of the Fed's monetary policy decision included: Chairman Powell, Vice Chairman Williams, Vice Chairman for Financial Supervision Barr, Governor Bowman, Boston Fed President Collins, Governor Cook, Chicago Fed President Goolsbee, Vice Chairman Jefferson, St. Louis Fed President Musallem, Kansas City Fed President Schmid, and Governor Waller. Governor Milan dissented, advocating a 50 basis point cut in the target range for the federal funds rate at this meeting.

(Comparison of the full text of the Federal Reserve's resolution and the two recent resolutions)

There are significant differences within the Federal Reserve on the interest rate path, and it is expected to cut interest rates by another 50 basis points this year.

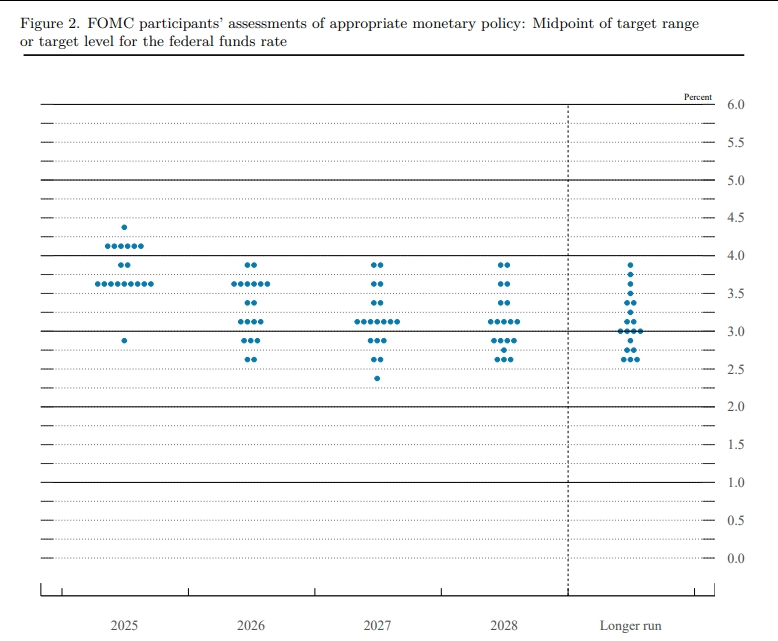

The latest released summary of quarterly economic forecasts shows that there are significant differences within decision-makers.

The median forecast now calls for a larger rate cut than three months ago, when the job market was stronger and President Trump had yet to appoint a new governor who explicitly supports rate cuts.

Wednesday’s rate decision was dissented by only one policymaker – new governor Michael Milan, a former economic adviser to Trump.

The Fed's "dot plot" doesn't detail individual policymakers' forecasts, but it shows one of the 19 policymakers, likely a non-voting regional Fed president, believes the current rate cut is inappropriate. That official expects rates to remain at 4.4% by year-end, above the current adjusted range of 4.00% to 4.25%.

On the other hand, one policymaker – likely Milan, who backed a 50 basis point cut – predicted rates would be as low as 2.9% by year-end.

The dot plot also showed that six officials saw no further rate cuts this year, two favored one more cut (by 25 basis points) and nine backed two more cuts (by 50 basis points in total), which constituted the median forecast.

Since the last round of forecasts in June, job growth has slowed significantly, the unemployment rate has risen to 4.3%, and Trump's tariffs have failed to trigger broad inflationary pressures. These factors have led most officials to support resuming rate cuts, but some remain cautious due to concerns about inflation.

Christopher Hodge, an economist at Natixis, said, "Both sides have valid arguments," and he expects a split in opinion. "We shouldn't rush to conclude that this decision is politically motivated, but we can't completely discount the possibility either."

The median forecast for the next two years shows the Fed planning to cut interest rates by 25 basis points each year. The range of forecasts for the rate at the end of 2026 is 2.6% to 3.9%.

Policymakers expect the unemployment rate to reach 4.5% in December this year and fall to 4.4% by the end of 2026.

At the same time, they maintained their forecast for PCE inflation at 3.0% by the end of 2025, falling to 2.6% by the end of 2026; core PCE inflation is expected to be 3.1% this year and fall to 2.6% next year. The Fed's inflation target is 2%.

Powell: Inflation risks are tilted upward, employment risks are tilted downward

“ In the near term, risks to inflation are tilted to the upside and risks to employment are tilted to the downside, which presents a challenging situation for monetary policymakers,” Chairman Powell said at a press conference after the Fed’s meeting. “The risks we see facing the labor market are a key focus for today’s decision.”

Powell said he believed the recent pace of job creation was below the break-even level needed to keep the unemployment rate stable, and with businesses overall hiring so little, any increase in layoffs could quickly lead to a rise in the unemployment rate.

"The labor market is softening and we don't want it to soften any further," he said.

The Fed chairman also said the Fed is in a "meeting-by-meeting mode" on the outlook for interest rates and characterized Wednesday's move as a risk-management rate cut , adding that he did not see the need for quick action on rates.

Market View Summary

Following the Federal Reserve's interest rate cut, Wall Street saw mixed gains and losses. The Dow Jones Industrial Average rose, while the S&P 500 and Nasdaq Composite Index fell. The 10-year Treasury yield and the US dollar index rebounded from a low, closing sharply higher. Several analysts offered the following interpretations of the policy decision and market trends:

KPMG believes that if the Fed continues its current policy into next year, it may lead to excessive stimulus; Mitsubishi UFJ pointed out that the Fed's decision this time was the most dovish statement it could make, and added another interest rate cut this year to its dot plot expectations, but it felt that the Fed did not enter the interest rate cut sprint mode, but simply restarted the interest rate cut process because it acknowledged that the job market was not as good as expected.

"New Bond King" Gundlach said that the Fed's 25 basis point interest rate cut was the right move, and the biggest opportunity worth paying attention to is the downward trend of the US dollar; some institutions said that the Fed expects the economy may continue to soft-land, which is very beneficial to the credit market; Fitch said that the Federal Reserve is now fully supporting the labor market and has clearly released a clear release that it will enter a decisive and aggressive interest rate cut cycle in 2025. The message is very clear, that is, growth and employment are the top priorities, even if it means tolerating higher inflation in the short term.

Michael Rosen, Chief Investment Officer at Angeles Investment, said Powell's comments have somewhat dampened market expectations for a more rapid rate cut. He noted that while the Fed acknowledges labor market pressures, it has left policy room to respond to more severe scenarios. Furthermore, the upward revision of inflation expectations reflects the dilemma faced by monetary policymakers between safeguarding employment and preventing inflation.

He noted that the US economy is experiencing characteristics of "mild stagflation," with growth momentum slowing while inflation continues to exceed expectations. This environment reminds investors to maintain a more cautious outlook on future stock and bond returns. He suggested that after the long period of outperformance of US dollar assets, investors should focus more on diversified allocations across markets and currencies.

Guy Lebas, chief fixed income strategist at Janney Capital Management, believes the decision fully met market expectations. He noted that there is a consensus within the Federal Reserve that economic risks are shifting further toward a downturn in employment. Regarding new Governor Milan's opposition, he said, "It's unreasonable for him to oppose a collective decision so soon after taking office," and expressed concern about the increasing politicization of Fed decision-making.

He expects that interest rates will continue to decline gradually from 2026 to 2028 as the economic and inflation situation develops, but new policymakers may underestimate the resilience of inflation, which may cause the yield curve to steepen in the future.

Brij Khurana, fixed income portfolio manager at Wellington Management, said the most surprising thing wasn't the rate cut itself, but that only Milan supported a larger cut. He had expected both Waller and Bowman to support a 50 basis point cut. He believes that despite signaling further rate cuts, the Fed's overall tone remains hawkish, with the dot plot not as downbeat as market expectations and the Fed openly acknowledging persistent inflation.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.