USD/JPY surges nearly 200 points! Powell's speech boosts the dollar's rebound, but is the Bank of Japan in trouble?

2025-09-18 14:46:50

It is worth noting that the Fed's dovish stance (foreshadowing further rate cuts in October and December) diverges significantly from the growing market consensus that the Bank of Japan will stick to its path of policy normalization. The narrowing trend in the US-Japan interest rate differential may limit further declines in the low-yielding yen.

The market may choose to wait and see before the Bank of Japan's policy benchmark interest rate announcement (September 19). The U.S. weekly initial jobless claims data tonight may provide new trading momentum for the market.

The yen was pressured by weak domestic data and a stronger dollar.

Government data released Thursday morning showed that Japan's core machinery orders fell 4.6% month-on-month in July, and the year-on-year growth rate slowed to 4.9% from 7.6% in June, far below market expectations, putting pressure on the yen in Asian trading.

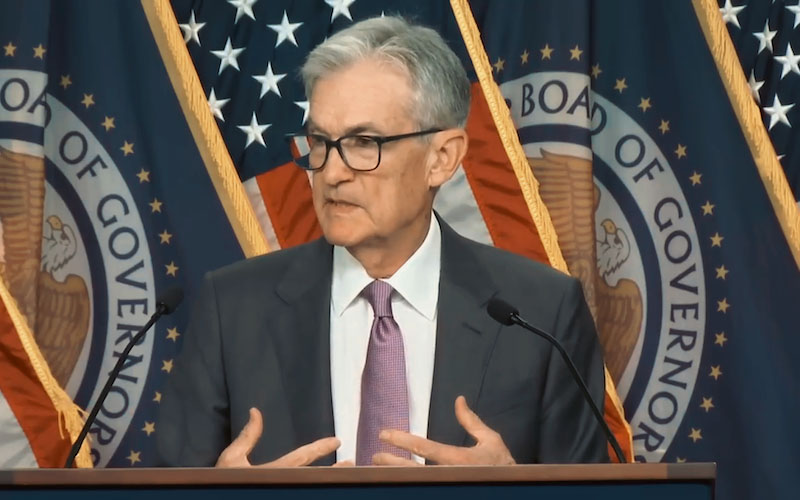

Although the Federal Reserve cut interest rates for the first time since December 2024 as expected, lowering them by 25 basis points to a range of 4.00%-4.25%, and indicated that further rate cuts would be made this year, Fed Chairman Powell emphasized at a press conference that "inflation risks are tilted to the upside," triggering short covering in the US dollar .

USD/JPY has rebounded strongly by about 200 pips from the 145.48 area hit overnight (its lowest point since July 7).

However, given growing market confidence that the Bank of Japan will raise interest rates this year, the yen's potential for significant depreciation is limited. The US-Japan trade agreement has mitigated domestic growth risks, a move the Bank of Japan believes paves the way for achieving its 2% inflation target. Coupled with a tight labor market and a positive economic outlook, the conditions for a rate hike are becoming increasingly favorable. Furthermore, geopolitical risks such as the Russia-Ukraine conflict and escalating conflict in the Middle East may also inhibit investors from aggressively shorting the safe-haven yen.

Market focus now turns to the Bank of Japan's two-day policy meeting, which begins Thursday. While the central bank is widely expected to remain on hold, investors will be closely watching for signals on the future policy path, which may determine the yen's near-term direction. Later in the day, the release of US weekly initial jobless claims and the Philadelphia Fed manufacturing index will also provide short-term trading opportunities.

USD/JPY encounters resistance as 147.60-147.70 resistance zone becomes a test for bulls

The technical outlook for USD/JPY suggests a tug-of-war between bulls and bears. Wednesday's break below the 146.30-146.20 support area was confirmed as a false break following the Fed's decision, with Thursday's strong rally above 147.00. However, daily oscillators haven't yet confirmed the positive outlook, suggesting strong resistance in the 147.60-147.70 area.

A sustained breakout could see the pair move towards the psychological 148.00 level, which could lead to a test of resistance at the 200-day simple moving average (148.61), the 149.00 level and the monthly high of 149.15.

On the downside, any effective pullback may find support around the 146.20 level, with the key defense level to be seen at 146.00. A break below this level could lead to a drop to the overnight low of 145.50-145.45. If this level is broken, the selling pressure may intensify and push the exchange rate to challenge the psychological level of 145.00.

(USD/JPY daily chart, source: Yihuitong)

At 14:43 Beijing time, the US dollar was trading at 147.46/47 against the Japanese yen.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.