Is it a good time to buy the dip when the Bank of England's interest rate decision is announced today?

2025-09-18 16:31:33

Although the Bank of England is likely to maintain the current interest rate unchanged, there is still uncertainty due to the divided vote. Coupled with the tail risks at the Federal Reserve level, the short-term exchange rate trend is highly uncertain.

Bank of England policy outlook:

As the Bank of England will not release new economic forecasts until November, if there is no unexpected interest rate adjustment at this meeting, foreign exchange market fluctuations will mainly depend on three aspects: subsequent UK inflation and employment data, the MPC monetary policy statement (including voting results), and the press conference held by Governor Andrew Bailey after the meeting to observe whether the Bank of England will end quantitative tightening.

While recent economic data released on both sides of the Atlantic (including UK inflation and labor market data) has been mixed, it hasn't changed the market's core assessment: the Bank of England's base rate will remain stable at 4% for the remainder of 2025. Swap market pricing indicates that as of the Bank of England's December meeting, only a 7 basis point interest rate change was factored in, with expectations of a full 25 basis point rate cut delayed until April 2026. UK inflation and employment data are central to the UK's interest rate decisions.

The UK Monetary Policy Committee (MPC) is split in its vote, and its stance could influence the short-term direction of the GBP/USD exchange rate. Recalling the previous Bank of England Monetary Policy Committee (MPC) vote, a 5-4 split favored a rate cut, with a second vote required to finalize the decision. Key concerns at this meeting include: if two votes (market expectations) favor another rate cut, this could trigger a repricing of easing expectations at the short end of the UK gilt curve, suppressing the GBP/USD exchange rate. A unanimous vote in favor of maintaining interest rates would likely boost GBP/USD's performance.

If the Bank of England's speech confirms a consensus on slowing quantitative tightening (QT) in the UK, this could put pressure on the GBP/USD exchange rate. Due to the UK's dire fiscal situation, long-term government bond yields have fluctuated sharply, and the market generally expects the Bank of England to slow QT. However, a cautionary tale: if the Bank of England fails to slow QT as expected (a hawkish signal), this could actually depress the long end of the UK government bond curve, indirectly pressuring the GBP/USD exchange rate.

Beware of unexpected Bank of England policy changes and tail risks from the Fed

After the Federal Reserve's interest rate decision was announced, it cut interest rates by 25 basis points. The Fed's subsequent hawkish remarks were somewhat below market expectations. Although the Bank of England's decision is the focus today, the continuity of the Fed's trend after its meeting on Wednesday is more worthy of attention.

The median expectation of Federal Reserve policymakers is currently two more rate cuts this year, leaning towards a milder easing cycle than the market is pricing. However, the reaction of the US dollar and US bond markets this time was flat, exceeding market expectations.

(The median of the dot plot votes shows that the interest rate is expected to be cut to 3.5%-3.75% this year, suggesting that there will be two more 25 basis point rate cuts)

Concerns about the Fed's independence (e.g., Trump appointing officials to "force the abdication") did not materialize: Waller and Bowman (a Trump-appointed official) both supported a 25 basis point rate cut, and did not dissent as they did in the July meeting.

(Affected by Powell's speech, overall expectations for interest rates at the end of next year have declined)

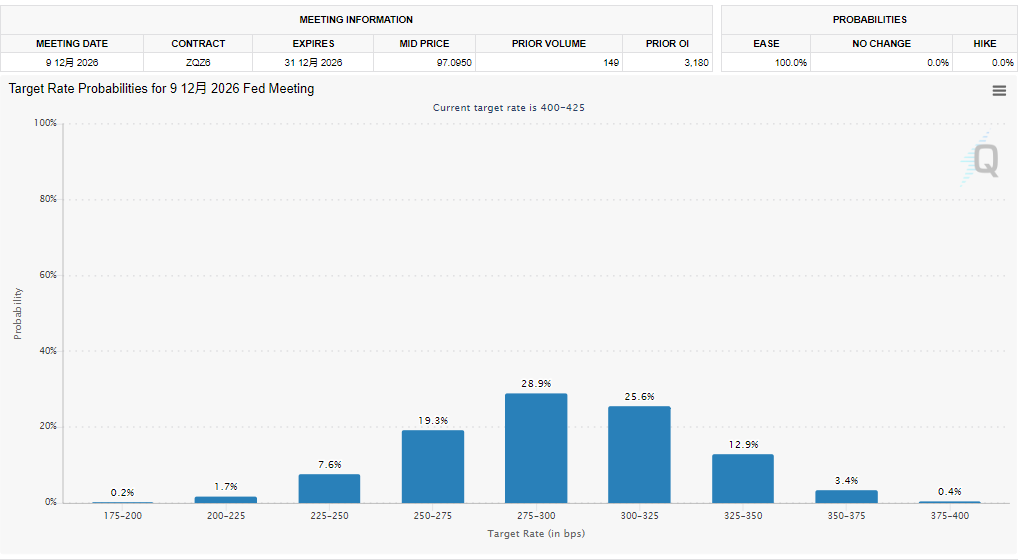

The game between market pricing and data: The current market pricing of "a cumulative interest rate cut of 125 basis points by the end of 2026" depends entirely on labor market data (we should be wary of the precedent that the weak non-farm payroll data in the summer of 2024 did not push up the unemployment rate).

(Although the highest probability is a 125 basis point rate cut in 2026, there is a lot of room for expectations to change.)

Historical experience shows that a delayed reaction often occurs after Federal Reserve meetings. Caution is advised: If the market subsequently realizes that expectations of easing are excessive as it digests the Fed's policy, this could trigger a further rebound in the US dollar and a correction in the US Treasury market, indirectly impacting the GBP/USD exchange rate. Conversely, if subsequent data falls short of expectations, there remains significant room for interest rate futures betting.

Although the market generally expects the Bank of England to maintain the current benchmark interest rate unchanged, coupled with the potential tail risks (low-probability extreme policy events) at the Federal Reserve level, the short-term trend of the pound and the US dollar is highly uncertain.

Technical Analysis

Technical signals are weak: bullish momentum is gradually fading, with the 14-day relative strength index (RSI) declining simultaneously, and the moving average convergence divergence (MACD) yet to confirm a bullish signal. The tail risk of the US dollar related to the Federal Reserve may further push up the volatility of the GBP/USD exchange rate.

At present, GBP/USD continues its correction trend, and the short-term upward support has been broken. The recent trend of GBP/USD shows a clear correction signal: first, a "shooting star line" (bearish K-line pattern) was recorded, and then it fell below the short-term upward trend support level started from the low point on September 3, indicating that the short-term exchange rate will adjust and consolidate.

The short-term support focuses on the line connecting multiple recent exchange rate highs at 1.3589. If it fails, it will most likely test the 20-day moving average and the neckline of the head and shoulders bottom. If it continues to fall below, it may even test the support range of 1.3450-1.3370. If the exchange rate rebounds, the recent high of 1.3725 and the January 2022 high of 1.3749 will be the core resistance levels.

In line with the trend, technical indicators also weakened: the 14-day RSI fell below its own upward trend, and the MACD has not yet confirmed a bullish signal, pointing to a short-term bearish pattern for GBP/USD.

(GBP/USD daily chart, source: Yihuitong)

Trading highlights of the day: Bank of England decision and US jobless claims data

Bank of England decision: Announcement time is 19:00 Beijing time. Focus will be on the voting results, the policy statement's description of the interest rate path, and the policy stance released by Bailey's press conference.

The number of initial jobless claims in the United States is released 90 minutes after the resolution is announced. As the most real-time labor market indicator, its data performance will directly affect the market's expectations of the Federal Reserve's policies, and thus affect the trend of the GBP/USD exchange rate.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.