The Federal Reserve faces its final stress test at the end of the month, raising concerns about balance sheet reduction.

2025-09-18 16:42:02

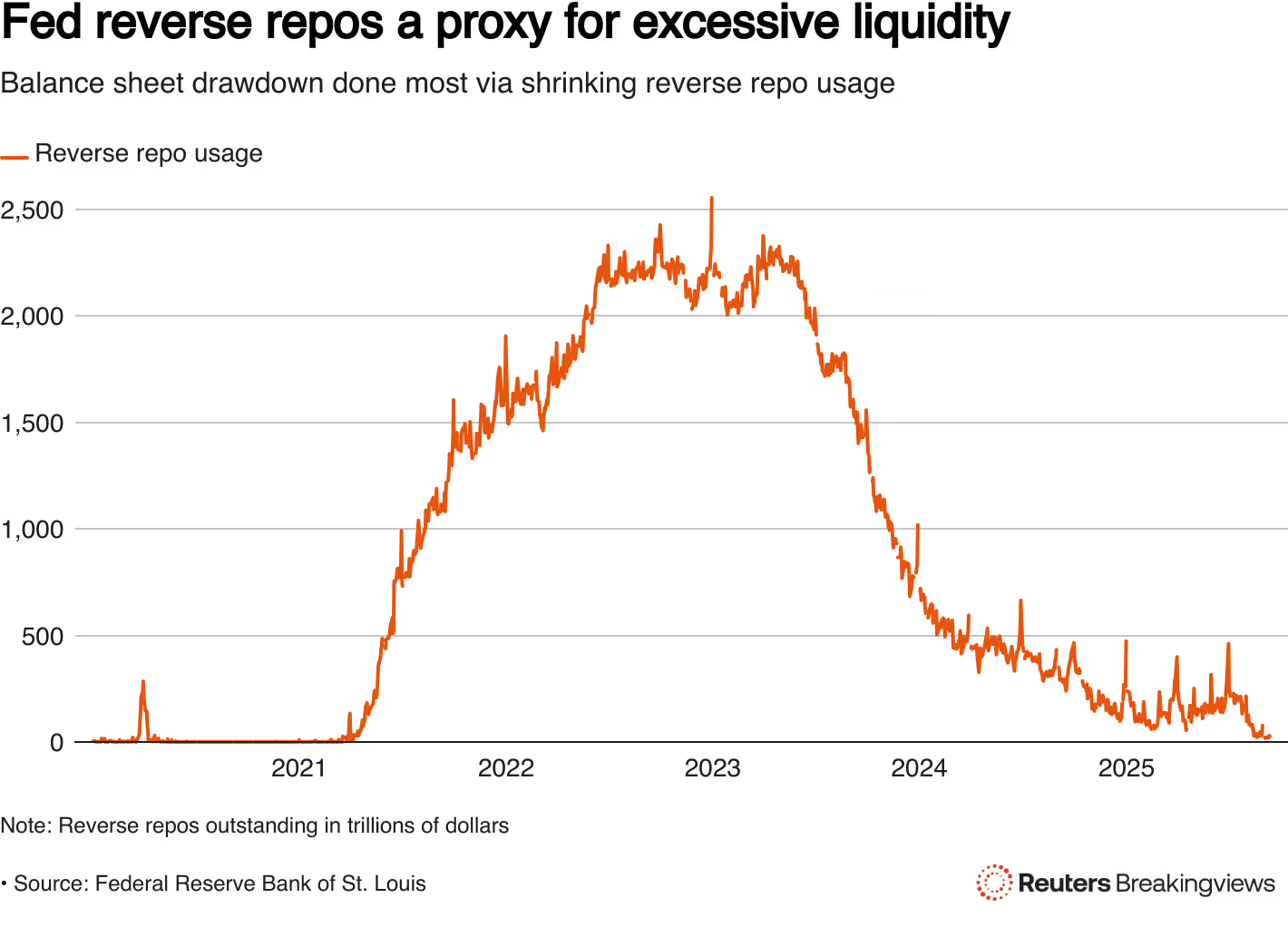

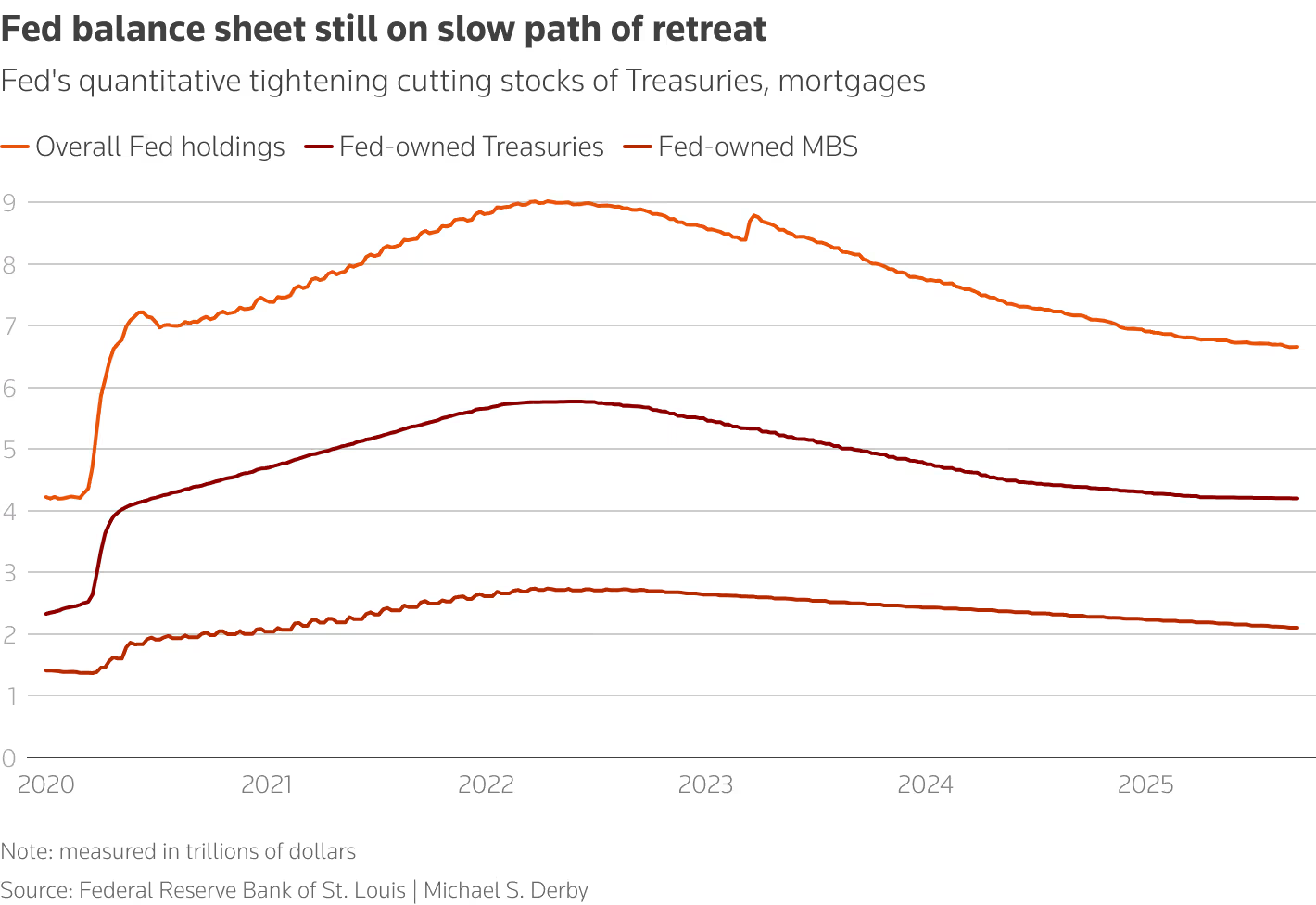

As the Federal Reserve slowly shrinks its balance sheet but continues to tighten liquidity, the Fed's reverse repo facility (RRP) and standing repo facility (SRF) are likely to see significant use as banks and other institutions cope with the normal month-end and quarter-end funding squeeze. The SRF, established by the Fed in 2021 to allow financial institutions to quickly exchange U.S. Treasury securities for cash, has so far remained largely untested.

Wrightson ICAP analysts estimate that reverse repo usage could surge to $275 billion by month-end from negligible levels now, but more noteworthy is the potential for significant usage of the SRF.

Wrightson ICAP “expects” around $50 billion in SRF usage on September 30, up significantly from $11 billion at the end of June.

Federal Reserve's short-term interest rate target

Accurately assessing quarter-end market liquidity is always difficult because the factors affecting capital flows are short-lived and can quickly reverse once the new quarter begins.

The Treasury's accounts at the Federal Reserve will also fluctuate significantly, putting pressure on liquidity in the financial sector. Therefore, the performance of these funding tools is critical for the Federal Reserve to control its short-term interest rate targets.

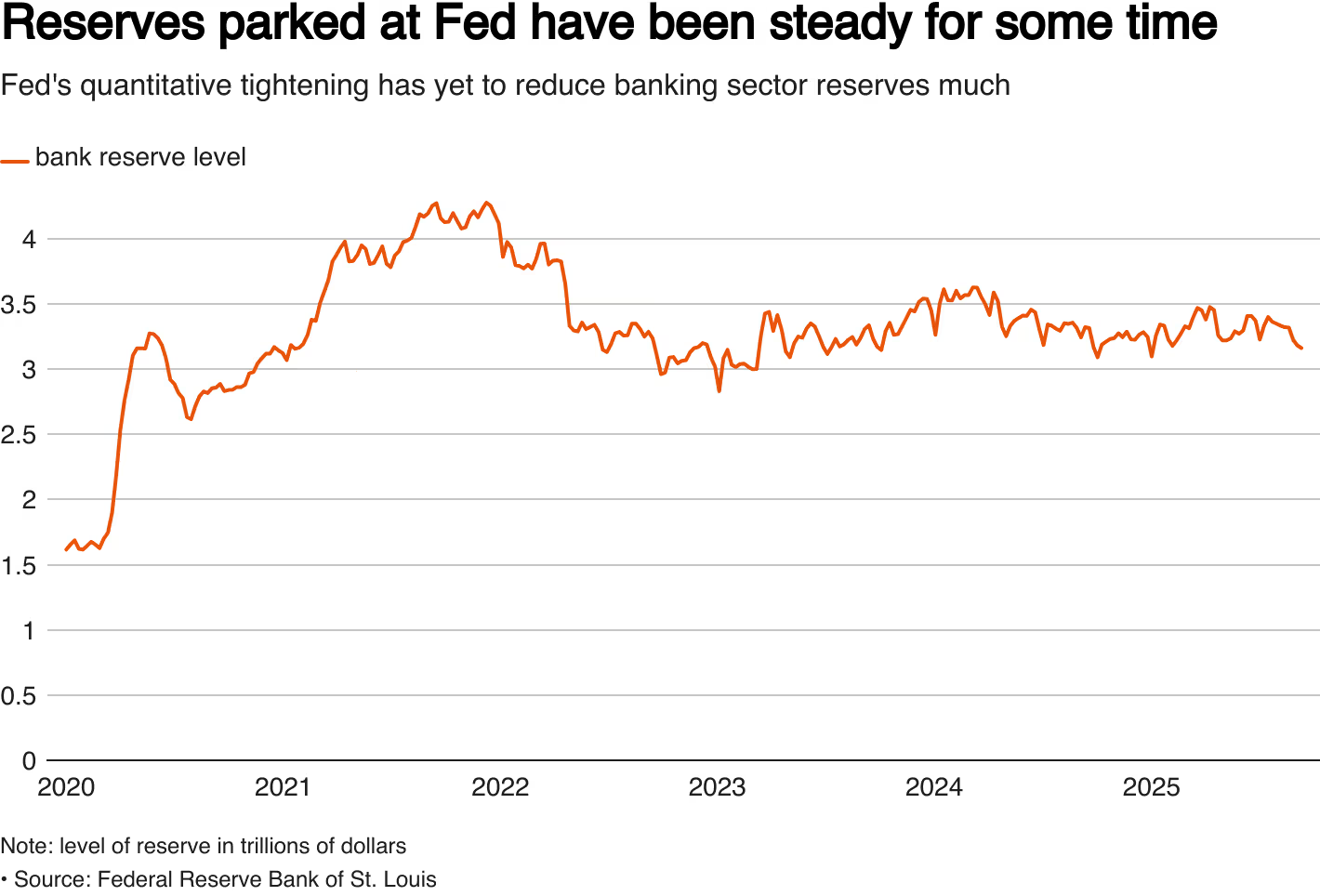

The Federal Reserve generally accepts that volatility in funding markets is normal and believes that liquidity tools will help smooth such volatility, thereby providing more room for quantitative tightening .

Dallas Fed President Logan said last month that temporary pressure may appear in September, but active use of the SRF will help the Fed continue to push for balance sheet reduction and reduce reserves to a more efficient level.

As Chairman Logan said, the active use of the SRF can provide more room for the Federal Reserve to continue to advance quantitative tightening. The continued advancement of quantitative tightening means withdrawing more US dollar liquidity from the market, which is a key factor supporting the strengthening of the US dollar in the medium term .

The U.S. banking system currently has $3.2 trillion in reserves. In a speech this summer, Federal Reserve Governor Waller said that by the end of the balance sheet reduction, reserves could be at $2.7 trillion.

Pressure on the repo market increases

The SRF is positioned to act as an automatic shock absorber, helping to reduce the pressure on the Federal Reserve to actively manage liquidity fluctuations and allowing quantitative tightening to continue.

Many observers believe that if the SRF is used in large and prolonged periods, especially after the stress period in September, it may be a signal that quantitative tightening needs to stop, which means a slowdown in the tightening of US dollar liquidity and may weaken the medium-term support for the US dollar .

Mark Cabana, head of U.S. interest rate strategy at Bank of America Securities, pointed out that the Federal Reserve has withdrawn too much liquidity from the banking system, and pressure in the repurchase market has continued to increase, which should only increase in the future.

Pressure on repo rates could disrupt the Fed's control over short-term interest rates, so it's a matter of great concern to policymakers.

Cabana believes that the Fed's funding tools will help it weather this quarter-end test, but market pressures reflected in rising repo rates will continue to rise. He pointed out that "this will be a key signal to the Fed that they need to stop quantitative tightening." At present, the Fed is likely to stop shrinking its balance sheet by the end of this year, but this may become a focus of the Fed's policy meeting on October 28-29.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.