Will Trump's tariff costs be passed on to consumers? Could inflation trigger a dollar crisis?

2025-09-24 13:37:20

Enterprises under pressure: the main body of current cost absorption

The consensus among economists is that the burden of Trump's tariffs has so far been borne mostly by U.S. businesses, while consumers have been relatively unaffected, although expectations are that the balance will tip significantly in favor of consumers in the coming months.

The ultimate impact remains to be seen, but given that consumer spending accounts for about 70% of annual U.S. economic activity, changes in the final price of imports may become one of the key factors determining the direction of economic growth and inflation.

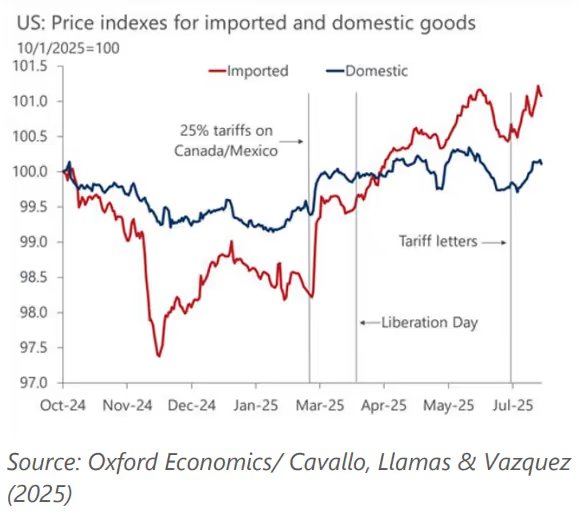

Six months of chaos since Trump announced the "Liberation Day" tariffs on April 2 are gradually calming, although final tariffs on goods from China and India, as well as key imports such as chips and semiconductors, remain to be finalized.

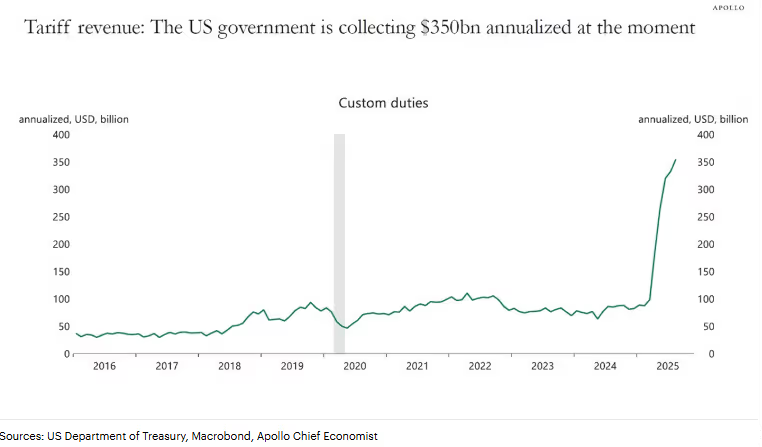

A rough range has emerged, with the average effective tariff likely to be between 15% and 20%, up from 2.5% in December and the highest level since the 1930s. The latest estimate from the Yale Budget Lab is 17.4%.

So far, the effective tax rate has been closer to 10% to 12%, with most of the costs being absorbed by American companies themselves, as they are reluctant to pass on higher costs to customers. Distortions caused by forward import orders and confusion over tariff rates and implementation have kept companies on the sidelines.

(Annualized tariff revenue of the U.S. government)

Consumer pressure is coming

The burden of tariffs varies significantly across industries. Oxford Economics points out that consumers bear almost all of the burden of tariffs on sporting goods and furniture, while companies bear the majority of the burden in the automotive and apparel sectors.

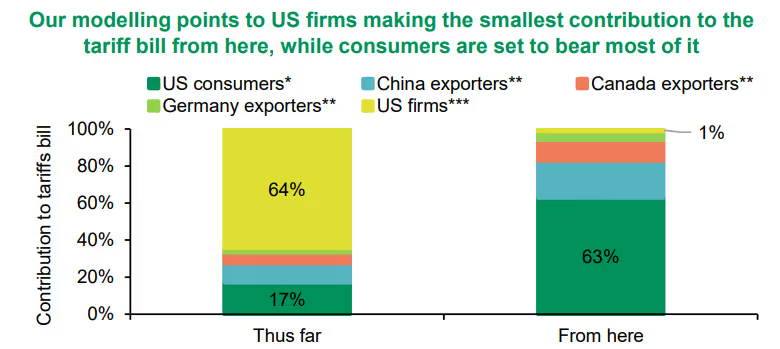

But overall, consumers haven't really felt the squeeze yet. Economists at BNP Paribas calculate that American businesses have so far borne 64% of the tariff costs, foreign exporters less than 20%, and American consumers just 17%.

Their economic models suggest that this ratio will flip dramatically in the coming months: U.S. consumers will bear 63% of the cost , while U.S. businesses will bear only 1%. Meanwhile, a recent Atlanta Fed blog concluded that, on average, U.S. businesses believe they can pass on more than half of a 10% cost increase without hurting demand.

(Tariff Cost Sharing Ratio Chart)

Can consumers withstand the price increase?

The US economy is already showing signs of fatigue: economic growth in the first half of the year slowed to half its level last year, job growth stagnated, and the Federal Reserve resumed its interest rate cut cycle. Against this backdrop, significant price increases by businesses could further dampen consumer spending and increase the risk of consumer inflation. Furthermore, businesses are concerned that significant price increases could provoke dissatisfaction with the Trump administration.

Michael Pearce of Oxford Economics said: "The burden of tariffs on the economy is gradually increasing, and the biggest impact on consumers is yet to come. But in the short term, less than two-thirds of the risk will be passed on to consumers."

The US dollar may face double pressure: if inflation continues to exceed expectations, the market may price in the Fed's hawkish turn in advance, supporting the dollar in the short term; but in the long run, tariffs will weaken consumer spending and economic growth, which will ultimately be bearish for the dollar.

Tariffs become a new source of government revenue

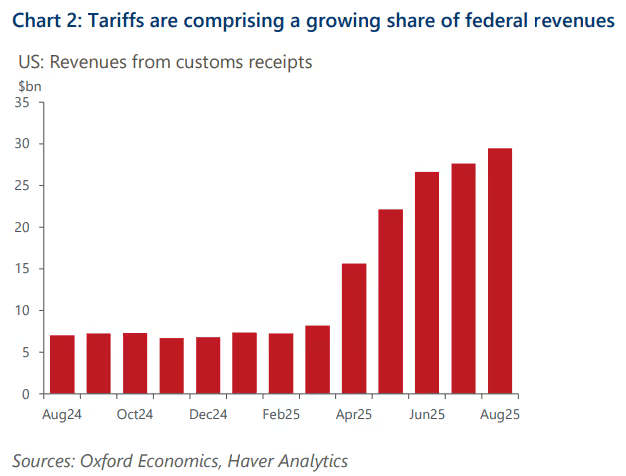

For the Trump administration, the surge in tariff revenue may be less of a concern than who bears the brunt of the impact. Data from the Yale Budget Lab shows that as of August, the new tariffs had already generated $88 billion in fiscal revenue, with approximately $23 billion coming in August alone.

In the long term, tariffs are projected to generate $2 trillion in net revenue over the next decade, and Oxford Economics estimates they could reduce the deficit by approximately $2.6 trillion. If this revenue stream continues, the likelihood of Congress cutting it off in the future will be significantly reduced .

(Import and Domestic Commodity Price Index Chart)

(Customs tax revenue chart)

Although companies are still struggling to absorb the costs, as the tariff pressure transmission chain extends, whether American consumers are willing (or able) to "swallow the tariffs" as Trump demands will become a core test of the real economy.

At 13:36 Beijing time, the US dollar index is currently at 97.36.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.