Gold hits resistance at 3770! Overbought and a rebounding US dollar weigh on the bulls. Can they hold up?

2025-09-24 18:52:17

Gold's performance suggests that investors have deeply priced in two more Federal Reserve rate cuts this year and continue to bet on subsequent rate cuts. This expectation may curb aggressive dollar bullish bets while continuing to support gold, a non-interest-bearing asset. Furthermore, escalating geopolitical tensions and a slight deterioration in global risk sentiment should help limit the downside for safe-haven gold. Therefore, caution is advised before cashing in on favorable trades and entering short positions in gold. The following is a sharing of recent market dynamics.

Gold bulls become cautious as dollar demand picks up

Traders expect the Federal Reserve to cut borrowing costs again in October and December after a quarter-point rate cut earlier this month, prompting some bargain hunting in gold, a non-interest-bearing asset, during Asian trading on Wednesday.

Federal Reserve Chairman Jerome Powell on Tuesday sought to dampen market expectations for further interest rate cuts in the coming months, saying the Fed would need to continue balancing the competing risks of high inflation and a weak job market in future rate decisions.

Powell added that overly aggressive easing could lead to a failure to control inflation, necessitating a reversal of policy direction. The dollar had previously retreated for two consecutive trading days from its high of more than a week, and his comments helped revive demand for the dollar, potentially suppressing gold.

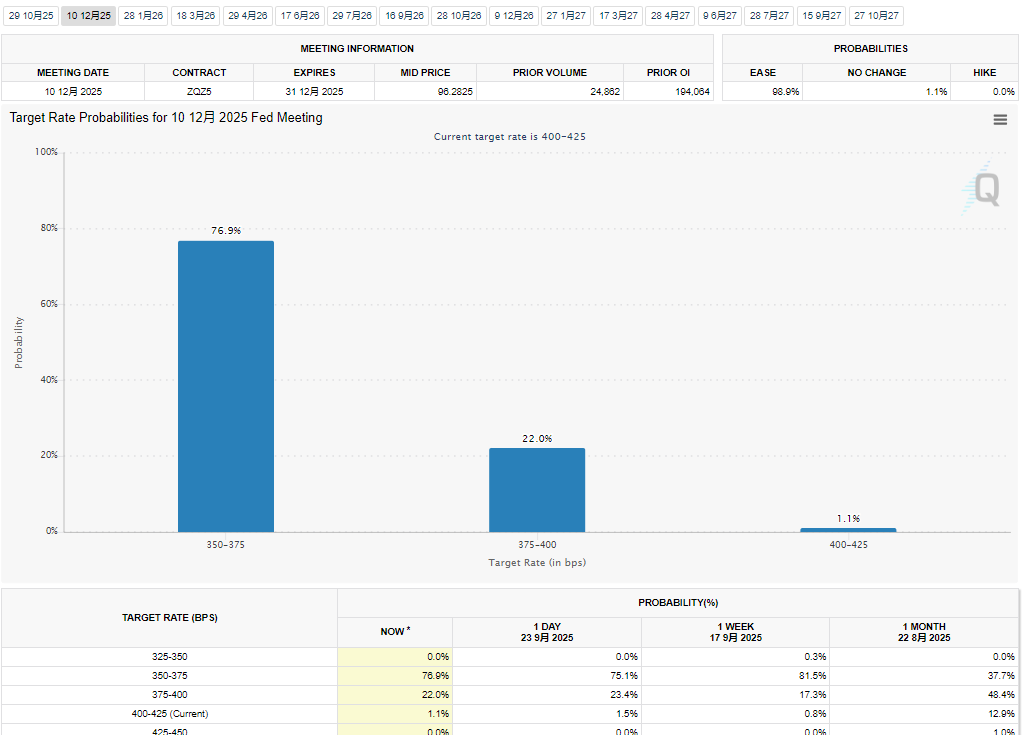

(CMEFedWatch interest rate futures indicate a 98.9% probability of at least one more rate cut in the United States this year, and a 76.9% probability of two rate cuts.)

Asian stock markets continue to surge, boosting market risk appetite

It is worth noting that the periods of sharp rise in spot gold are basically concentrated in the European and American sessions, but the main fluctuations in the Asia-Europe session are during the opening of the Asian stock market. It is particularly pointed out that as the leader of the Asian market, Hong Kong stocks have shown a very high correlation with their stock index trends during their trading hours.

A slight rebound in geopolitics limits the adjustment space for gold

NATO warned Russia on Tuesday that it would use all necessary military and non-military means to defend its security. Meanwhile, Israel continues its military offensive in the Gaza Strip. A recent UN report indicates that the Israeli government clearly intends to permanently establish control over the Gaza Strip.

This has exacerbated market concerns about the expansion of conflicts in the Middle East, and geopolitical risks continue to ferment, which has become another factor providing support for the safe-haven asset gold.

Trading reminder:

Traders are currently watching U.S. new home sales data for fresh trading guidance.

This week's US economic data calendar also includes the release of final second-quarter GDP and durable goods orders data on Thursday, and the release of the US Personal Consumption Expenditures (PCE) price index on Friday. These data will dominate the US dollar and spot gold price fluctuations in the short term.

Gold may struggle to extend its gains in this overbought market, as evidenced by the 5-minute chart. If it fails to break above 3770, it will likely see further corrections to mitigate the overbought conditions. Meanwhile, within a $10 range, support exists at 3760 and 3750.

(Spot gold 5-minute line)

Gold's recent sharp rise broke through the overbought condition, and the emergence of bargain hunting on Wednesday suggests that the path of least resistance for gold prices is still tilted to the upside. However, gold prices encountered resistance below the $3,800 mark overnight, which may be regarded as the first sign of potential exhaustion of bullish momentum.

Therefore, if gold prices fall below the Asian trading low (around $3,750) and follow-up selling occurs, it may test the $3,710-3,700 support range. On the 4-hour chart, traders can operate around the middle line of the ascending channel, shorting below the line and buying above the line.

(Spot gold 4-hour chart, source: Yihuitong)

At 18:42 Beijing time, spot gold was trading at $3,763.3 per ounce.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.