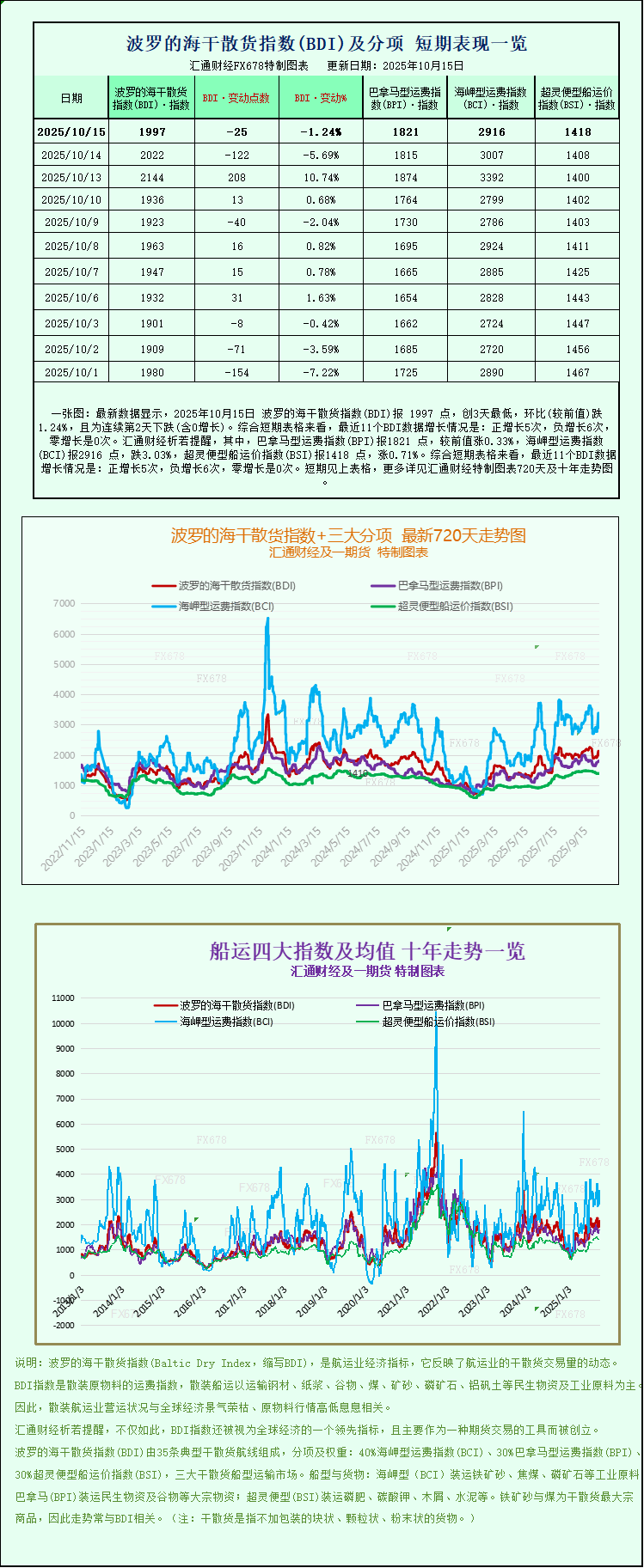

A chart: Baltic Index extends decline as capesize rates fall

2025-10-15 23:59:53

The Baltic Exchange's dry bulk shipping index, which monitors freight rates for ships transporting dry bulk commodities, fell for a second consecutive day on Wednesday, driven by weakness in rates for large capesize vessels.

The main index measuring freight rates for Capesize, Panamax and Supramax vessels fell 25 points, or 1.2%, to 1,997.

The index had its worst day in two weeks on Tuesday.

The capesize index fell 91 points, or 3%, to 2,916.

Average daily earnings for Cape vessels, which typically carry 150,000-ton cargoes such as iron ore and coal, fell by $753 to $24,185.

Iron ore futures fell for a second straight session as worsening trade disputes stoked concerns about the demand outlook and steel inventories in top consumer China rose.

The United States and China on Tuesday began imposing additional port fees on ocean carriers hauling everything from holiday toys to crude oil.

“This development is expected to impact trade flows, potentially increase operating costs and introduce additional volatility to freight sentiment,” Intermodal senior analyst Nikos Tagoulis said in a weekly report.

“The avoidance of Chinese cargoes by US-linked vessels is likely to keep the available tonnage tight, providing sustained support to freight rates rather than a purely temporary spike,” Tagoulis said.

The Panamax index rose 0.3% to 1,821 points.

Average daily earnings for Panamax vessels, which typically carry 60,000-70,000 tonnes of coal or grain, rose $49 to $16,386.

Among smaller vessels, the supramax index rose 0.7% to 1,418 points.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.