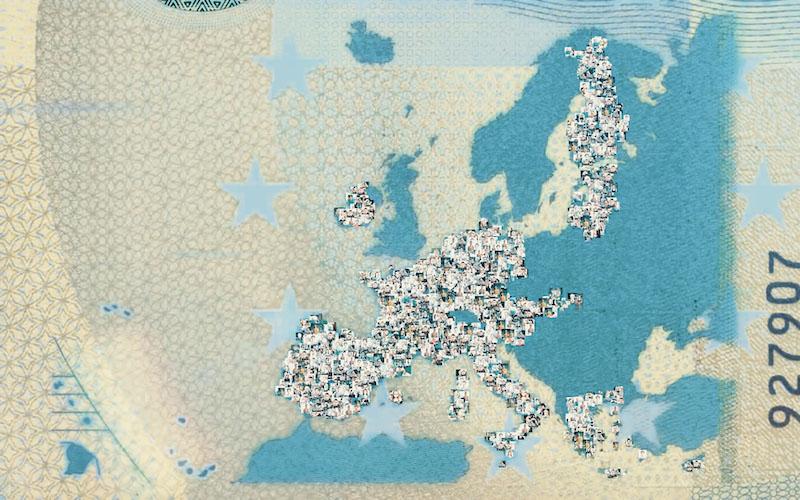

The European Central Bank sounded the alarm: The euro's lifeline is in the United States!

2025-10-22 15:27:37

Since Trump announced a series of trade tariffs and put pressure on the Federal Reserve at the beginning of this year, concerns about dollar funding have been lingering on the minds of central bank governors around the world.

Ryan noted that while eurozone banks have remained resilient amidst the turmoil, they could still face difficulties due to their significant exposure to the US dollar. Data shows that in the second quarter of this year, US dollar liabilities accounted for between 7% and 28% of total eurozone bank liabilities, while US dollar assets accounted for 10%. The former Governor of the Central Bank of Ireland stated that the possibility of a sudden shift in these net exposures cannot be ruled out, potentially constraining banks' credit to the real economy.

Ryan added: "The increased probability of such risk events will put pressure on both sides of banks' balance sheets and may put downward pressure on on-balance sheet exposures such as lending to the real economy."

European banks typically borrow dollars from U.S. banks and other financial institutions, meaning such funding is less reliable in times of crisis than deposits, which tend to move more slowly.

ECB regulators continue to ask banks to closely monitor their dollar exposure and work to reduce mismatches between assets such as loans and their own borrowing liabilities.

The ECB's dollar liquidity defense system

Central bank officials from non-US economies have even explored the idea of establishing a pool of US dollar reserves to provide a backstop for banks if the Federal Reserve withdraws its emergency currency swap lines. However, given the trillions of dollars in credit in international markets, such cooperation faces political obstacles and its effectiveness is also questionable.

To prevent a dollar liquidity crisis, the Federal Reserve has maintained currency swap agreements with other central banks since the last financial crisis. These facilities essentially allow commercial banks outside the United States to obtain dollar funding from their own central banks when the market is unable to obtain dollars .

Ryan pointed out that eurozone banks have built a solid buffer of US dollar cash, with their liquidity coverage ratio climbing from around 85% at the end of 2021 to the current level of well over 110%. A ratio exceeding 100% indicates that banks hold sufficient high-quality, highly liquid assets to cope with net cash outflows under a 30-day stress scenario.

This risk control measure allows the banking industry to withstand pressure during market fluctuations - for example, in April this year, when the sell-off of US Treasury bonds and the depreciation of the US dollar coincided with the banks' traditional hedging mechanisms, and the buffer system played a key role.

“Given the progress made by the euro area banking system in recent years in improving dollar liquidity coverage…even during the height of exchange rate volatility in early April, there was no significant liquidity stress, but this event may have altered the calculus for liquidity management decisions for the rest of the year,” Lane said.

Potential threats to the euro

The eurozone's financial stability is deeply dependent on the sustainability of the US dollar. This is not only an operational risk for the banking system, but also a systemic vulnerability for the euro.

Eurozone banks rely on large-scale dollar financing from US banks and markets, meaning that the euro's financial stability is not fully in Europe's own hands at critical moments . This dependence itself constitutes a risk premium that will constrain the euro's strength in the long term.

Amidst the global trade and financial uncertainty ignited by Trump's policies, the Eurozone banking system's substantial dollar exposure (7%-28% on the liability side and 10% on the asset side) presents a potential Achilles' heel. Any turbulence in the dollar funding market would directly impact the liquidity of Eurozone banks, which would then be transmitted to the real economy through credit contraction, ultimately threatening the value and stability of the euro.

The value of the euro depends not only on the eurozone's own economic data and political unity, but also on the stability of the global dollar system. If cracks appear in this system, the euro may not be a safe haven, but rather bear the brunt of the impact . This uncontrollable external risk is a "Sword of Damocles" hanging over the euro.

At 15:27 Beijing time, the euro was trading at 1.1601/02 against the US dollar.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.