The dawn of trade wars cannot withstand the supply surge! Uncovering the culprit behind the weak rebound in oil prices

2025-10-22 15:31:24

However, under the influence of declining geopolitical risks and OPEC+ production increases, the continued upward space of US crude oil may be limited.

API surprise: crude oil, gasoline inventories fall

The American Petroleum Institute (API) estimated on Wednesday that U.S. crude oil inventories fell by 2.98 million barrels in the week ending October 17, while the market had expected a sharp increase, which completely offset the inventory increase of 2.78 million barrels in the previous week.

U.S. crude oil inventories have continued to show a net decline this year, having decreased by 2.423 million barrels according to Oilprice's calculations of API data.

Earlier this week, the U.S. Department of Energy reported a 900,000-barrel increase in crude oil inventories in the Strategic Petroleum Reserve (SPR), as the government sought to replenish the 408.6 million barrels drawn down by the previous administration in the week ended Oct. 17.

U.S. production hit a record high in the week ended October 10, reaching 13.636 million barrels per day, according to the U.S. Energy Information Administration (EIA).

Gasoline inventories also fell by 236,000 barrels in the week ended October 17, after increasing by 2.99 million barrels the previous week. As of last week, gasoline inventories were slightly below the five-year average for this time of year, according to the U.S. Energy Information Administration.

Distillate fuel inventories continued to decline during the reporting period, falling by 974,000 barrels after a 4.79 million barrel drop in the previous week. The latest data from the U.S. Energy Information Administration showed that distillate fuel inventories were 7% below the five-year average as of the week ending October 10.

US buys token crude oil to replenish strategic reserves

The Trump administration is taking a tentative step toward replenishing the U.S. Strategic Petroleum Reserve (SPR), announcing plans to purchase 1 million barrels of crude oil for delivery in December and January. While symbolic, this move represents a drop in the bucket for a reserve that once held 700 million barrels of oil.

The U.S. Department of Energy will use $171 million in President Trump's new tax and spending bill to purchase crude oil for the Strategic Petroleum Reserve. The department has issued a request for proposals to ship crude oil to the Bayou Choctaw Reserve in Louisiana. Bids are due by October 28th, and the final contract price will be tied to the spot market price.

Since the continuous decline in U.S. crude oil prices in January, due to the increase in inventories, the U.S. crude oil production hitting a record of 13.6 million barrels per day, and the global supply glut, the oil price has fallen by about 30%, and traders have begun to discuss that the oil price may fall to $50.

The U.S. Strategic Petroleum Reserve (SPR), the country's emergency oil buffer, was significantly reduced during the Biden administration when the government released 180 million barrels of oil to stabilize gasoline prices. The release brought the reserve to a 40-year low of about 395 million barrels.

Replenishing the Strategic Petroleum Reserve is neither cheap nor quick. Energy Secretary Chris Wright has said it could take years and cost up to $20 billion to rebuild the stockpile. Congress quickly approved $1.3 billion to replenish and maintain the reserve, while also rescinding the policy of previous years that forced the reserve to be depleted.

Still, the million-barrel purchase is more political posturing than energy strategy. With maintenance delays pushing back other planned deliveries until the end of 2025, and with every government purchase signaling to traders that prices may rise , Washington is walking a fine line between replenishing its reserves and spurring another surge in oil prices.

The world's largest crude oil exporter is gradually increasing production along with other OPEC+ members.

The Organization of the Petroleum Exporting Countries and its allies (OPEC+) continue to push forward with their production increase plans, prompting market forecasts of crude oil oversupply this year and next.

The International Monetary Fund noted that while Saudi Arabia has made progress in diversifying its $1.2 trillion economy, the recovery in oil prices and production will benefit the kingdom's fiscal and current accounts the most.

"Any increase in oil prices or a return of oil production would have an immediate impact," Jihad Azour, director of the IMF's Middle East, North Africa and Central Asia department, said in a television interview.

He said that for every 1 million barrels per day increase in oil production, Saudi Arabia's fiscal balance would improve by 3.2% of GDP and the current account by 3.7%.

The world’s largest crude exporter is gradually increasing production alongside other OPEC+ members, with output rising from just under 9 million barrels per day (bpd) to nearly 10 million bpd as of September.

Partly due to the increase in supply, the Washington-based foundation raised its forecast for Saudi economic growth this year to 4% from 3% previously in its latest regional economic report released on Tuesday.

While rising oil supplies are currently supporting Saudi Arabia's GDP growth, they are also weighing on crude prices. Brent crude has fallen 18% this year, well below the level needed for the kingdom to balance its budget.

Easing trade tensions

U.S. President Donald Trump last week threatened to impose a new round of 100% tariffs and hinted he might skip a meeting in South Korea later this month. However, he softened his stance over the weekend, saying the high tariffs were unsustainable and expressing a desire for smoother trade relations.

Trump predicted late Tuesday that his upcoming meeting would produce a "good deal" on trade, but he also acknowledged that the highly anticipated talks might not take place.

U.S. Treasury Secretary Scott Besant will also be preparing to meet to discuss easing trade tensions, paving the way for an upcoming meeting between the leaders. As the world's two largest economies and major crude oil consumers, any sign of easing trade frictions could push up oil prices in the short term.

If the trade conflict escalates, it could lead to a more intense tariff war that would hurt economic growth prospects in both countries, and their economic slowdown would put global oil demand at risk.

Furthermore, OPEC+ continues to focus on gradually increasing production through 2025. The combination of increased supply and weakening demand could lead to a structural imbalance between supply and demand. As long as this situation persists and uncertainty remains, a bearish trend is likely to prevail in the short term.

What changes are taking place in confidence in the crude oil market?

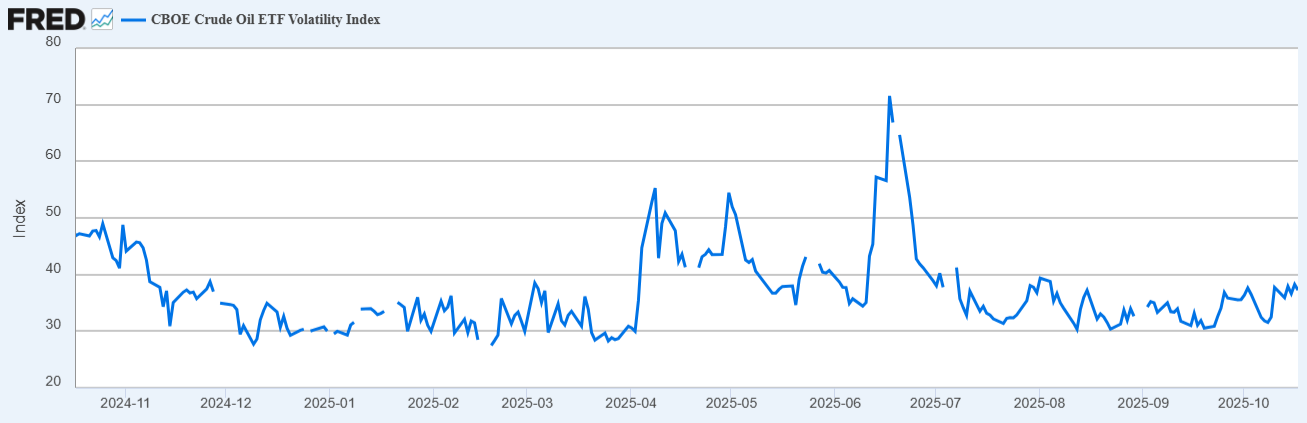

In the short term, the CBOE Volatility Index (VIX) has begun to climb, approaching the 40 mark, reflecting a rise in implied crude oil volatility. This increase in volatility indicates increased market uncertainty about the future outlook for oil, potentially leading to sharp price fluctuations and possibly a deeper short-term correction.

The continued rise in the crude oil volatility index (VIX) can be interpreted as a sign of a lack of market confidence—rising volatility often drives oil prices lower quickly. As long as the market fails to perceive price stabilization, the index is likely to continue its upward trend, reinforcing the perception that crude oil remains a risky asset amid ongoing uncertainty about future demand. This situation could dampen short-term demand and reinforce a temporary bearish bias.

Technical Analysis

Continuing Downward Trend: Since late June, US crude oil has maintained a steady bearish trend, and no significant bullish correction has yet occurred to break this trend. As long as selling pressure continues to dominate, the overall outlook will remain bearish.

RSI relative strength index: The indicator is still below the 50 axis, indicating that selling momentum has continued to dominate over the past 14 trading days.

MACD indicator: The MACD histogram continues to stay below the zero axis, reflecting that market sentiment remains bearish. If the indicator continues to move away from the neutral zone, selling pressure may further intensify in the coming days.

Key price points:

$65 - core resistance level: As an important level, if it is effectively broken through, it may challenge the current bearish trend and turn the future trend of oil prices to a bullish one.

$60 - recent resistance level: If oil prices effectively break through and stabilize above this point, it may further strengthen the short-term technical rebound.

$55 – Key Support: This level coincides with the yearly low of $55.12 and remains the most important selling barrier. A break below this support level would confirm a stronger short-term bearish acceleration signal.

(U.S. crude oil continuous daily chart, source: Yihuitong)

At 15:31 Beijing time, U.S. crude oil continued to trade at $58.08 per barrel.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.