The "hawk-dove game" behind crude oil's 7% weekly rebound: Are sanctions loaded? The battle for $65 is entering its final stages.

2025-10-25 20:28:17

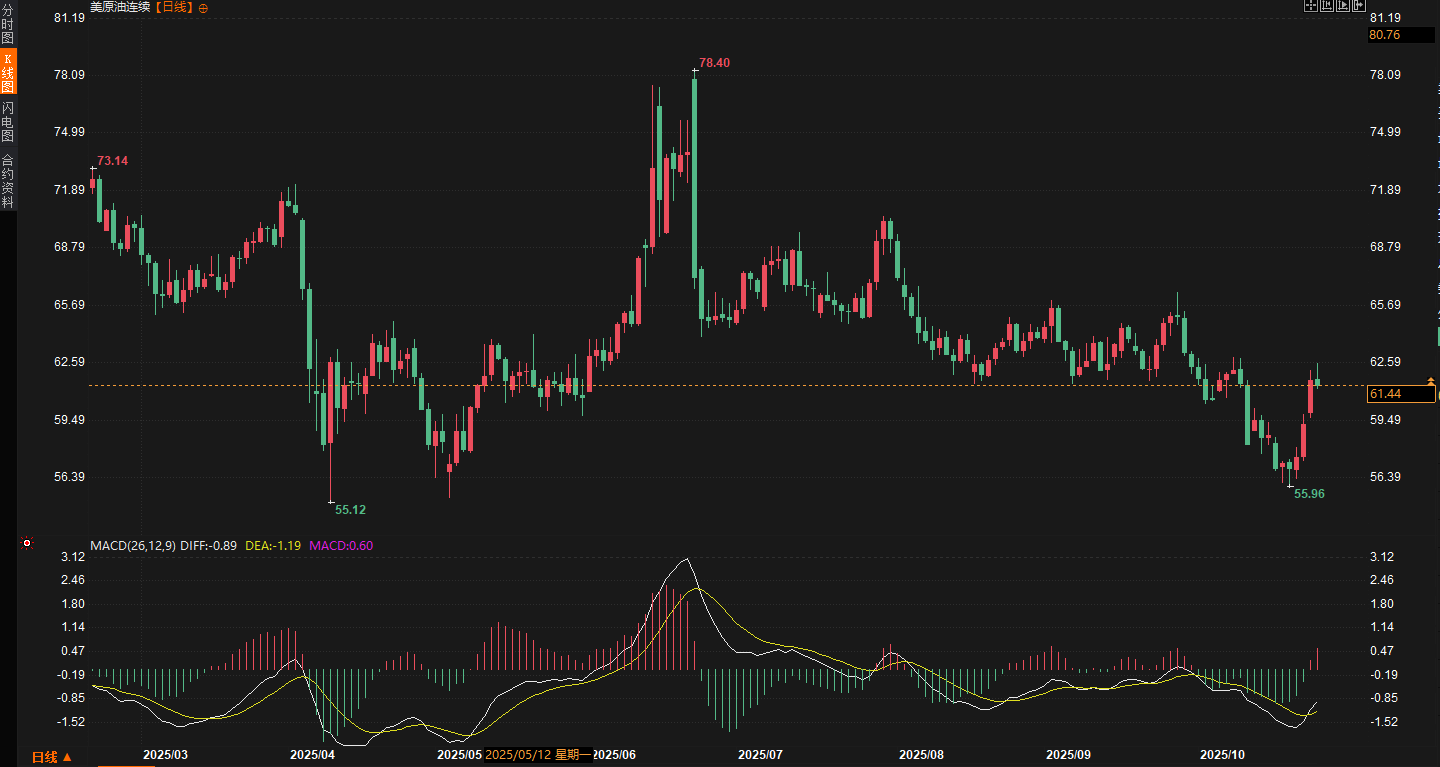

Review of crude oil trends this week: bottoming out at the beginning of the week and rebounding strongly in the middle and late stages

The crude oil market got off to a sluggish start this week, with prices plummeting due to expectations of ample global supply and concerns about escalating trade frictions. On Monday (October 20), WTI crude futures hit a low of $55.96 per barrel, a new low since early May and down more than 4% from Friday's settlement. Brent crude also came under pressure, falling to a low of $60.05 per barrel, approaching the crucial $60 mark and down more than 3% on the day. This decline was primarily driven by market concerns about potential oversupply and pressure from previously accumulated inventories. Traders are concerned that the unexpected inventory decline reported by the U.S. Energy Information Administration (EIA) last week will not reverse the overall easing of supply.

However, starting on Tuesday (October 21st), the market shifted dramatically. Spurred by the US announcement of new sanctions against two Russian oil giants, Rosneft and Lukoil, oil prices began a four-day winning streak. On Tuesday, WTI rebounded over 3%, recovering some of its losses; Brent also rose by about 2.5%, returning above $62. On Wednesday and Thursday, the gains deepened, with WTI soaring to around $63 and Brent reaching $66, representing cumulative gains of over 5%. During this period, the sanctions news dominated, with traders betting that the risk of supply disruptions from Russia, the world's second-largest crude oil producer, would drive up oil prices. On Friday (October 25th), the rally continued in early trading, but retreated within the last two hours of trading, with WTI and Brent closing at $61.75 and $65.88 per barrel respectively. For the week, WTI rose 7.32% and Brent 7.31%, their largest weekly gains since mid-June. From a technical perspective, WTI broke through the 20-day moving average of $62.60, indicating that short-term bullish momentum has increased, but the upper resistance level of $65 still needs to be observed.

Overall, oil prices rebounded by over $7 from their lows this week, demonstrating a clear V-shaped recovery. However, increased volatility also reflects the fragility of market sentiment. During intraday trading, Brent briefly retreated from above $65, highlighting investors' caution regarding geopolitical supply risks.

Key economic data and events: Sanctions implementation and trade signals go hand in hand

This week, the crude oil market was impacted by multiple macroeconomic events and data, with supply-side sanctions news and demand-side trade dynamics creating a tug-of-war. Primarily, the Trump administration announced sanctions on two major Russian oil companies on Wednesday. The move, intended to pressure Russia by restricting its global trade activities, quickly drew market scrutiny, but the market quickly questioned the effectiveness of their enforcement. Rosneft and Lukoil together account for over 5% of global oil production. If strictly enforced, these sanctions could lead to a sharp decline in Russian seaborne crude oil exports, further exacerbating the global supply gap. Trade sources revealed that the news has prompted some Asian buyers to adjust their purchasing strategies. Chinese state-owned oil companies have temporarily suspended Russian crude oil imports, while Indian refineries, the largest buyer, plan to significantly reduce imports. These developments have fueled increased risk aversion in the market, driving a mid- to late-stage rebound in oil prices, but also exacerbating short-term supply uncertainty.

On the demand side, trade tensions have become another focus. Although the Trump administration has recently intensified the tariff war, the expectation of a meeting between leaders next week has injected a glimmer of easing into the market.

On Tuesday, Chinese customs data showed that crude oil imports in September increased 3.9% year-on-year to 11.5 million barrels per day, exceeding market expectations and alleviating some concerns about weak demand. However, earlier escalations in trade tensions caused oil prices to plummet on Monday, with investors concerned that Trump's tariffs would further curb global economic growth and amplify downside risks to demand. From a market sentiment perspective, these tariff war dynamics have intensified safe-haven demand, driving inflows into crude oil as a hedge, but also limiting the sustainability of gains.

Regarding supply data, the U.S. Energy Information Administration (EIA) released its weekly report on Wednesday, showing that U.S. crude oil inventories unexpectedly fell by approximately 2 million barrels last week, with gasoline and distillate inventories also decreasing, exceeding analysts' expectations. This provided support for oil prices and eased concerns about oversupply. Preliminary data from the American Petroleum Institute (API) on Tuesday showed a slight increase in inventories, but the official EIA data was more influential, pushing oil prices higher on Wednesday.

OPEC+ developments also attracted considerable attention. Kuwait's oil minister stated that the organization would be prepared to increase production to offset any potential shortfalls and maintain a balanced market. This statement, released shortly after the sanctions announcement, was intended to mitigate market volatility but also hinted at OPEC+'s ability to respond to global supply disruptions.

On a geopolitical level, the Russia-Ukraine conflict continues to escalate, but market focus is shifting more towards its impact on energy supply sentiment rather than specific attribution. Investors are concerned that an escalation of the conflict could further disrupt Russian export routes and increase global tanker scheduling pressures. The tanker backlog mentioned in an earlier IEA report exacerbated supply concerns earlier this week.

Summary of analysts and institutions' views

This week, many institutions and analysts expressed their views on the crude oil market, generally focusing on sanctions implementation, trade easing and supply balance.

John Kilduff, partner at Again Capital LLC, said market participants are again doubting the severity of the sanctions, which could limit further upside for oil prices.

Janiv Shah, vice president of oil market analysis at Rystad Energy, said in a client note that Russian crude oil flowing to India faces greater risks, while adjustment pressure on other Asian refineries is relatively mild given diversified sources and ample inventories.

JPMorgan Chase & Co.'s research team lowered its Brent crude oil forecast to $66 a barrel in 2025 and further to $58 a barrel in 2026, citing trade policy uncertainty that could prolong the oversupply cycle.

In its Short-Term Energy Outlook, the U.S. Energy Information Administration (EIA) predicts that the average price of Brent crude oil will fall back to $62 per barrel in the fourth quarter and to $52 per barrel in 2026, mainly due to the fact that global oil production grows faster than demand.

The International Energy Agency (IEA)'s October report emphasized that although Brent futures rose by $0.30 to $67.60 per barrel in September, signs of tanker backlogs in early October showed that supply pressure remained, and it was recommended to pay attention to OPEC+'s production adjustments.

These views show that institutions are cautiously optimistic about the short-term rebound, but are bearish in the medium and long term due to oversupply.

Weekend Outlook: Trade Meeting Becomes Key Variable

Looking back at this week, the key focus in the crude oil market remains the tussle between sanctions concerns and trade easing. While the Trump administration's sanctions on Russia sparked a rebound, implementation concerns and tariff war sentiment limited gains. Import data and declining inventories provided support, while OPEC+'s production increase pledge alleviated supply concerns. Looking ahead to next week, the leaders' meeting will be a key focus. If trade tensions are eased and retaliatory measures are ended, demand expectations could be further boosted, pushing oil prices above $67. Otherwise, risk aversion could reignite, testing support at $55. Traders should monitor inventory updates and geopolitical developments. Short-term bullishness remains in the ascendant, but volatility risks remain.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.