The bond market is "anchored" to everything: the dollar's resilience and gold's unusual movements are all waiting for Powell's starting gun.

2025-10-29 20:20:13

US Treasury yields rebound: the bond market anchors the dollar's resilience

The 0.50% intraday increase in the 10-year US Treasury yield is not isolated, but rather an immediate response of the bond market to multiple fundamental signals. With the Fed meeting approaching, the market has priced in a 25 basis point rate cut today and is hoping for another round of easing in December. This should have lowered the yield curve, but in reality, traders are more focused on the hints in the policy statement regarding the pace of quantitative tightening (QT). A well-known institution's analysis points out that if the Fed announces an early end to QT—earlier than the market expects by the end of the year—it could trigger a knee-jerk drop in yields in the short term. However, Powell's cautious remarks at the press conference may limit the strength of forward guidance, causing the bond market rebound to be quickly digested. Currently, yields are hovering below the psychological threshold of 4%, rising only 1 basis point, with the entire curve fluctuating by only 2 basis points, reflecting a wait-and-see attitude amid low trading volume.

From the perspective of the transmission from the bond market to the US dollar, this dynamic directly strengthened the structural support for the dollar. The US dollar index rose slightly to 98.8460 during the day, shaking off recent selling pressure, partly due to easing signals in trade negotiations—Trump expressed his expectation for a "great deal" in a speech in South Korea. Although such tariff remarks still have uncertainties, they have ignited market imaginations of risk easing. The head of the Tokyo branch pointed out incisively that the dollar's previous sustained selling pressure is now experiencing a mechanism-based rebound. After trading behavior overreacted to trade noise, the stabilization of bond yields has become a key anchor. Although the Fed's interest rate cut path is clear—a cumulative 75 basis points for the year—the "fog" environment of missing data has made Powell's statements on future easing more conservative, which in turn has increased the short-term attractiveness of the dollar. The expectation that the European Central Bank and the Bank of Japan will keep interest rates unchanged tomorrow has further amplified the dollar's strength against the euro, with the euro falling to 1.1628 against the dollar, ending a five-day winning streak.

The correlation between the bond market and the US dollar is not linear, but rather amplified through yield sensitivity. Currently, the median yield of US Treasury bonds is holding steady at 3.997%. If the 4% mark is breached, it could trigger a test of the upper limit of 99.0379 for the US dollar index; conversely, if yields fall back to the lower limit of 3.958, it will test the stability of the dollar's support at 98.5844. This bond market-driven transmission mechanism ensures that the dollar remains resilient before and after Fed events, rather than solely relying on trade narratives.

Gold and bond market spillover: An unexpected resonance of safe-haven effects

Spot gold rose 1.65% intraday, pushing it to $4017.73 per ounce. While this move mirrored the dollar's rise, it actually stemmed from a safe-haven spillover effect transmitted through the bond market. Traditionally, a stronger dollar tends to suppress gold, but today's synchronized movement highlights the dominant role of uncertainty in the bond market: while rising yields benefit the dollar, they also amplify perceived policy risks, driving funds towards gold. Although the Fed's rate cut was expected, Powell's emphasis on data blind spots—last week's CPI, though softer than expected, couldn't mask the statistical gaps caused by the government shutdown—increased market doubts about the easing path. This uncertainty, through fluctuations in bond yields, directly translated into safe-haven demand for gold.

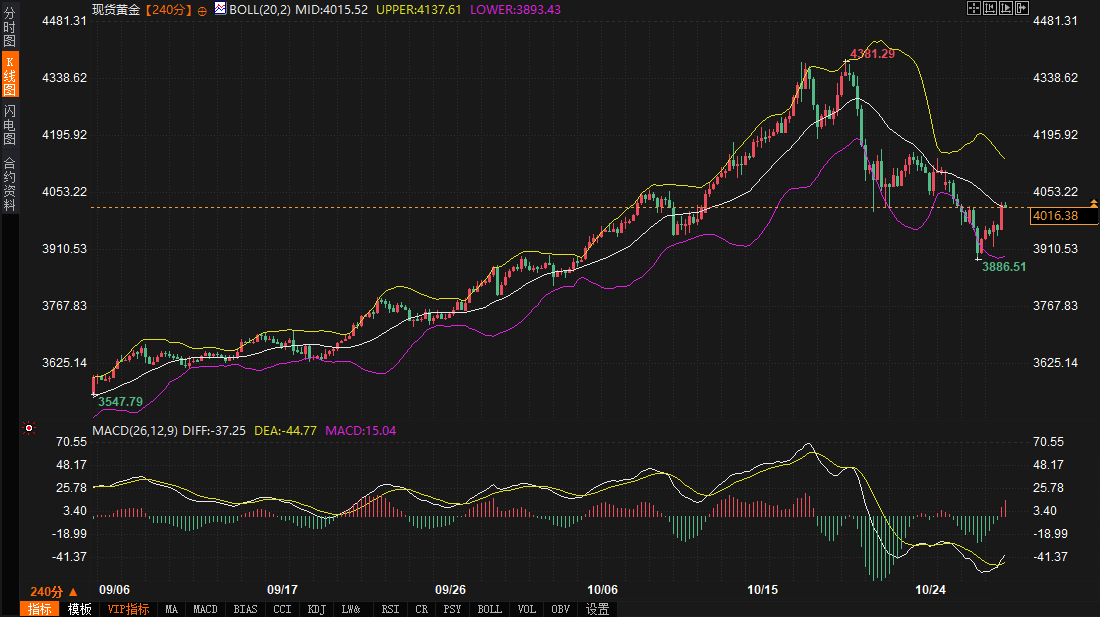

It's worth analyzing that the unusual phenomenon of gold and the US dollar rising simultaneously today is essentially a mirror image of bullish sentiment in the bond market. The 10-year yield rose 0.50%, failing to break through the 4.035 upper limit, but it has already stirred up global capital allocation logic. A well-known institution's tactical view suggests that the bond market is relatively flat in the short term, oscillating around the 4% range, which will indirectly stimulate bullish momentum in gold—the subtle upward movement of yields reminds traders that the Fed's "risk management" stance may delay the end of QT, thereby increasing inflation concerns. Gold prices benefited from this, rising above the 4015.54 middle limit and moving away from the 3893.43 lower limit, indicating the intervention of safe-haven buying. While the initial positive developments in trade negotiations have eased geopolitical risks, potential concerns triggered by tariff rhetoric still provide additional support for gold as a "buffer" for the bond market rather than simply an anti-dollar tool.

From a fundamental perspective, the ongoing stalemate in the Russia-Ukraine conflict further strengthens the transmission channel of gold through the bond market. In an environment of a flattening yield curve, gold not only captures immediate fluctuations related to Fed events but also amplifies the bond market's feedback from global risk aversion. The prudent stances of the European Central Bank and the Bank of Japan tomorrow, in contrast to the Fed's accommodative tone, may exacerbate this spillover effect, driving gold to maintain an upward bias amidst narrow fluctuations in the bond market.

Technical Factors in Sync: Indicator Signals and Their Imprint on the Bond Market

Turning to the technical level, the 240-minute charts of US Treasuries, the US dollar, and gold collectively outline a short-term pattern dominated by the bond market. The US dollar index is currently at 98.8460, with the Bollinger Band middle line at 98.8108 providing immediate support, while the upper band at 99.0379 serves as a rebound target. The MACD indicator shows DIFF at -0.0135 above DEA at -0.0223. Although the histogram is still negative, signs of convergence below the zero line are emerging, suggesting that after bond yields stabilize, the dollar's momentum may shift from weak to neutral. The intraday gain of 0.12%, while modest, has already digested the initial optimism surrounding trade negotiations. The key lies in whether the index can hold the lower Bollinger Band at 98.5844 after the Fed's press conference, avoiding a slide towards recent lows.

The 10-year US Treasury yield is at 3.996%, with the Bollinger Band middle line at 3.997 almost coinciding with the current price. The upper band resistance level at 4.035 is testing the bulls' intentions. The slight negative difference between the MACD DIFF (-0.002) and DEA (-0.001) indicates that the indicator lines are nearing a golden cross. Given the low trading volume, this suggests that the yield may fluctuate slightly within the 3.958-4.035 range. Historically, such narrow trading ranges before the FOMC meeting often lead to amplified volatility after the press conference—if Powell downplays future rate cuts, the yield may break above 4%, strengthening the positive transmission of the bond market to the dollar.

The 240-minute chart for gold further highlights the bond market's influence: the price of 4017.73 has broken through the middle Bollinger Band at 4015.54 and is approaching the upper Bollinger Band at 4137.62. The MACD DIFF at -37.27 is narrowing compared to the DEA at -44.78, and the negative value of the histogram is gradually decreasing, suggesting the accumulation of safe-haven momentum. The intraday gain of 1.65%, diverging from the rise in the US dollar, stems from the bond market signal of the upper Bollinger Band expanding—rising yields amplify volatility, allowing gold to rebound from the lower Bollinger Band's low of 3893.43. Technically, the synchronized convergence of the three indicators reinforces the bond market's role as a "pivot": the US dollar is holding the middle Bollinger Band, yields are stabilizing at the central level, and gold is testing the upper limit, forming a short-term resonance.

Combining fundamental and technical factors, the mystery of today's simultaneous rise in gold and the US dollar can be traced back to the "double-edged" effect of bond yields: while rising yields support the resilience of the US dollar, they also trigger safe-haven demand for gold through policy uncertainties. We need to be wary of the risk of divergence in indicators after the press conference.

Short-term outlook: The volatility window anchored by the bond market

Looking ahead to the next 2-3 days, US Treasury yields are expected to fluctuate around the 4% mark, with a narrow range of 3.95%-4.02% likely to be the main theme. The Fed's QT hints and Powell's press conference will determine whether the bond market breaks through the psychological threshold. The US dollar index may stabilize along with yields, testing above 99.00, but subsequent noise from trade negotiations may limit gains to near the middle band. Spot gold continues to benefit from the spillover effect from the bond market, with safe-haven demand potentially pushing it towards the 4100 level, especially if triggered by falling yields.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.