Silver Forecast: The upside target is the $50.02-$51.07 range; Powell's remarks will dominate subsequent price movements.

2025-10-30 00:24:21

Gold rebound played a key driving role

Silver's recent surge was not driven by its own fundamentals, but rather by gold. Spot gold rebounded nearly 2% after hitting a three-week low of $3,886.46. This rally was fueled by bargain hunting, short covering, and market speculation about central bank reserve managers re-entering the market.

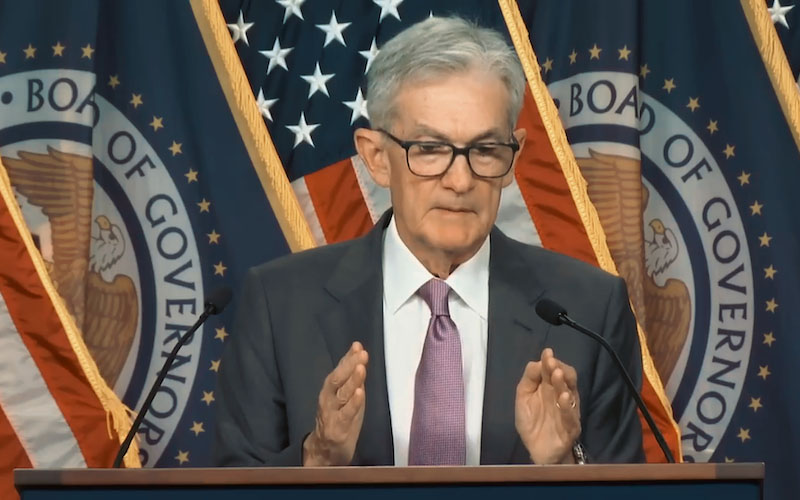

Traders are also adjusting their positions in anticipation of today's Fed rate decision, with the market largely pricing in a 25 basis point rate cut. However, the real catalyst for market movements will be Powell's press conference: if he hints at scaling back quantitative easing (QT) or adopts a more dovish stance, gold could surge, and silver will likely follow suit.

Interest rate cuts have already been priced in, but a stronger dollar remains an uncertainty.

The bullish logic for silver depends on the market's interpretation of Powell's remarks. Currently, Bank of America and Deutsche Bank have stated that the Federal Reserve may end quantitative tightening this month, which will further strengthen demand for non-interest-bearing assets such as gold and silver. However, the US dollar has not yet weakened; influenced by improved sentiment regarding US-China trade and waning safe-haven demand, the dollar is gradually strengthening. If the dollar continues to rise after the Fed's policy announcement, silver's upside potential may be limited near resistance levels.

Key levels: Pay attention to the 50-day moving average and the pullback range.

(Spot silver daily chart source: EasyTrade)

The current upside potential could extend to the top of the retracement range at $51.07. A break above this level would target $54.49. If the upward momentum weakens, watch for buying opportunities near the 50-day moving average at $45.03, which acts as the bulls' first line of defense. A break below this level, coupled with a regaining of control by the bears, could bring the previous high of $44.22 and the key support level of $41.40 into focus.

Bulls are currently in control, but the Federal Reserve will determine the future direction.

Silver is approaching a resistance level, riding the wave of gold's rise. While bulls are testing the market, the market's reaction after Powell's speech will be the key signal. If gold gains upward momentum, silver may break through $51; if it fails to do so, a pullback could put downward pressure on prices, potentially leading to a significant correction in silver.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.