A comparison of the full text of the Federal Reserve's October 29 monetary policy meeting statement and the two most recent statements.

2025-10-30 09:13:48

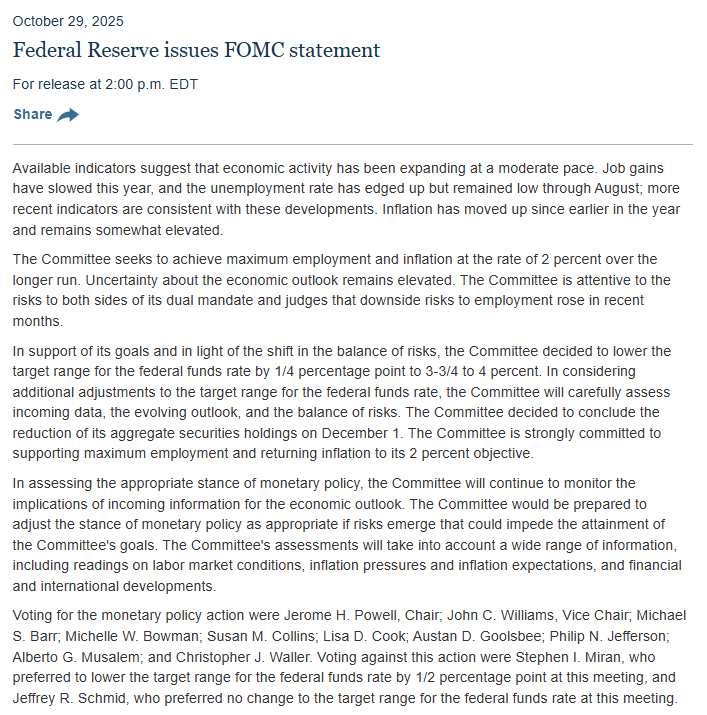

Current indicators suggest that economic activity is expanding at a moderate pace. Job growth has slowed this year, and the unemployment rate has risen slightly, but remained low as of August; recent economic indicators are consistent with these trends. Inflation has risen since earlier this year and remains at a slightly high level.

The Committee seeks to achieve its goal of full employment and 2 percent inflation over the longer term. Uncertainty surrounding the economic outlook remains high. The Committee is concerned about the risks on both sides of its dual policy mandate and considers the downside risks to employment to have increased in recent months.

To support its objectives and taking into account changes in the balance of risks, the Committee decided to lower the target range for the federal funds rate by 25 basis points to 3.75%–4%. In considering further adjustments to the target range for the federal funds rate, the Committee will carefully assess newly released data, the evolving outlook, and the balance of risks. The Committee also decided to end its reduction of its total securities holdings on December 1. The Committee remains firmly committed to supporting maximum employment and returning inflation to its 2 percent objective.

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of newly released information for the economic outlook. The Committee is prepared to adjust the stance of monetary policy as appropriate should risks arise that could hinder the achievement of its objectives. The Committee's assessment will take into account a wide range of information, including indicators of labor market conditions, inflationary pressures and expectations, as well as developments in the financial and international situation.

The FOMC members who voted in favor of the Federal Reserve's monetary policy decision included: Fed Chairman Jerome Powell, Vice Chairman John Williams, Vice Chairman for Supervision Barr, Governor Bowman, Boston Fed President John Collins, Governor Tim Cook, Chicago Fed President John Goolsby, Vice Chairman Thomas Jefferson, St. Louis Fed President Sam Mussalem, and Governor Waller. Governors Jerry Milan and Kansas City Fed President Schmid voted against the decision. Milan advocated for a 50-basis-point reduction in the target range for the federal funds rate, while Schmid advocated for maintaining the current rate.

Compared to the September interest rate decision, there are six main changes:

I. Economic Situation

September: Economic activity growth slowed somewhat in the first half of the year.

October: Economic activity is expanding at a moderate pace.

II. Job Market

September: Job growth slowed, and the unemployment rate rose slightly but remained low; downside risks to employment increased.

October: Job growth has slowed this year, and the unemployment rate has risen slightly, but remained at a low level as of August; downside risks to employment have increased in recent months.

III. Inflation:

September: Inflation rose and remains at a slightly high level.

October: Recent economic indicators are consistent with the trends described above. Inflation has risen since earlier this year and remains at a slightly high level.

IV. Interest Rate Level

September: 4%-4.25%

October: 3.75%-4%

V. Ending quantitative tightening

September: Continued to reduce its total holdings of U.S. Treasury securities, agency debt, and agency mortgage-backed securities (MBS).

October: The reduction in total securities holdings ended on December 1st.

VI. Changes in Voting

September: 11:1, newly appointed Federal Reserve Governor Milan supported a 50 basis point rate cut, while newly appointed Federal Reserve Governor Waller and Vice Chairman for Supervision Bowman supported the majority's 25 basis point measure.

October: 10:2, Federal Reserve Governor Milan supported a 50 basis point rate cut, while Kansas City Fed President Schmid supported keeping rates unchanged.

Powell signaled a pause in rate cuts in December, but the policy path will still depend on data.

Federal Reserve Chairman Jerome Powell said at a press conference following the policy meeting that this could be the last rate cut in 2025, and emphasized that whether further action will be taken in December is "far from certain," with policy direction heavily dependent on subsequent economic data.

Following a two-day policy meeting, the Federal Reserve decided to cut its benchmark interest rate by 25 basis points. Powell stated that this move was "strong support" for accommodative policy and would help alleviate pressure from a gradually cooling labor market.

However, Powell also expressed caution regarding the future policy path. He pointed out that there was a clear division within the committee at this meeting regarding whether to continue cutting interest rates in December. "There is no predetermined path in policy, and we will carefully assess the economic situation based on all available data," he said. "If you're driving in fog, what do you do? You slow down."

Currently, the Federal Reserve's policy rate has fallen 150 basis points from its peak last year, entering what some policymakers consider a "neutral" range. Powell revealed that a growing number of committee members believe that they should "wait at least one cycle" before considering further action.

He judged that the current interest rate level was "somewhat restrictive" and still exerts downward pressure on inflation. Although inflation may rise temporarily in the coming months due to tariff policies, it is expected to subsequently fall back to a more moderate level.

In addition, Powell also mentioned that the Federal Reserve will restart balance sheet expansion at some point in the future and adjust the duration of its securities holdings to match the term structure of outstanding Treasury bonds.

He concluded that the risk of persistently high inflation has decreased significantly since April, but the Federal Reserve may still resume interest rate cuts in the future. "Our goal is to ensure that the labor market remains robust while allowing inflation to return to or approach our 2% target level."

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.