Gold and silver experienced a normal corrective rebound.

2025-10-30 01:43:35

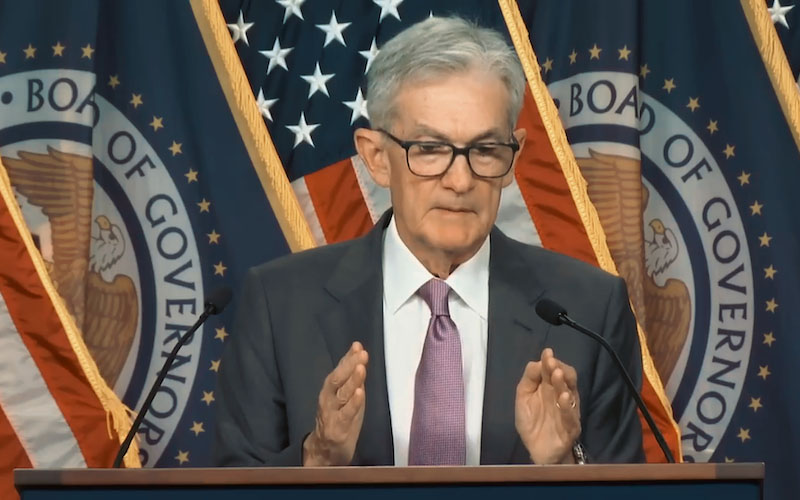

The Federal Open Market Committee (FOMC) began its meeting Tuesday morning and will release its statement this afternoon, followed by a press conference by Fed Chairman Jerome Powell. The market widely expects the FOMC to announce a second consecutive interest rate cut of 25 basis points this afternoon. Although the rate cut is already anticipated by the market, traders and investors will still be closely watching the FOMC statement and Powell's press conference for new clues about the direction of US monetary policy in the coming months.

US policymakers are increasingly divided on the interest rate outlook, and traders are awaiting Powell's speech to determine the next course of action. A softening labor market supports a rate cut, but economic data showing core inflation well above target complicates the situation. Swap contract pricing indicates that investors have fully priced in a 25-basis-point rate cut by the Fed on Wednesday and expect three more cuts by July next year. However, Powell's comments could change this expectation, potentially pushing US Treasuries out of their current consolidation.

Key external market data today show: the US dollar index rose; crude oil prices stabilized, trading around $60.50 per barrel; and the benchmark 10-year US Treasury yield is currently at 3.99%.

Technical Analysis

(COMEX Gold Daily Chart Source: FX678)

December gold futures: The bulls' next price target is to push the contract close above the key resistance level of $4,100.00; the bears' short-term price target is to push the futures price below the key technical support level of $3,800.00. The first resistance level is at $4,050, with further resistance at $4,100.00; the first support level is at $4,000.00, with further support at the overnight low of $3,930.00.

December silver futures: The bulls' next price target is to push the contract close above the key technical resistance level of $50.00; the bears' short-term price target is to push the futures price below the key support level of $45.00. The first resistance level is seen at today's high of $48.51, with further resistance at $49.00; the first support level is the overnight low of $46.92, with further support at this week's low of $45.51.

Note: The gold market operates primarily through two pricing mechanisms. The first is the spot market, where prices are applicable to immediate purchase and delivery; the second is the futures market, where pricing is based on delivery on a specific future date. Due to year-end position adjustments and market liquidity, the most actively traded gold futures contract on the Chicago Mercantile Exchange (CME) is currently the December delivery contract.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.