US Dollar Price Forecast: After the Fed's 25 basis point rate cut, the focus shifts to the ECB's policy.

2025-10-30 18:20:12

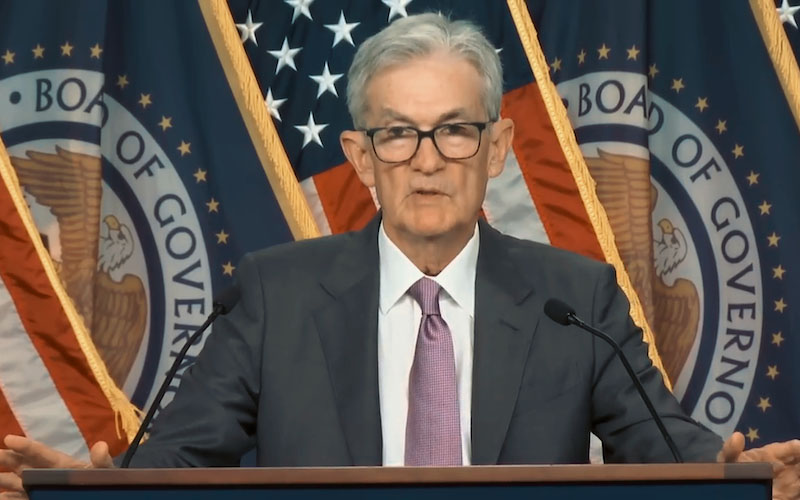

Federal Reserve Chairman Jerome Powell's cautious remarks suggest that future policy will depend on economic data, which has dampened market expectations for another rate cut in December. Meanwhile, the latest pending home sales data showed a mere 0.0% increase, below the expected 1.6%, highlighting the continued weakness in the U.S. housing market.

ING believes that last night's statement from the Federal Reserve has made it more difficult to sell the dollar now. The dollar is expected to remain strong, especially against the yen, as the Bank of Japan seems in no hurry to tighten monetary policy and appears to need more data on wage negotiations and food inflation before raising interest rates again. Currently, the risk level for the USD/JPY exchange rate is around 155. The dollar index is likely to continue hovering in the 98-100 trading range for some time.

Commerzbank currency analyst Volkmar Bauer points out that the highly anticipated meeting between the Chinese and American leaders has concluded, but judging solely from the foreign exchange market's performance, you might not have even noticed the event. The currency market will likely continue to closely monitor developments in the political situation. For now, the meeting yielded no unexpected results.

Focus on key European data

Market focus has now shifted to Europe, with a series of key economic data influencing market sentiment. Germany's preliminary GDP figure remained unchanged at 0.0% compared to the previous -0.3%, indicating that the economy is stabilizing but growth momentum is limited.

Germany's preliminary consumer price index (CPI) remained stable at 0.2%, while Spain's rapid CPI fell to 2.9%, slightly lower than the previous 3.0%.

European Central Bank Policy and CPI Outlook

The European Central Bank is expected to keep its main refinancing rate unchanged at 2.15%, and the market is awaiting President Christine Lagarde's remarks at the press conference for clues about future easing policies.

The Eurozone's core CPI quick estimate will be released on Friday, with the market expecting 2.3%, slightly lower than the previous 2.4%; the overall CPI may slow from 2.2% to 2.1%, reflecting a slight easing of inflationary pressures in the region.

Technical Analysis

(US Dollar Index Daily Chart Source: FX678)

The US Dollar Index (DXY) is trading around 99.17, testing resistance near 99.21 after rebounding from support at 98.80. The index remains above its 50-period exponential moving average (98.89) and 200-period exponential moving average (98.29), indicating a mild bullish trend.

The Relative Strength Index (RSI) remains around 59, indicating stable buying interest and no overbought pressure. A sustained break above 99.21 could open up upside potential to 99.46 and 99.55; a break below 98.90 could push the index back down to the 98.56 support level.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.