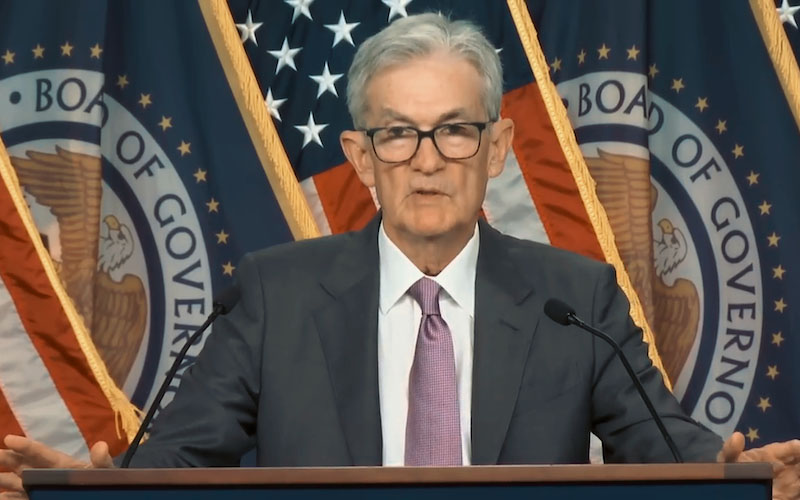

A strong dollar and a cautious outlook from the Federal Reserve continue to put pressure on gold.

2025-11-05 02:13:03

Gold prices rebounded after hitting a record high of $4,381 on October 20th and currently appear to be in a healthy consolidation phase. The decline in global stock markets provided some support for gold, limiting its losses—as reduced market risk appetite led to some safe-haven buying. However, the upside potential for gold remains limited due to reduced safe-haven flows and fading expectations of another Fed rate cut this year.

However, the overall upward trend remains unchanged. Current geopolitical and economic uncertainties persist, keeping investors cautious; meanwhile, the prolonged US government shutdown is also weighing on market sentiment.

StoneX analyst Ronna O'Connell noted in a report: "The gold bubble has deflated somewhat, but the market still reflects concerns about the Fed's independence, the possibility of stagflation, and potential geopolitical risks and international tensions. Some of the bubble has been eliminated in a necessary adjustment."

David Meger, head of metals trading at HighRidgeFutures, said, "As the dollar hit new highs, we're seeing that put pressure on the gold market... Part of the reason for the recent strength of the dollar and the pressure on the gold market is the reduced likelihood of a Fed rate cut in December."

Market drivers: Following the Fed's statement, traders reassessed the probability of a December rate cut.

Impact of China's New Gold Value Added Tax Regulations: Following the adjustment of China's gold value added tax policy, several state-owned banks have suspended the redemption of physical gold and the opening of new retail accounts. This policy revision reduces the value added tax exemption for some gold transactions from 13% to 6%, aiming to cool speculative demand in the domestic gold market. As one of the world's largest buyers of physical gold, the temporary restriction on retail purchases in China is expected to suppress short-term gold demand.

Federal Reserve officials signaled divergent opinions: On Monday, Fed officials expressed differing views. Some emphasized inflation risks, while others pointed to a gradually cooling labor market.

Federal Reserve Governor Lisa Cook stated that current inflation remains above the 2% target and is likely to remain high next year due to tariffs. However, she also emphasized that policy needs to "remain appropriately focused" to restore price stability; and noted that the recent 25-basis-point rate cut was reasonable given the rising downside risks to employment, but the Fed is prepared to respond forcefully if inflation becomes stickier than expected.

Chicago Fed President Austan Goolsbee stated that he remains uneasy about "preemptive rate cuts" and believes that current inflation "remains a concern." Fed Governor Stephen Miran warned that "it's a mistake to judge the direction of monetary policy solely based on financial conditions." Goolsbee pointed out that the threshold for further rate cuts is now higher than in the previous two meetings; Miran stated that the Fed "can achieve a neutral policy stance through multiple 50-basis-point rate cuts without resorting to a large 75-basis-point cut," adding that "even though the Fed has already implemented rate cuts, policy is still effectively tightening passively."

Traders are repricing their rate cut expectations: Influenced by divergent statements from Federal Reserve officials, traders are beginning to reassess the prospect of a December rate cut. According to the CME FedWatch Tool, the market currently sees about a 70% probability of a 25-basis-point rate cut at the next Fed meeting—a significant drop from 94% a week ago, but slightly higher than Monday's 65%.

UBS's view: UBS believes the recent gold pullback is likely temporary and maintains its target price of $4,200 per ounce; if geopolitical or market risks escalate, gold prices could even test $4,700. The bank notes that "the long-awaited pullback has paused," and although weakening price momentum led to a second decline in futures open interest, "underlying demand remains strong," and "this decline lacks fundamental support."

Technical Analysis

(Spot gold 4-hour chart)

Spot gold is currently in a consolidation phase after a pullback on the 240-minute chart, facing resistance at the 4000 level and short-term moving averages, while finding support at the medium-term moving average and the 3900 level. The RSI and MACD indicators suggest a mild battle between bulls and bears in the short term, lacking clear directional momentum.

If the price breaks through and holds above the 4000 level, it may test the 4050 resistance level; if it breaks below the 3900 level, it may further test the 3886.51 or even the 3800 support level. Currently, a range-bound trading strategy is recommended, focusing on breakout signals at key levels.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.