US Dollar Forecast: As expectations of a Fed rate cut fade and safe-haven flows increase, the US dollar index will break through 100.

2025-11-05 01:09:40

A decisive break above this level could extend the rally to a target of 101.977. On the downside, the nearest support is defined by the retracement range of 98.714 to 98.238, which also includes the 50-day moving average at 98.279.

The Federal Reserve's disagreement has cast a shadow over expectations of interest rate cuts.

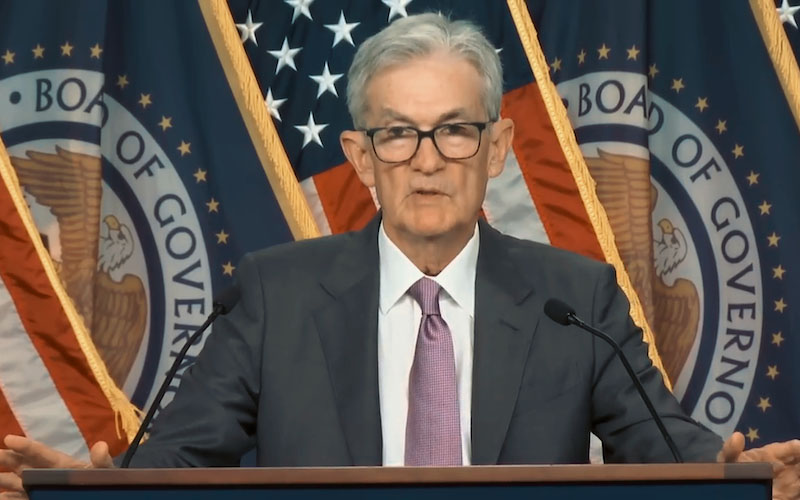

The dollar's rise was fueled by waning expectations of a December rate cut. Following last week's rate cut by the Federal Reserve, Chairman Powell indicated that another rate cut in December was not certain. Traders adjusted accordingly, with the CME FedWatch Tool now showing a 65% probability of a December rate cut, a significant drop from 94% a week earlier.

The ongoing government shutdown has halted the release of official economic data, leaving investors reliant on private sources. Monday's Institute for Supply Management (ISM) manufacturing survey showed U.S. factory activity contracted for the eighth consecutive month, highlighting underlying weakness. Nevertheless, the dollar continues to benefit from safe-haven flows and reduced expectations of interest rate cuts due to the lack of clear policy signals and limited data.

The pound and euro weakened due to domestic pressure.

The weakening of the pound and euro further supported the dollar index. The pound fell 0.61% to $1.3057 after UK Chancellor of the Exchequer Reeves pointed to fiscal constraints and persistent inflation ahead of the budget address. The euro fell 0.2% to $1.149, near a three-month low. Overall risk sentiment remained defensive, increasing demand for the dollar.

The yen strengthened, but the risk of intervention remains.

The yen strengthened 0.4% against the dollar to 153.56, after approaching a level that previously prompted the Japanese government to intervene. Japanese Finance Minister Katayama reiterated that the government is urgently monitoring exchange rate movements, hinting that it might take action if the yen weakens again.

Market forecast: Cautiously bullish on the dollar due to support from the Fed's outlook and risk sentiment.

(US Dollar Index Daily Chart Source: FX678)

The near-term outlook for the US dollar index remains cautiously bullish, supported by waning expectations of a December Federal Reserve rate cut and continued demand for safe-haven assets. The CME FedWatch Tool now shows only a 65% probability of another rate cut, compared to 94% a week ago, as traders reassess their dollar exposure and tend to hold the dollar during periods of policy uncertainty. Meanwhile, global risk sentiment remains fragile, with stock markets under pressure and demand for defensive assets rising, further solidifying the dollar's fundamental strength.

However, the rebound faces technical resistance at the 200-day moving average of 100.421. A sustained stay above this level could indicate that traders are pricing in a more hawkish Fed stance or heightened global risk aversion, paving the way for a move towards 101.977. Conversely, a failure to break through could reflect limited market confidence due to weak US manufacturing data and the continued lack of official economic reports during the government shutdown. In this scenario, traders may reassess long positions, potentially triggering a pullback towards the 98.714-98.238 retracement support zone.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.