Gold and silver prices rose as central banks continued to increase their gold holdings.

2025-10-30 23:32:05

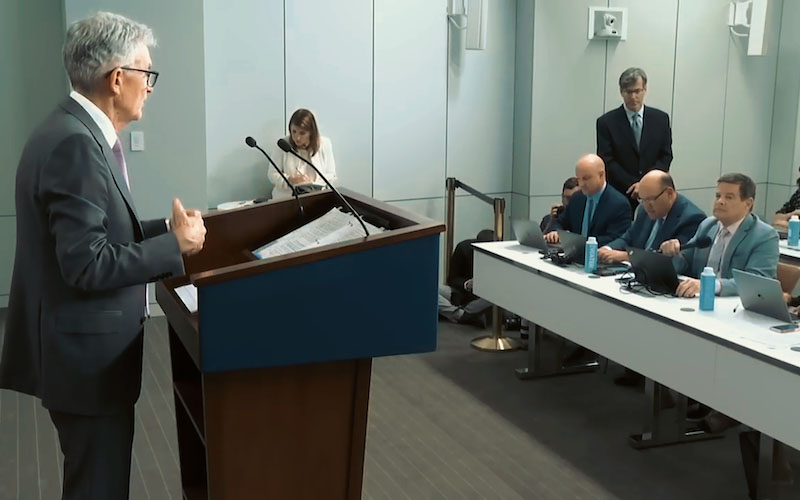

The Federal Open Market Committee (FOMC) cut the target range for the federal funds rate by 0.25% on Wednesday, in line with market expectations, though opinions differed. However, Jerome Powell warned investors need to manage their expectations for a December rate cut, highlighting the escalating tug-of-war among US monetary policymakers who hold differing views on the employment and inflation outlook. Powell made it clear that a further rate cut in December is not a certainty, stating, "Further reductions in the policy rate at the December meeting are not a given, far from it." Powell's hawkish tone led to a decline in US Treasury prices (and a rise in yields), making another Fed rate cut in December unlikely. While Powell explicitly stated that some are primarily concerned about a cooling job market, others within the Fed warned that persistent inflation will limit the scope for further easing. Freezing the release of official economic data during the government shutdown will only exacerbate this divergence.

Global stock markets were mixed overnight, while U.S. stock indices are expected to open slightly lower at the start of the New York trading day.

In overnight news, central banks around the world continued to increase their gold holdings. Central banks accelerated their gold purchases in the third quarter, with some countries that had previously bought gold buying again despite record high prices, betting on gold as a hedge against a weakening dollar. The World Gold Council reported that central banks purchased 220 tons of gold between July and September, a 28% increase from the previous quarter, bringing their gold reserves to 634 tons in the year ending in September. The World Gold Council predicts that central bank gold purchases for the whole of 2025 will be between 750 and 900 tons, citing escalating geopolitical tensions, persistent inflationary pressures, and uncertainty surrounding global trade policy as factors driving demand for safe-haven assets.

In a landmark 90-minute summit in South Korea today, the leaders of the United States and China agreed to extend the tariff truce, remove export controls, and reduce other trade barriers. China will resume purchases of what Trump called “large quantities” of U.S. soybeans, as well as sorghum and other U.S. agricultural products. The U.S. will halve tariffs on Chinese goods related to fentanyl. The U.S. will also extend the suspension of some retaliatory tariffs on China for another year. The agreement includes China suspending its full control over rare earth magnets in exchange for the U.S. lifting of expanded restrictions on Chinese companies. Furthermore, the two countries will cooperate on issues such as trade, energy, and artificial intelligence. Today’s meeting may stabilize relations between the world’s two largest economies after months of turmoil. After the summit, Trump told reporters as he boarded Air Force One, which he had just taken from Busan, South Korea, where he met with Xi Jinping, “I think on a scale of 0 to 10, 10 is the best, and I would say this meeting was a 12. You know, the whole relationship is very, very important. I think it’s very good.”

The United States will resume nuclear weapons testing. Following Russia's announcement of tests of a nuclear-powered underwater drone and a nuclear-capable cruise missile, President Trump said Wednesday that the U.S. will match its adversaries in nuclear weapons testing. Trump instructed the War Department to begin nuclear weapons testing on an equal footing, a process that will begin immediately, in response to Russia's accelerated testing of nuclear-capable superweapons. The White House did not immediately respond to requests for clarification regarding whether Trump ordered tests of nuclear-powered weapons and weapons capable of carrying nuclear warheads, rather than nuclear explosions.

Trump had a “very pleasant conversation” with Canadian Prime Minister Mark Carney. Trump said today that despite recent escalation in trade tensions between the two countries, he had a “very pleasant conversation” with Canadian Prime Minister Mark Carney on Wednesday.

Trump made the remarks aboard Air Force One after leaving South Korea today to attend the APEC summit. On Wednesday, Carney and Trump sat at the same table at an APEC dinner. "I had a very pleasant conversation with him last night," Trump told reporters. Carney's office referred to the meeting in a statement late Wednesday: "The Prime Minister had constructive conversations with all participants, including the President of the United States, on a wide range of topics of interest."

In key external markets today, the US dollar index rose slightly. Crude oil prices weakened, trading at around $60 per barrel. The benchmark 10-year US Treasury yield is currently at 4.07%.

(COMEXA Gold Daily Chart Source: EasyForex)

From a technical perspective, the next upside price target for December gold futures bulls is to close above the strong resistance level of $4100.00. The next near-term downside price target for bears is to push futures prices below the strong technical support level of $3800.00. The first resistance level is seen at the overnight high of $4024.20, followed by $4050.00. The first support level is seen at the overnight low of $3925.10, followed by $3900.00.

For December silver futures bulls, the next upside target is a close above the strong technical resistance level of $50.00. For bears, the next downside target is a close below the strong support level of $45.00. First resistance is seen at this week's high of $48.595, followed by $49.00. Next support is seen at $48.92, followed by this week's low of $45.51.

Note: The gold market operates through two main pricing mechanisms. The first is the spot market, which quotes prices for immediate purchase and delivery. The second is the futures market, which sets prices for delivery at a future date. Due to year-end market liquidity, the December gold futures contract is currently the most actively traded contract on the Chicago Mercantile Exchange.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.