US Dollar Outlook: Powell downplays expectations of a December rate cut, and the dollar index climbs toward the 100 mark.

2025-10-31 01:10:07

The 98.714 to 98.238 range forms secondary support, while the 50-day moving average (around 98.173) is currently a key support level. If the dollar bulls continue to dominate the market, the next upside target is the August 1 high of 100.257, followed by the 200-day moving average at 100.538.

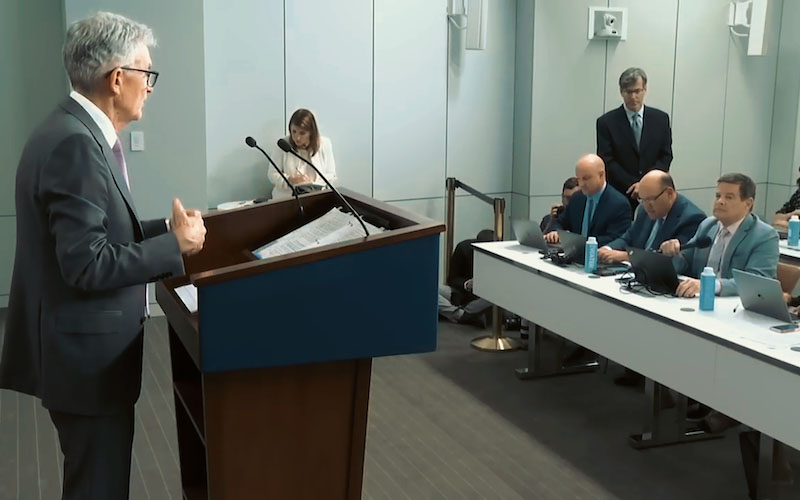

Powell suppresses dovish expectations

On Wednesday, Federal Reserve Chairman Jerome Powell adopted a more cautious stance on future interest rate cuts, boosting the dollar. Although the Fed cut rates by 25 basis points as expected, adjusting the target range for the federal funds rate to 3.75%-4.00%, Powell's post-meeting comments dampened dovish expectations.

"A further cut in policy rates at the December meeting is not a done deal, far from it," Powell warned, citing internal disagreements within the Federal Reserve and data gaps caused by the ongoing government shutdown. This statement caught traders who had bet on a rate cut off off guard; as of Thursday, the probability of a December rate cut had fallen from 85% to 71%.

Yields reflect the Fed's cautious stance

Treasury yields rose in tandem with the dollar. The 10-year Treasury yield climbed more than 2 basis points to 4.087%, while the 2-year yield edged up to 3.612%. This mild steepening of the yield curve suggests that the market is reassessing the magnitude and pace of the Fed's rate cuts before the end of the year. Traders' confidence in chasing a dovish narrative has waned—at least for now—due to Powell's hints of uncertainty and dissent within the Federal Open Market Committee (FOMC).

Policy divergence drives USD/JPY to surge and EUR/JPY to fall

The Bank of Japan's decision to maintain its policy unchanged and provide no clear guidance on future interest rate hikes disappointed the market. Subsequently, the USD/JPY pair surged 1.1% to 154.31, a new high since February. Governor Kazuo Ueda's hints about a possible tightening in December lacked persuasiveness, with traders focusing more on the lack of urgency in his policy stance. The Bank of Japan's patience, coupled with Powell's restraint on rate cuts, created a policy divergence, driving the USD/JPY pair significantly higher and reinforcing the overall strength of the US dollar.

The euro also failed to provide support for dollar bears – the European Central Bank kept interest rates unchanged for the third consecutive time without providing forward guidance, causing the euro/dollar exchange rate to fall. Traders interpreted the statement as a signal that the ECB had ended its rate hike cycle, pushing the euro to its lowest level since October 14.

Bulls are targeting 100.25—but yield needs to be monitored.

(US Dollar Index Daily Chart Source: FX678)

Looking ahead to next week, the US dollar index is still biased towards an upward trend, but it won't be without its challenges. If yields remain at current levels or rise further, and Powell's cautious stance continues to suppress expectations of a December rate cut, then the path for the dollar index towards 100.257 will remain valid.

Be wary of signs of a bond market reversal, or statements from Federal Reserve officials downplaying Powell's remarks—this could cause the dollar to fall back to its support level. Currently, bargain hunters are still actively entering the market.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.