Gold prices rose above $4,000 amid a cautious stance from the Federal Reserve and easing tensions between the US and China.

2025-10-31 01:49:53

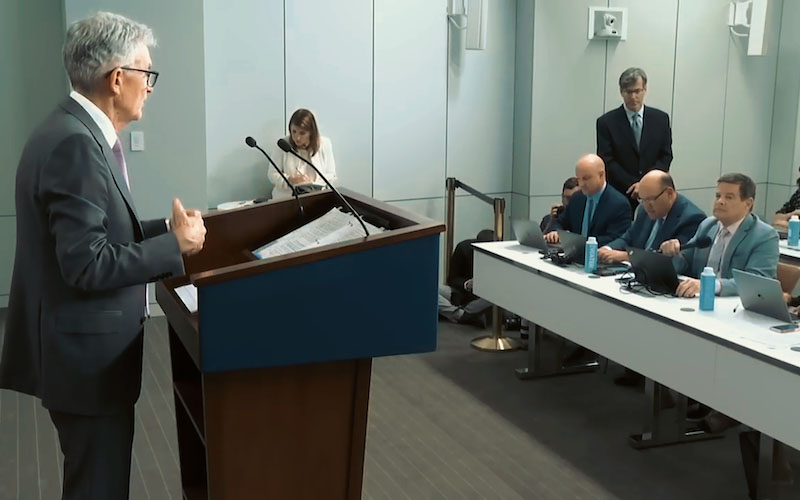

On Wednesday, the Federal Reserve cut interest rates by 25 basis points for the second consecutive time as part of its "risk management" strategy, in line with market expectations. However, since this move had largely been priced in by the market, attention quickly shifted to Fed Chairman Jerome Powell's remarks after the meeting, which clouded the prospect of future rate cuts.

Powell stated that "further rate cuts at the December meeting are not a certainty, far from it," a statement that briefly pressured precious metal prices while pushing up the dollar and U.S. Treasury yields.

The short-term outlook for gold appears mixed, as traders have lowered their expectations for a December rate cut amid Powell's cautious tone. Since lower interest rates typically enhance the attractiveness of non-yielding assets, the fading prospect of further monetary easing limits gold's upside potential.

Meanwhile, talks between the Chinese and US leaders eased some tensions, providing a temporary respite for markets. Nevertheless, the ongoing US government shutdown, coupled with continued geopolitical and economic uncertainty, keeps investors cautious.

Market drivers: Fed rate cuts, Powell's cautious stance, and the US-China trade agreement shaped market sentiment.

Earlier Thursday, U.S. President Donald Trump and Chinese President Xi Jinping concluded talks on the sidelines of the APEC summit in South Korea. The two leaders reached a trade agreement, which included reducing U.S. tariffs on Chinese goods from approximately 57% to 47% and a Chinese commitment to resume purchases of U.S. soybeans. Trump stated that China had agreed to "continue to supply rare earths, critical minerals, magnetite, and other items openly and freely."

The U.S. Federal Reserve cut the federal funds rate by 25 basis points to a target range of 3.75%-4.00%. This decision was not unanimous; Federal Reserve Governor Stephen Milan voted for a larger 50-basis-point cut, while Kansas City Fed President Jeffrey Schmid favored keeping rates unchanged.

In its monetary policy statement, the Federal Reserve said that economic activity continued to expand at a moderate pace, although job growth had slowed and inflation remained slightly high. Policymakers acknowledged that uncertainty about the outlook remained high and that downside risks to employment had increased in recent months. The committee also announced plans to stop selling securities on December 1, ending quantitative tightening (QT), which marks a pause in the reduction of its balance sheet.

At a press conference, Federal Reserve Chairman Jerome Powell stated that there is a trade-off between addressing inflation and supporting employment, noting that neither issue can be resolved with a single policy tool. He added that the policy rate is currently within the range of many neutral rate estimates, and if labor market data shows signs of stabilization or strengthening, this will influence future policy decisions. Powell also stated that "a growing number" within the committee believe it is best to wait before taking further action.

According to the World Gold Council's (WGC) Gold Demand Trends for Q3 2025 report released on October 30, total gold demand increased by 3% year-on-year to 1,313 tons, a new quarterly high. Investment demand surged 47% to 537 tons, driven by inflows of 222 tons into exchange-traded funds (ETFs) and continued purchases of gold bars and coins reaching 316 tons. Central bank purchases remained stable at 220 tons, a 28% increase from the previous quarter, while jewelry consumption declined by 19% despite record-high prices.

Technical Analysis: Spot gold is moderately bullish above $4,000.

(4-hour chart of spot gold source: EasyForex)

Spot gold remains vulnerable below the $4,000 level, attempting to stabilize after recent volatility but lacking follow-through buying. On the four-hour chart, immediate resistance lies near the 21-period simple moving average around $3,982, followed by the $4,000-$4,020 range.

A decisive breakout above this area could turn the short-term outlook to the upside, although gold prices may face renewed selling pressure in the $4,100-$4,200 range.

On the downside, $3,900 is a strong support level, where bargain hunters have repeatedly shown interest in recent trading sessions. A break below this level could signal a continuation of a broader correction. The Relative Strength Index (RSI) remains near 50, indicating a mild bullish momentum, but with limited upside potential.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.