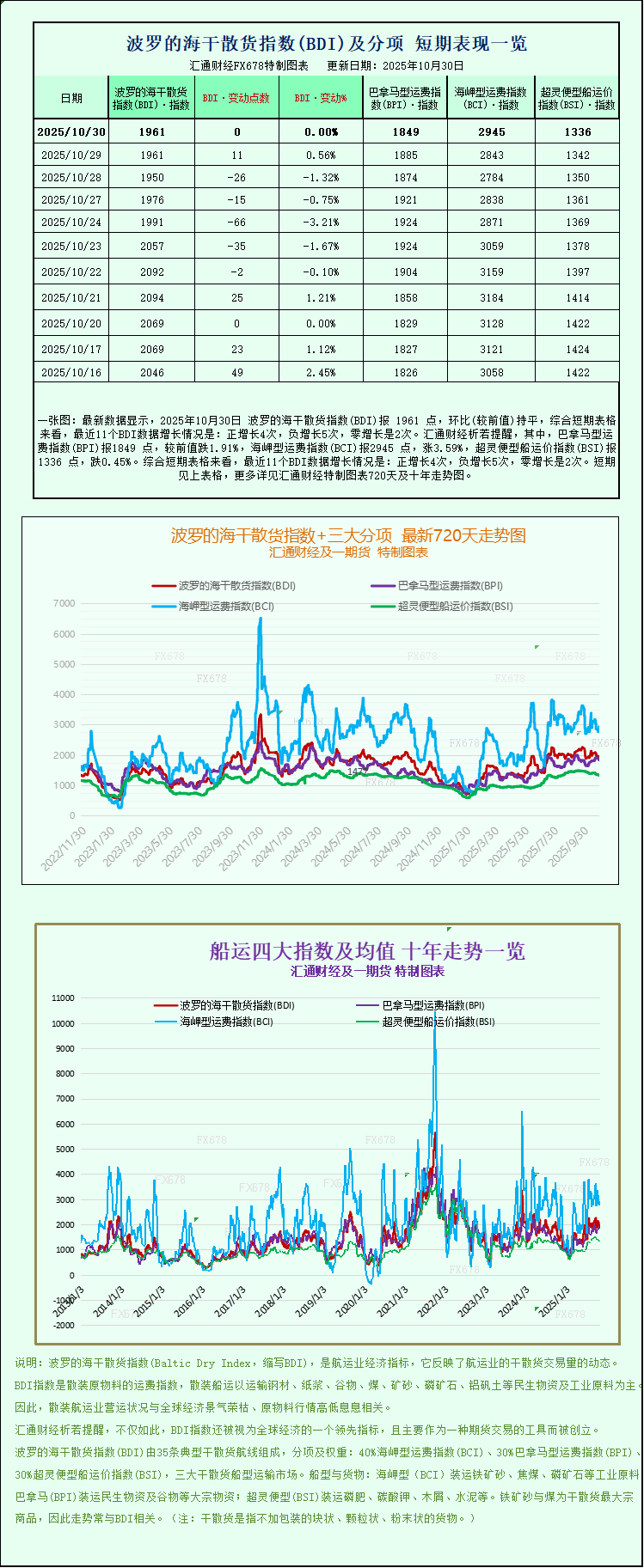

A chart shows that the Baltic Dry Index remained flat, while Capesize tanker prices rose to a one-week high.

2025-10-30 22:39:12

Supported by rising freight rates for Capesize vessels, the Baltic Dry Index (which monitors freight rates for vessels transporting dry bulk commodities) continued its upward trend on Thursday.

The main index, the Baltic Dry Index, which takes into account freight rates for Capesize, Panamax, and Supramax vessels, remained unchanged at 1,961 points.

The Capesize index rose 102 points, or 3.6%, to 2,945, a one-week high.

The average daily earnings of Capesize vessels transporting 150,000 tons of cargo, such as iron ore and coal, increased by $848 to $24,428.

Iron ore futures prices fell on Thursday after profit-taking emerged following a meeting between the leaders of the world's two largest economies.

U.S. President Donald Trump announced on Thursday that he and Chinese President Xi Jinping have reached an agreement to lower tariffs in exchange for China’s efforts to curb fentanyl trafficking, resume U.S. soybean imports, and maintain rare earth exports.

The two presidents also agreed to suspend tit-for-tat port fees imposed on shipping, a move aimed at preventing dominance in shipbuilding, ocean freight, and logistics.

Meanwhile, the Panamax index fell for the fourth consecutive trading day, dropping 36 points, or 1.9%, to 1,849 points, its lowest level since October 20.

The average daily earnings of Panamax vessels (typically carrying 60,000-70,000 tons of coal or grain) fell by $319 to $16,643.

"Overall, sentiment in the Panamax market has turned cautious, and the market appears poised for a pullback after recent highs," Fearnleys, a ship brokerage firm, wrote in a weekly report released Wednesday.

Among smaller vessels, the Very Large Vessel Index dropped 6 points to 1,336.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.