Bridgewater's Dalio: Gold is the safest currency; overweight during times of war and devaluation.

2025-10-31 23:05:36

Dalio wrote on Thursday: "In my view, gold is undeniably a currency, and the least likely to be devalued or confiscated. Here are the reasons why I believe this is true."

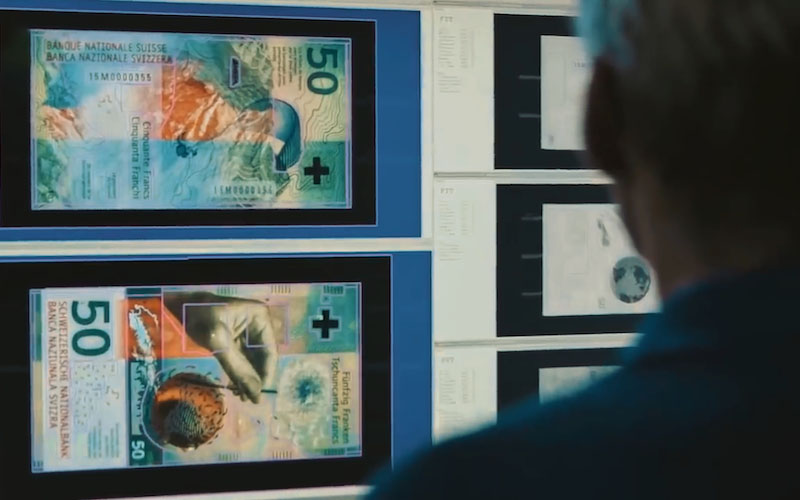

Historically, all currencies fall into two categories: those pegged to finite, globally recognized hard assets such as gold or silver, and those fiat currencies with no physical anchor and unlimited supply. Whenever a pegged currency is burdened with excessive debt or commitments, the system inevitably collapses. Policymakers face a dilemma: upholding repayment commitments leads to debt defaults and a deflationary Great Depression; or breaking commitments and issuing excessive amounts of currency triggers high inflation and rising gold prices.

"Before the establishment of the Federal Reserve in 1913, the United States mostly followed a deflationary path; since then, it has almost always opted for printing money," Dalio said. Both paths ultimately reduce the debt-to-income ratio through a "major debt/currency crisis," allowing the economy to restart at new, higher price levels.

After the Bretton Woods system collapsed in 1971, the world entered an era of pure fiat currency. The experience of such a system collapsing is even more relevant: "Central banks always create large amounts of money and credit, leading to higher inflation and higher gold prices." Gold has performed exceptionally well as an alternative to "paper debt money," maintaining its best long-term purchasing power—which is why it ranks as the second largest reserve asset for central banks.

The core advantages of gold

Gold is not dependent on others for redemption, can be held securely, and is difficult to steal through cyberattacks. During periods of high tax burdens or economic/currency wars (such as sanctions) triggered by financial crises, when the risk of confiscation is highest, gold often appreciates significantly—more accurately, it is "the only currency that does not depreciate."

“This is how the debt/currency/gold dynamic works, and it’s especially noteworthy when debt is too high relative to income and the risk of foreclosure is rising,” Dalio added.

Investment Allocation Recommendations

Dalio incorporates gold into his overall asset allocation framework, treating it on par with cash: assessing expected returns, risk, relevance, and liquidity to determine the strategic proportion. He criticizes most investors for viewing gold as a speculative asset: "Strategic asset allocation should be the primary consideration, not market timing. Most people lack the ability to time the market and should adhere to strategic allocation."

The strategic allocation ratio is 5%-15%, depending on other asset portfolios and risk appetite. Tactical adjustments include: overweighting gold during periods of monetary system collapse, confiscation risk, or economic war; reducing allocation at other times, as gold is a non-productive asset with lower returns than stocks in the long run.

Dalio concluded by stating, "Gold is the base currency in any case, and investors should hold at least a certain percentage of it, but most people don't."

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.