Gold Trading Alert: The US dollar rose for the fifth consecutive day, hitting a three-month high, while gold prices fell by more than 1.5%, breaking below the $4,000 mark! Will ADP data be a lifeline?

2025-11-05 07:36:27

Expectations for a December rate cut by the Federal Reserve have cooled, and the dollar index has broken through 100, hitting a three-month high.

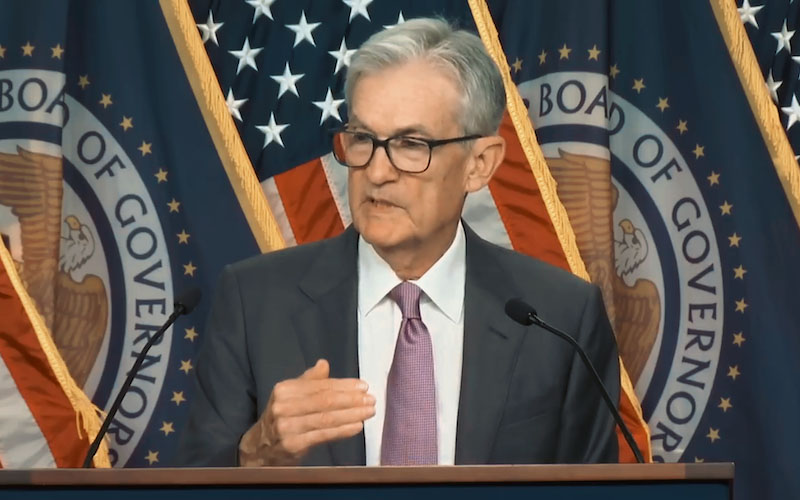

Last week, the Federal Reserve cut interest rates by 25 basis points as expected, but Chairman Powell poured cold water on the idea at the subsequent press conference: "A further rate cut in December is not a certainty." This statement immediately shook market confidence in the easing path. Coupled with the fact that the US government shutdown has entered its 35th day, tying the record for the longest shutdown during Trump's first term, and with official economic data completely "out of reach," Fed officials are interpreting the same set of private data in vastly different ways. Some are worried about an overheated economy, while others are concerned about policy mistakes in the data vacuum.

A week ago, the CME FedWatch tool showed that the probability of a December rate cut was close to 100%, but it has now fallen to 70%; other data sources show that it is only 65%.

The cooling of expectations for interest rate cuts provided strong upward momentum for the US dollar, which in turn suppressed gold prices.

On Tuesday, the US dollar index broke through the 100 mark, closing at 100.21, marking its fifth consecutive day of gains. During the session, it hit a three-month high of 100.22, the highest since early August. This surge in the dollar directly increased the cost of gold for holders of non-US currencies, deterring global buying interest.

David Meger, head of metals trading at Gaoling Futures, pointed out: "The dollar hit a new high, naturally putting pressure on the gold market. The deeper reason is the sharp drop in the probability of an interest rate cut in December."

Stock market bubble alarms sounded, and funds fled en masse to US Treasury bonds.

Wall Street heavyweights have sounded the alarm: the CEOs of Morgan Stanley, Goldman Sachs, and JPMorgan Chase have all warned that stock market valuations are too high and the risk of a bubble in AI tech stocks is imminent. The Nasdaq Composite Index plunged 2.04% in a single day, the Philadelphia Semiconductor Index plummeted 4.0%, and six of the seven major tech stocks saw their share prices drop. The S&P 500 and Dow Jones Industrial Average fell 1.17% and 0.53% respectively, marking their largest single-day declines since October 10th. Panic spread rapidly, with funds flowing out of high-risk assets and into US Treasury bonds. The 10-year Treasury yield fell 1.8 basis points to 4.089% at the close, and the 30-year yield fell 2.1 basis points to 4.669%.

Greg Faranello, head of interest rate strategy at AmeriVet Securities, pointed out: "AI stocks fell across the board, risk aversion pervaded the market, and US Treasuries became a high-quality safe haven." Gold should have benefited from the safe-haven trend, but it was overshadowed by the strong dollar and high interest rate expectations.

With the government shut down for 35 days, the ADP report has become a bellwether for a "last-ditch effort."

With the US government shutdown lasting 35 days and the Labor Department's monthly jobs report due on Friday, investors can only pin their hopes on Wednesday's ADP national employment report.

If the October ADP data falls significantly short of expectations (market consensus around +25,000), it will confirm the cooling of the labor market, and the probability of a December rate cut may instantly rise to over 80%, with gold prices likely to rebound. Conversely, if the data exceeds expectations, the US dollar will continue its strong upward trend, and gold may retest the $3,900 mark.

Pepperstone senior strategist Michael Brown bluntly stated, "This is just traditional safe-haven buying, but the dollar is still king."

In addition, the Treasury will announce its quarterly refinancing plan on Wednesday. If the massive bond issuance pushes up long-term yields, the pressure on gold will be further exacerbated.

Conclusion: Short-term bearish frenzy prevails; long-term outlook remains focused on inflation and geopolitics.

In the short term, the ADP report will be a key factor in determining the fate of gold prices—a weaker-than-expected report will lead to short covering, while a stronger-than-expected report will see continued short-selling pressure.

However, looking at the long term, with global central banks continuing their gold purchases, geopolitical risks surging in the Middle East, and inflation sticking, the strategic value of gold as the ultimate safe-haven asset remains unshaken.

Investors may consider buying on dips around $3,900, as a bullish counterattack could be imminent once risk aversion reverses.

In addition, investors should pay attention to the US October ISM non-manufacturing PMI data, with the market expectation at 50.8. Also, keep an eye on the US Supreme Court's ruling on the legality of Trump's "reciprocal tariffs."

(Spot gold daily chart, source: FX678)

At 07:29 Beijing time, spot gold was trading at $3,937.49 per ounce.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.