Afraid to hoard yen? The continued depreciation of the yen may just be a perfect trap.

2025-11-06 16:05:10

On Tuesday, following another verbal warning from Japanese Finance Minister Satsuki Katayama, the USD/JPY pair fell 0.5% despite a rise in the US dollar index. On Wednesday, the pair continued its decline in the early morning before rebounding quickly and turning positive. In the late session, it accelerated its rise due to better-than-expected US ADP data, recovering all the losses caused by the Japanese government's window guidance. It showed resilience in its depreciation efforts, as if the yen would continue to depreciate.

This article attempts to find clues about the recent resilience of the yen in its depreciation, and to discuss whether the yen will continue to depreciate.

The Bank of Japan awaits key data points to support an interest rate hike.

The Bank of Japan hopes to see wage growth momentum before raising interest rates, but the 1.4% year-on-year decline in wage income in September, released today, may fall short of this target. With the political buffer that can be waited for, a December rate hike is by no means a certainty.

Japan's real wages declined year-on-year for the ninth consecutive month in September. Kazuo Ueda clearly stated that he hopes to see clear growth momentum at the beginning of wage negotiations in the spring of 2026. This statement indicates that the Bank of Japan is not in a hurry to act, suggesting that it will have to wait until the first quarter of next year for the central bank to make a definitive assessment.

Ueda's cautious stance is justified—the large annual wage increase agreements reached by the unions over the past two years have not yet had a ripple effect on the broader economy.

Amid inflation, Japanese wages have continued to weaken, leading the market to question whether the Bank of Japan can generate sustainable demand-driven inflationary pressures.

Bank of Japan Governor Kazuo Ueda's upcoming speech could be a key variable, especially after Tokyo's unexpected CPI surge last month. However, given calls from political leaders for cautious policy measures and sluggish wage growth, the Bank of Japan faces no immediate pressure to raise interest rates, even if inflation continues to deviate from its target.

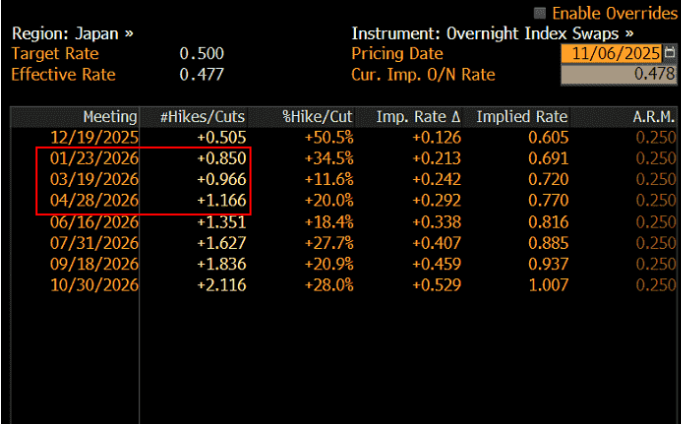

However, the Bank of Japan issued a special announcement last week, stating that Kazuo Ueda will deliver a speech on December 1, just days before the next Tokyo CPI report. This arrangement deserves close attention. Meanwhile, interest rate futures indicate that the probability of the Bank of Japan raising interest rates in January-April next year will rise rapidly.

Japan's real wages declined again.

Japan's real wages fell again in September, marking the ninth consecutive month of year-on-year decline, primarily due to inflation continuing to outpace wage growth.

Despite a 1.9% year-on-year increase in nominal cash income, real wages, adjusted for inflation, declined by 1.4%, highlighting the pressure on household purchasing power.

As consumption is the core pillar of the Japanese economy, the continued shrinkage of real income remains the main obstacle for the Bank of Japan to achieve demand-driven inflation.

This window of opportunity may provide the central bank with room to maneuver, allowing it to warm up the market for potential policy adjustments in December, especially after the last Tokyo CPI report showed that both core and overall inflation data rose significantly more than expected.

Based on current market pricing, the swap market implies a 50% probability of the Bank of Japan raising interest rates by 25 basis points at its December 19 meeting, effectively treating the outcome as a 50/50 game.

By the time spring wage negotiations are fully underway in March next year, the market will have largely priced in a complete rate hike.

The risk of foreign exchange market intervention remains controllable.

While Ueda's speech will be a key event going forward, Prime Minister Sanae Takaichi's remarks this week have further reinforced the market perception that "the Bank of Japan's policy action pressure is moderate."

Finance Minister Satsuki Katayama reiterated on Tuesday that the government will closely monitor currency market fluctuations with a high degree of urgency as the yen falls to an eight-month low of around 154.50 against the dollar. His latest statement is highly consistent with his remarks last Friday, suggesting that verbal warnings from Tokyo may be the limit for current actions.

However, Sanae Takaichi made it clear that Japan has only completed half of the process in achieving sustainable inflation supported by wage growth, a signal that she does not want to push the central bank to tighten policy too early.

This stance aligns with her image as a "policy dove who follows in the footsteps of former Prime Minister Shinzo Abe," suggesting that despite inflation being significantly higher than the Bank of Japan's 2% policy target, she is unwilling to risk weakening economic growth or pushing the yen to appreciate excessively.

His dovish stance limits the credibility of the Finance Minister's warnings about the yen's trajectory—after all, the USD/JPY pair has always been a typical interest rate-driven trading instrument.

Unless supported by fundamentals—whether it's a hawkish shift by the Bank of Japan pushing up domestic bond yields or a substantial decline in US Treasury yields—any foreign exchange market intervention measures requested by the government from the Bank of Japan are likely to have little effect.

Technical Analysis:

The USD/JPY pair is currently holding above the upper trendline of its upward channel, but Tuesday's decline despite a rise in the US dollar index left a significant impact on the market, indicating a clear decrease in market enthusiasm for shorting the yen, while some funds have begun to buy the yen on dips.

The exchange rate is currently supported by the upper channel line and continues to close above the downtrend line. However, given that the US dollar may have reached a recent high and the yen's interest rate hike process is progressing, the risk of a correction in USD/JPY is increasing, and the possibility of this being a top area is also growing.

(USD/JPY daily chart, source: FX678)

At 16:00 Beijing time, the USD/JPY exchange rate is currently at 153.76/77.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.