Historical lessons suggest the Federal Reserve may make a wise choice.

2025-11-10 21:57:46

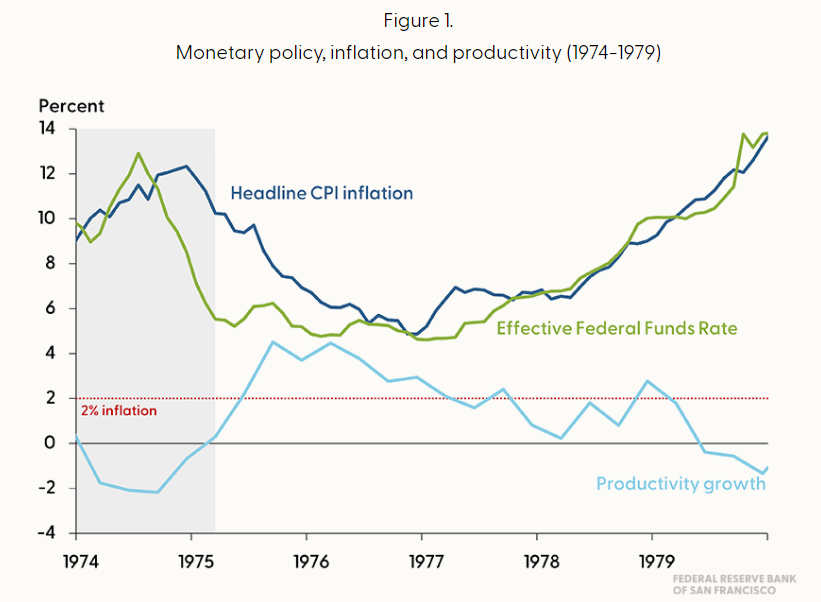

When making decisions, the Federal Reserve often has to recall the mistakes it made in previous policy-making processes. San Francisco Fed President Daly said that the FOMC made such policy misjudgments in the 1970s.

Back in the 1970s, the committee began cutting interest rates after observing a softening labor market, but ignored the structural slowdown in productivity growth, which led to a sharp rise in inflation and inflation expectations, until the Federal Reserve under Volcker took aggressive tightening measures to reverse the trend.

(Federal Reserve interest rates, inflation, and total factor productivity)

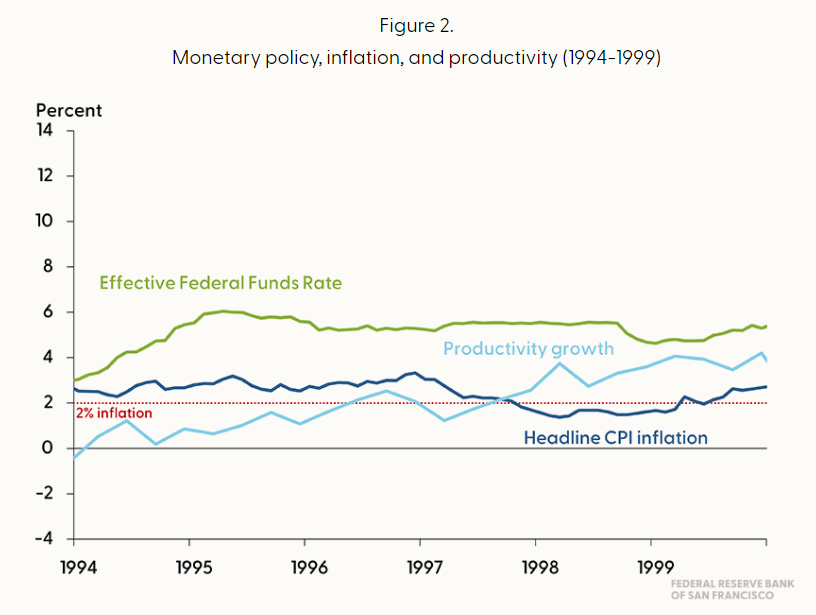

Meanwhile, the 1990s will present a drastically different landscape for the market. It will also be a challenging period for policymakers: cautious sentiment in the labor market, relatively low unemployment, high inflation, and the potential for significant productivity gains driven by computer and internet technologies.

The FOMC engaged in a heated debate at the time: whether to take strong tightening measures in response to low unemployment and rising inflation, or to seek policy clues from signs of long-term changes in productivity growth and the labor market.

Ultimately, the committee adopted a balanced policy approach, which led to the “Roaring Nineties” and effectively controlled inflation.

(Federal Reserve interest rates, inflation, and total factor productivity)

So, what is the core lesson?

The comparison in the above figure shows the crucial role that total factor productivity plays in the process.

Total factor productivity (TFP) is the core "invisible engine" driving economic growth. It refers to the output growth brought about by technological progress, management innovation, and efficiency improvement after deducting the input of factors such as labor and capital.

It played completely opposite roles in the 1970s and 1990s—the stagnation of TFP in the 1970s amplified the contradiction of “structural supply shortage” in the labor market, while the TFP boom in the 1990s resolved potential supply constraints and reshaped the virtuous cycle of the labor market.

Simply put, the stagnation of TFP in the 1970s meant that the contradiction of "not enough people" in the labor market could not be alleviated by "efficiency improvement," and could only fall into a vicious cycle of "grabbing people → raising wages → inflation → grabbing people again."

The TFP boom of the 1990s replaced "labor input" with "efficiency improvement," which not only resolved potential supply constraints but also created a virtuous cycle of wages, employment, and inflation. This was the core support for achieving "low inflation, low unemployment, and high growth" in the "Roaring 1990s."

Observing the current employment and inflation issues, is the slowdown in non-farm payroll growth due to a negative supply shock (long-term labor shortage) or a negative demand shock (cyclical)? In other words, is the slowdown in non-farm payroll growth due to a negative supply shock of "long-term structural labor shortage that cannot be made up by the supply side" or a negative demand shock of "short-term economic cycle leading to job shortages in enterprises and a contraction in demand"?

Wage changes provide a clear answer. As the labor market cools, both nominal and real wage growth are slowing, even in industries with a high proportion of foreign-born workers.

If the slowdown in non-farm payroll growth is mainly due to structural labor supply issues, the situation will be quite the opposite: wage growth will rise against the trend, especially in industries directly affected by changes in immigration policy.

Key takeaway: The current economy is likely experiencing a negative demand shock (i.e., a lack of jobs). Job losses have already occurred, but this is simply offset by a simultaneous contraction in labor supply (due to the pandemic and shifts in immigration policy).

in conclusion:

Since we infer that the job market slowdown is due to a lack of available jobs , the Federal Reserve is inclined to continue cutting interest rates, possibly more "aggressively" than the market expects, but at an unusually cautious pace.

The core of the Fed's interest rate and QE policies will focus on "gradual easing + precise support": on the interest rate side, interest rate cuts will be moderately increased in stages of 25 basis points to reduce corporate financing costs and stimulate job demand; on the QE side, the QT process will be suspended first, and if necessary, long-term interest rates will be lowered through small-scale purchases of short-term Treasury bonds to support recruitment in capital-intensive industries.

At the same time, by clarifying the boundaries of easing through policy communication, funds will be guided to areas such as AI that enhance TFP (Total Productive Finance). Continued interest rate cuts will only provide a mild boost to inflation (to absorb idle capacity and avoid deflation). Since there is no rigidity in labor supply, wages are unlikely to rise significantly, and inflation will remain controllable in the long term.

The key to policy is to adhere to data-driven approaches, dynamically match demand gaps, and avoid blindly easing or excessively tightening.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.