GBP/USD Forex Trading Signal: Target 1.3600 Ahead of Key UK Macroeconomic Data Release

2025-12-15 20:22:01

Macroeconomic data to be released by the UK and the US

The pound/dollar exchange rate continued to rise following the Federal Reserve's final interest rate decision of the year. In this decision, the Fed announced a 50 basis point rate cut, lowering the benchmark interest rate to a range of 3.50%-3.75%.

Federal Reserve officials also launched quantitative easing, beginning monthly purchases of $40 billion in short-term Treasury bonds. Typically, quantitative easing increases dollar liquidity, which in the long term puts pressure on the pound/dollar exchange rate.

Looking ahead, the U.S. Bureau of Labor Statistics (BLS) will release the latest inflation and employment data this week. The market expects the October non-farm payroll report to show an increase of over 50,000 jobs, significantly lower than September's 112,000.

The weak employment data was due to the government shutdown causing hiring freezes in key sectors. In addition, the Bureau of Labor Statistics will release its latest consumer inflation report on Friday.

The above data will help the Federal Reserve determine whether the number of rate cuts in 2025 needs to exceed previous expectations. The Fed's guidance at this policy meeting was that there would only be one rate cut in 2025.

Another key factor influencing the pound/dollar exchange rate is the upcoming UK economic data. The UK Office for National Statistics (ONS) will release the latest employment data on Tuesday, followed by consumer inflation data the following day.

Economists predict that the UK's overall consumer price index (CPI) will slow to 3.5% year-on-year in November from 3.6% in October; core inflation, excluding volatile food and energy prices, is expected to remain at 3.4%.

The market expects the Bank of England to announce a 25 basis point rate cut at its next policy meeting, despite inflation remaining above the 2% target level.

Technical Analysis

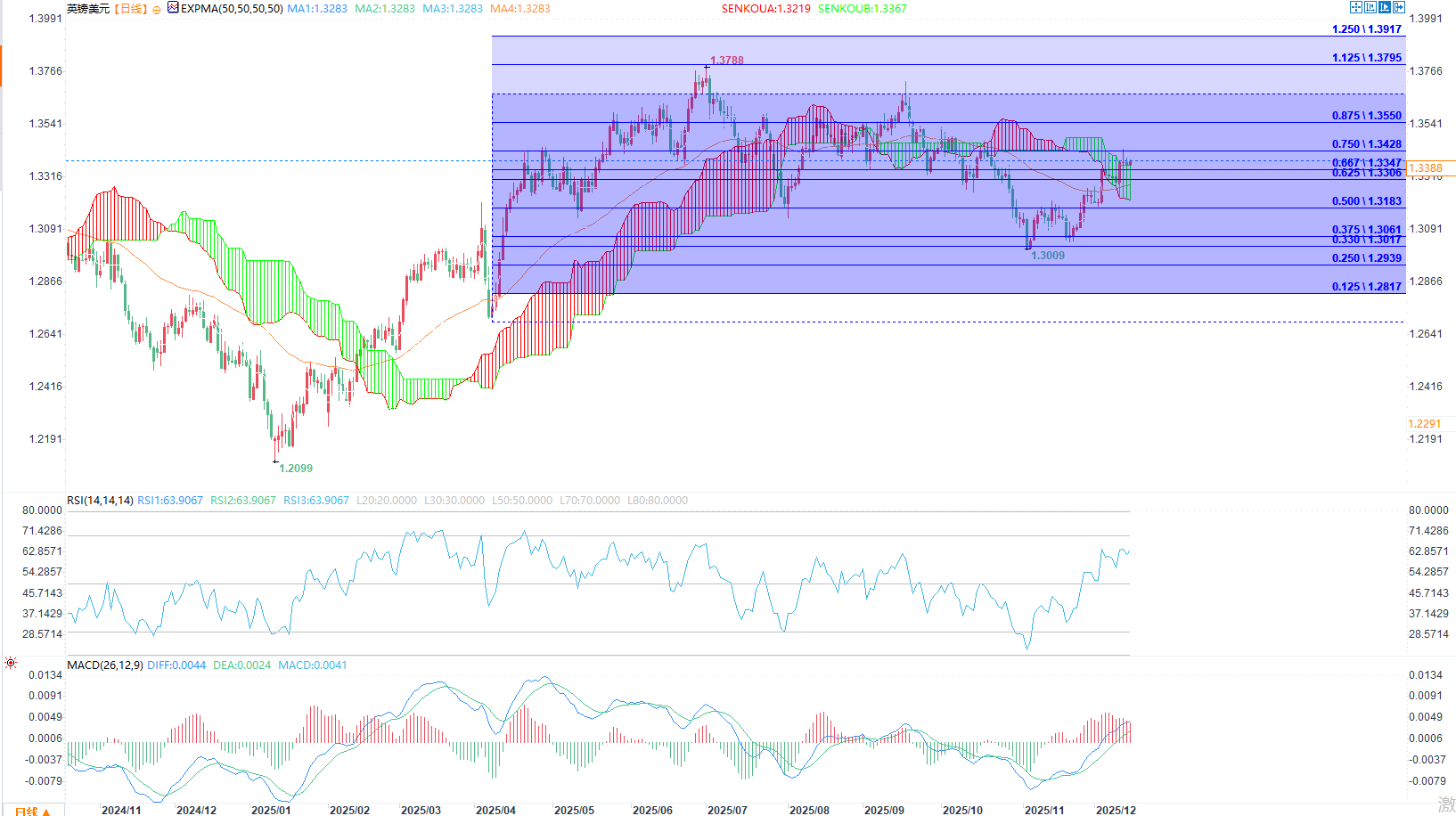

The daily chart shows that the GBP/USD exchange rate has rebounded continuously over the past few months, climbing from a November low of 1.300 to a high of 1.3435.

The exchange rate has broken through the 50-day moving average and is currently approaching the key reversal pivot point (6/8) in the Murray Mathematical Lines indicator; at the same time, the exchange rate is moving above the Ichimoku Cloud indicator, and the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) are both trending upwards.

Therefore, GBP/USD is likely to continue its upward trend, with the bulls targeting the psychological level of 1.3600. A break below the 1.3200 support level would disprove the bullish outlook.

bullish view

Buy GBP/USD with a take-profit target of 1.3600 and a stop-loss target of 1.3200. Timeframe: 1-2 days.

Bearish view

Sell GBP/USD with a take-profit target of 1.3200 and a stop-loss target of 1.3600.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.