A chart shows the Baltic Dry Index (BDI) slightly lower, dragged down by weaker Panamax freight rates.

2025-12-16 01:45:14

The Baltic Dry Index (BDI), which tracks freight rates for dry bulk commodity shipping vessels, fell slightly on Monday, mainly dragged down by weaker Panamax rates. As a key indicator of the global dry bulk shipping market, the index's movements directly reflect the demand and supply of shipping capacity for key commodities such as iron ore, coal, and grains, and its trends have significant implications for global trade and related supply chains.

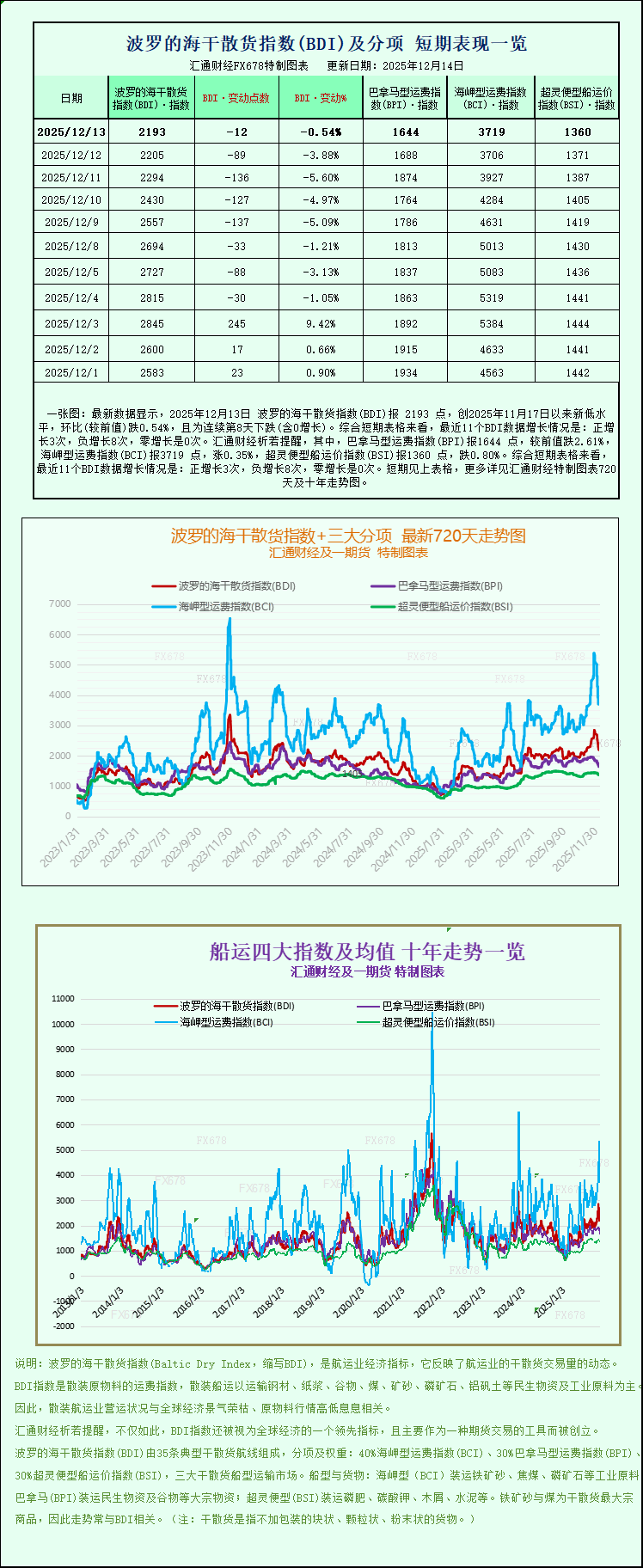

The composite dry bulk index, which covers freight rates for Capesize, Panamax, and Supramax vessels, fell 12 points, or 0.5%, to close at 2193 points, its lowest level since November 17. While this decline is relatively mild, it reflects a lack of upward momentum in the market, as indicated by recent trends. Some analysts believe this is related to the slowdown in commodity import demand from major global economies.

The Capesize index ended its seven-day losing streak, rising 13 points, or about 0.4%, to close at 3719. As the "juggernaut" of dry bulk shipping, Capesize freight rates have historically been closely linked to the demand for transporting heavy industrial raw materials such as iron ore and coal. This rebound has injected a glimmer of hope into the sluggish market.

The average daily earnings of Capesize vessels also rebounded, increasing by $110 to $30,841. These vessels typically have a capacity of 150,000 tons and are mainly responsible for transoceanic transportation of bulk raw materials such as iron ore and coal. The improvement in their earnings reflects, to some extent, a temporary recovery in demand for the transportation of raw materials for heavy industry in certain regions.

It's worth noting that iron ore futures prices in Dalian fell on Monday, hitting their lowest level in over five months. The main reason behind this is that China, the world's largest iron ore consumer, plans to implement a steel export license system starting in 2026. This policy move has sparked concerns in the market about the future scale of steel production and the outlook for iron ore demand, which in turn has impacted both the spot and futures markets, significantly suppressing prices. Related market analysis points out that if steel export controls are formally implemented, it may further affect the import demand for iron ore, thus potentially putting downward pressure on the future trend of Capesize shipping rates.

The Panamax index performed poorly on the day, falling sharply by 44 points, or 2.6%, to close at 1644 points, its lowest point in four months. Panamax vessels are the backbone of the dry bulk shipping market, and the significant decline in their freight rates was the core factor dragging down the overall index. The market generally believes this is closely related to the contraction in global demand for shipping specific commodities such as grains and coal.

Panamax vessels saw their average daily earnings drop by $398 to $14,796. These vessels typically have a capacity of 60,000 to 70,000 tons and primarily transport bulk commodities such as coal and grain. The decline in their earnings directly reflects the current supply-demand imbalance in the maritime transport market for these commodities, with the problem of relative overcapacity being particularly prominent in the short term.

In the small and medium-sized vessel sector, the Supramax index also showed a downward trend, falling 11 points to close at 1360 points. Supramax vessels are mainly responsible for regional or short-distance dry bulk cargo transportation, and their freight rates are more directly affected by regional market supply and demand. This slight decline may reflect the weak transportation demand in some regional markets.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.