Non-farm payrolls data was weak, but the market remained calm; a strange divergence is underway.

2026-01-09 21:50:00

The discrepancy between market expectations and actual data

Ahead of the data release, market expectations were generally cautiously optimistic. Most analysts predicted December job growth of between 60,000 and 70,000, partly based on the ADP private sector employment report showing 41,000 new jobs added, while initial jobless claims fell from an average of 227,000 in November to 217,000 in December, suggesting a possible moderate recovery in labor demand. Analysts interpreted the later Thanksgiving date as potentially dragging down November retail hiring, but suggesting a boost of about 15,000 jobs in December; weather factors might have a slight negative impact on some industries. The market generally believed that strong data could strengthen expectations that the Federal Reserve would pause rate cuts in January—before the data release, traders' assessment of the probability of a January rate cut was close to zero.

However, the actual number of new jobs added was lower than expected, highlighting the pattern of "low hiring and low layoffs" in the labor market, which contrasted with the market's expectation of a moderate recovery, leading to a rapid adjustment in sentiment.

Real-time reactions and interpretations of financial markets

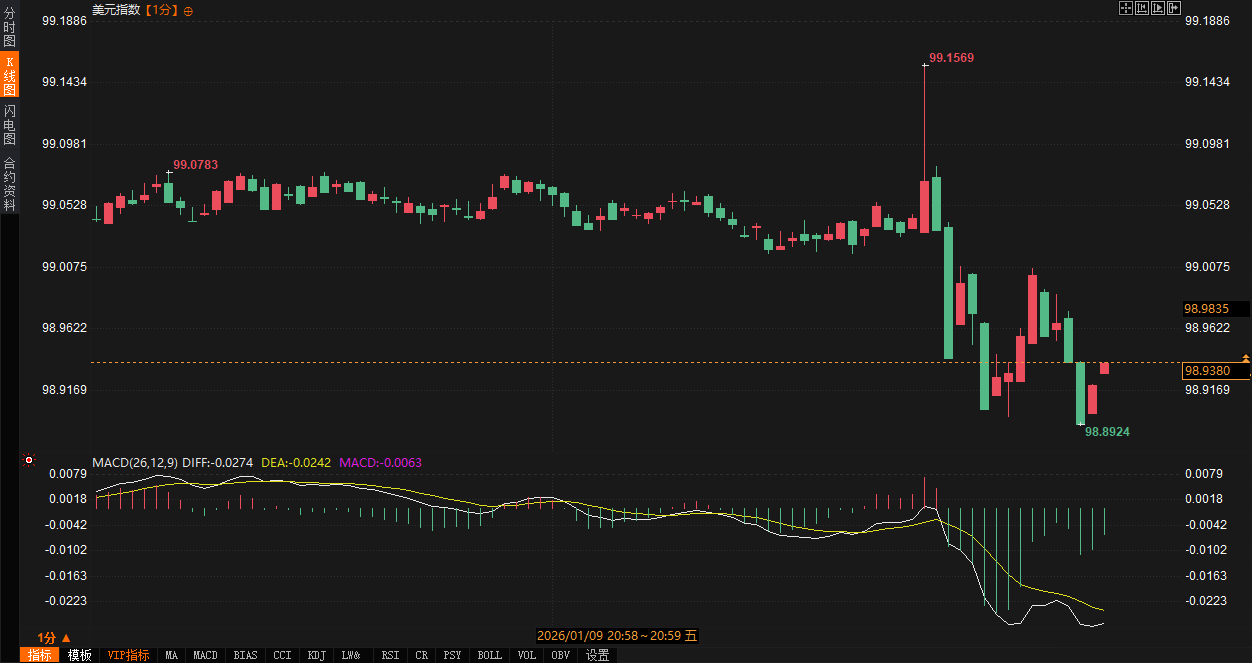

Following the data release, financial markets reacted mildly but in divergent directions. The US dollar index rose briefly by 12 points before quickly falling back by about 26 points. Spot gold jumped $14 before rebounding by about $30, reaching a high of $4491.46 per ounce. US Treasury yields continued their upward trend, with the 10-year yield rising 1.6 basis points to 4.195% and the 2-year yield rising 3.6 basis points to 3.524%. The yield curve for both 2-year and 10-year Treasury bonds remained positive, indicating that market concerns about an economic recession have eased and the yield curve is in the process of normalization.

This trend contrasts with the backdrop of 2025: last year, job growth continued to slow, with average monthly job creation far below 2024 levels, prompting the Federal Reserve to cut interest rates in its last three meetings, bringing rates to a three-year low of 3.5%-3.75%. Following the release of this data, the market digested the weak employment figures while also being supported by the low unemployment rate, avoiding sharp fluctuations.

Focus on the views of institutional and retail investors

Following the release of the data, interpretations from both institutional and retail investors quickly emerged, resulting in a mixed sentiment.

Interpretations by various institutions generally emphasize the structural contradictions in the data. One viewpoint points out that "the non-farm payrolls increase of 50,000 was lower than expected, but the unemployment rate fell to 4.4%, better than expected, indicating that the labor market is not collapsing, but rather entering a 'no-hires, no-layoffs' mode." Another institution believes that "the private sector added only 37,000 jobs, far below the expected 64,000, showing that companies are cautious about hiring, possibly influenced by tariff rhetoric and increased investment in artificial intelligence," but also notes that the low unemployment rate may lead the Federal Reserve to keep interest rates unchanged at its January meeting.

Retail traders' opinions were more divided. Some users expressed disappointment, believing that "new job creation hit the brakes, falling far short of expectations, and the signs of a slowdown in hiring are obvious"; others were relatively optimistic, pointing out that "the 4.4% unemployment rate is a bright spot, the labor force participation rate remains stable at 62.4%, and the economy is still resilient." Some retail investors also noted that "the ADP report had already hinted at weakness before the data release, but the better-than-expected unemployment rate prevented the market from a sharp drop, and attention should be paid to AI-driven productivity gains." Overall, the platform's interpretation, after comparing the optimistic expectations before the release, highlighted both the impact of the weaker-than-expected data and the buffer provided by the improved unemployment rate, with market sentiment shifting from expectations of moderate growth to a focus on structural issues.

Policy Expectations and Future Outlook

From the perspective of Federal Reserve policy, this report further reinforces the market's assessment of short-term policy stability. Before and after the data release, traders' expectations for a January rate cut remained extremely low. Despite weak job growth, the decline in the unemployment rate and hourly wage growth were in line with expectations, indicating moderate inflationary pressures and that the labor market has not deteriorated sharply. Institutional economists pointed out that "the challenges in the labor market are more structural than cyclical; tariff rhetoric and AI investment have dampened hiring, but productivity grew at its fastest pace in two years in the third quarter, supporting jobless expansion." This aligns with the trend expected in 2025: slower job growth was previously a major driver of Fed rate cuts, but the latest data does not provide sufficient evidence to justify further easing.

Looking ahead, the labor market may gradually recover in 2026, supported by low borrowing costs and potential tax breaks, but uncertainties remain. Job growth in 2025 was concentrated in areas such as education and healthcare, with overall demand slowing, but third-quarter GDP grew at its fastest pace in two years, primarily driven by resilient consumption and AI investment, laying a foundation for 2026. However, tariff rhetoric, geopolitical instability, and the substitution effect of AI on some jobs could exacerbate structural challenges. Consumer confidence has recently declined due to concerns about inflation and the employment outlook, but accelerating productivity growth suggests the economy has long-term healthy potential. The Federal Reserve is likely to continue its cautious assessment, seeking a balance between growth and inflation.

Overall, the trend points to a moderate recovery, but close attention needs to be paid to whether hiring activity can break free from the pattern of "low hiring, low layoffs." Short-term market sentiment has shifted from cautious optimism before the data release to neutral to cautious, and subsequent trends will depend on the evolution of consumer spending, business investment, and inflation data.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.