The investigation into Powell triggered "systemic panic," with condemnation from multiple officials and a surge in gold as a safe haven.

2026-01-13 11:13:07

According to sources familiar with the matter, the investigation was initiated by Jenny Piro, the Washington district attorney and an ally of US President Donald Trump. The Federal Reserve confirmed this after receiving the subpoena. One source indicated that Attorney General Pam Bondi and Deputy Attorney General Todd Branch were unaware of the decision prior to issuing the subpoena.

The escalation of the situation drew strong opposition from former Federal Reserve leadership and key Republican senators, raising concerns about the Fed's independence. Market reactions included rising U.S. Treasury yields as investors weighed the risk of political interference in the Fed.

Official reasons and Powell's allegations

In a public statement, Piro said the Justice Department acted after the Federal Reserve ignored requests to discuss cost overruns in renovations of two historic buildings at its headquarters. Piro posted on social media platform X: “This office’s decision is based on facts, nothing more.”

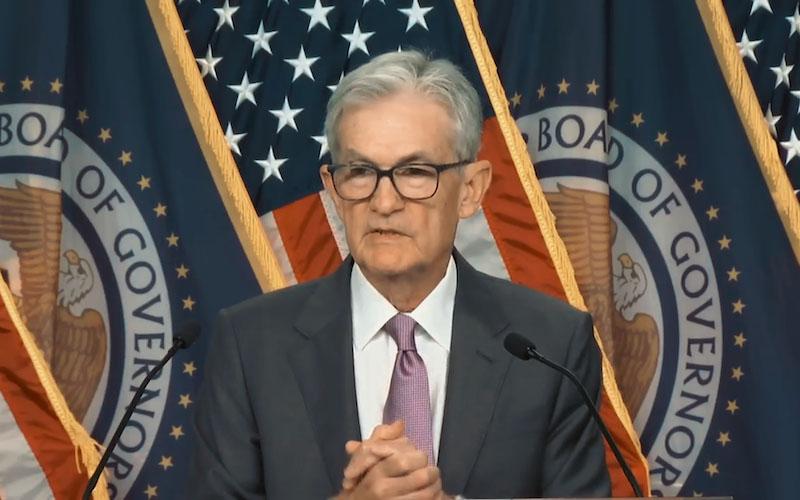

However, Powell described the investigation as a direct attack on the Federal Reserve's autonomy. While he expressed respect for the rule of law, he argued that the investigation was not truly targeting his testimony before Congress regarding the renovation project.

Powell declared, "These are all excuses, the threat of criminal charges, because the Federal Reserve sets interest rates based on our assessment of what best serves the public, not on the president's preferences." He added that this "unprecedented action should be seen as a product of the broader context of government threats and continued pressure."

President Trump said he knew nothing about the Justice Department’s actions, but added that Powell “was certainly not good at the Fed, and he wasn’t good at building either.”

Bipartisan backlash and institutional warnings

This move drew swift condemnation from the political and economic establishment, uniting Powell's critics and allies in opposition to the administration's action.

Former Federal Reserve Chairman issues warning

Former Federal Reserve Chairs Janet Yellen, Ben Bernanke, and Alan Greenspan, along with other former economic officials, issued a joint statement. They warned that the survey mirrors the methods used in unstable economies. They wrote, "This is how emerging markets formulate monetary policy under weak institutional conditions, with extremely negative consequences for inflation and economic performance."

The principle of Federal Reserve independence is the cornerstone of modern economic policy, designed to separate monetary policy decisions from short-term political pressures in order to ensure long-term price stability.

Republican senators condemned the investigation.

Several key Republicans on the Senate Banking Committee (which oversees the Federal Reserve) have publicly criticized the investigation.

Senator Thom Tillis called the move a “huge mistake” and threatened to oppose any Federal Reserve nominee, including Powell’s successor, until the issue is resolved.

Senators Kevin Kramer and Lisa Murkowski expressed similar concerns, with Murkowski stating, "If the Federal Reserve loses its independence, our market stability and the overall economy will be affected."

Senator Cynthia Loomis, usually a sharp critic of Powell, said that applying criminal law seemed “very difficult” and that she found no criminal intent.

Senator John Kennedy bluntly stated, "We don't need this at all, just like we don't need a hole drilled in our heads."

The report stated that Treasury Secretary Scott Bessant told President Trump that the investigation was a “mess” and could damage financial markets.

How the market interprets the Fed's crisis

Financial markets reacted with mixed emotions, but the results were quite telling. Rising long-term U.S. Treasury yields indicate investor concerns that weakening Federal Reserve independence could lead to increased inflation. Continued increases in borrowing costs could undermine government efforts to address economic affordability issues.

Meanwhile, gold prices hit a record high of $4,630.08 per ounce on Monday as investors sought safe-haven assets. During Tuesday's Asian trading session, gold prices fluctuated around $4,595, remaining at relatively high levels. However, major stock indices closed at record highs, driven by the technology and retail sectors. This event is expected to provide sustained support for gold prices.

(Spot gold daily chart, source: FX678)

Krishna Guha of Evercore ISI points out that the market is "taking significant comfort" from the strong political backlash triggered by the attack on the Fed's independence, viewing it as a check on the government.

What will Powell and the Federal Reserve do next?

This confrontation marks a new and more turbulent chapter in the ongoing friction between the White House and the Federal Reserve. Until now, Powell has avoided a public confrontation with the administration.

The criminal investigation comes as the Supreme Court is scheduled to hear arguments in two weeks regarding the government’s attempt to fire another Federal Reserve official, Governor Lisa Cook.

Jerome Powell was nominated by Trump in late 2017, and his term as chairman will end in May 2026. However, he could continue serving as a member of the Federal Reserve Board of Governors until 2028, and some analysts believe this latest pressure increases the likelihood that he will choose to remain in office as a form of resistance.

At 11:12 Beijing time, spot gold is currently trading at $4,597 per ounce.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.