One chart: The Baltic Dry Index (BDI) rose across the board, ending a nine-day losing streak.

2026-01-16 22:40:01

The Baltic Dry Index, published by the Baltic Exchange, rebounded on Friday, ending a nine-day losing streak. This index is a core indicator measuring global dry bulk shipping costs, and its trend directly reflects the health of the maritime shipping market for commodities such as iron ore, coal, and grain.

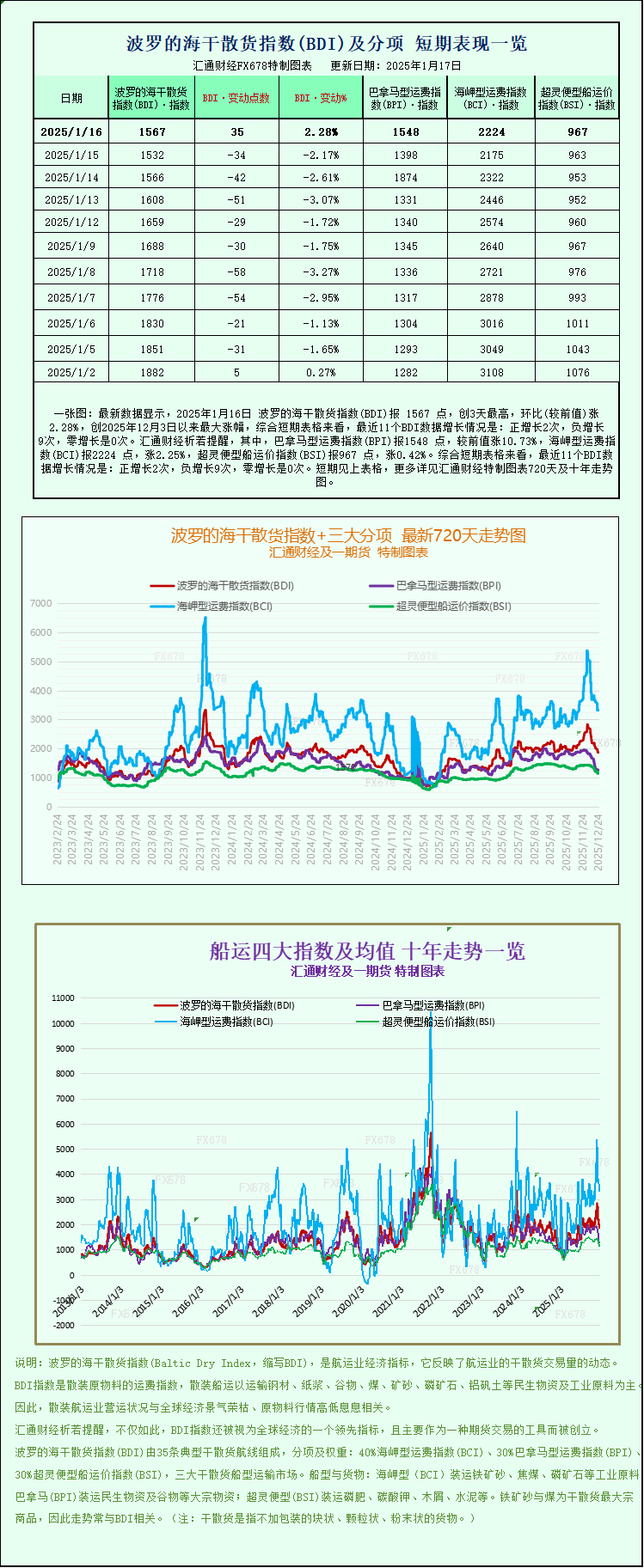

The Baltic Dry Index (BDI), which covers freight rates for Capesize, Panamax, and Supramax vessels, rose 35 points, or 2.3%, to close at 1567. However, dragged down by weak performance in the Capesize segment, the index still recorded an overall decline of 7.2% for the week. In the dry bulk shipping market, these three vessel types cover mainstream freight demand from very large to medium-sized vessels, and their freight rate fluctuations are a leading indicator of the overall market trend.

The Capesize freight index rose 49 points, or 2.3%, to close at 2224. Despite the single-day rebound, the index is still down 15.8% for the week. Capesize vessels are the "main force" in dry bulk shipping, primarily handling ultra-large cargo transport across the ocean. Their freight rate fluctuations are often highly correlated with the global trade activity of energy and industrial raw materials such as iron ore and coal.

The average daily earnings of Capesize vessels increased by $444 to $16,670. These vessels typically have a deadweight tonnage of around 150,000 tons and primarily transport commodities such as iron ore and coal. Changes in their daily earnings directly impact the operating profits of shipping companies.

It is worth noting that as the world's largest consumer of iron ore, China's market has been affected by both high ore prices and narrowing profit margins for downstream enterprises, leading to a weakening of purchasing intentions and consequently a continued decline in iron ore futures prices. Data shows that the Dalian iron ore futures contract saw its first weekly decline in two weeks this week. The weakening of iron ore prices has further impacted the shipping sector, becoming a significant factor suppressing Capesize freight rates.

In the small and medium-sized vessel sector, the Supramax freight rate index rose 4 points to close at 967 points, but still fell slightly by 0.9% this week. Supramax vessels, with their flexible loading and unloading advantages, mainly serve cargo transportation in small and medium-sized ports within the region, and their market performance is more significantly affected by changes in regional trade patterns.

The Panamax freight index performed exceptionally well, rising 60 points, or 4.3%, to close at 1548 points. Its cumulative increase this week reached 15.1%, making it a major highlight in the dry bulk market.

The average daily earnings for Panamax vessels increased by $535 to $13,120. These vessels, with a deadweight range of 60,000 to 70,000 tons, primarily transport goods such as coal and grain. The strong rebound in their freight rates is likely closely related to the recent recovery in global demand for grain trade and the increase in regional coal transport demand.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.