Trump continues his criminal investigation against Powell, jeopardizing the Federal Reserve's independence.

2026-02-03 13:18:36

On Tuesday (February 3), the US dollar index fluctuated around 97.45 during the Asian session.

Trump hints he will not back down on the Powell investigation.

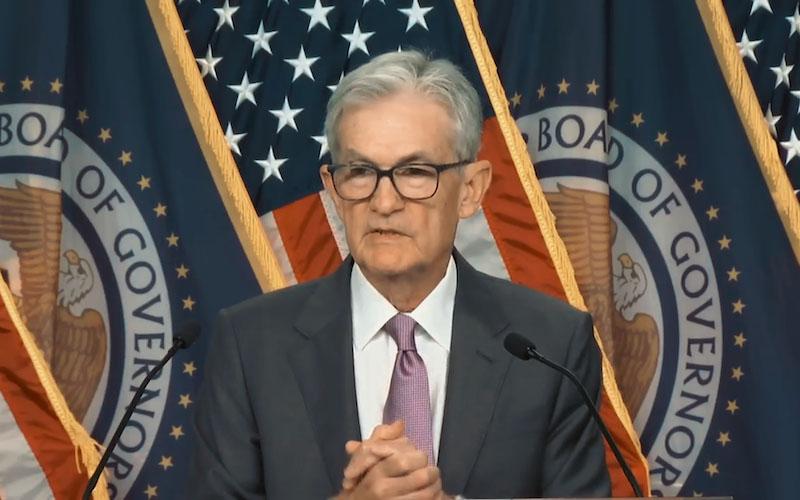

U.S. President Donald Trump said Monday that the criminal investigation into Federal Reserve Chairman Jerome Powell should continue uninterrupted, dismissing concerns that the investigation could undermine the government's plans for new leadership at the Fed. Speaking in the Oval Office, Trump said Washington District Attorney Jean Piro should "stick to it and see what happens," emphasizing that the investigation must continue regardless of political consequences.

Trump's remarks come as the criminal investigation into the current Federal Reserve chairman is under increasing scrutiny due to its unprecedented nature. The president's stance suggests, at least verbally, that he intends to separate the legal proceedings from the political timetable surrounding the transition of leadership at the Federal Reserve.

Senate resistance and confirmation risks

This investigation has quickly become entangled with the confirmation process for Kevin Warsh, Trump's nominee to succeed Powell. Senator Thom Tillis, a Republican member of the Senate Banking, Housing, and Urban Affairs Committee, has stated that he will oppose any new nominee for Federal Reserve Chair until the investigation into Powell is fully completed.

This position carries significant procedural weight. The Senate Banking Committee is very evenly divided, with Republicans holding 13 seats and Democrats 11. If Tillis joins all Democrats in opposing Warsh, the committee could become deadlocked, preventing the nomination from reaching a full Senate vote. The risk here is institutional rather than symbolic, as a committee deadlock would directly delay the transition of leadership at the Federal Reserve.

Probes rooted in long-term policy conflicts

On January 11, Powell revealed that he was facing a criminal investigation. This came months after Trump and his allies publicly criticized the Federal Reserve for its reluctance to cut interest rates as sharply as the president had advocated. Powell characterized the investigation as politically motivated pressure, stating that the Fed's policy decisions were based on assessments of what was best in the public interest, rather than on the president's preferences.

This conflict reflects a deeper structural tension between executive expectations and the Federal Reserve's independence. While the investigation itself did not change monetary policy, its very existence poses a significant causal risk to the institution's credibility, as markets may interpret legal pressure on the Fed as a challenge to its autonomy.

Renovation costs become the tipping point

Trump has repeatedly cited the multi-billion dollar renovation of the Federal Reserve's Washington headquarters as a potential source of misconduct. He has suggested the project may involve "gross incompetence" or corruption, including possible kickbacks, although he has not provided direct evidence. Trump has stated his belief that Piro will investigate whether any wrongdoing has occurred.

The Federal Reserve defended the overhaul project, stating that the upgrades aimed to reduce long-term operating costs and improve efficiency, while acknowledging increased expenses. This controversy highlights how the Fed's administrative and financial decisions have become politicized, intensifying external scrutiny and moving beyond traditional policy debates.

Impact on Federal Reserve independence and market confidence

Jerome Powell's term as Federal Reserve Chairman ends in May, creating a conflict between the investigation and the timeline for a leadership transition. Although Trump has nominated Walsh as his preferred successor, the unresolved investigation adds uncertainty to the confirmation process and to overall perceptions of the Fed's independence.

The relationship between the survey and market confidence is largely indirect but significant. Even without immediate policy changes, ongoing legal and political pressure on the Federal Reserve could erode investor confidence in its ability to operate independently without administrative intervention. As the survey continues, its findings could influence not only personnel decisions but also shape perceptions of the long-term stability of U.S. monetary policy institutions. The overall impact on the dollar is negative and damaging.

(US Dollar Index Daily Chart, Source: FX678)

At 13:18 Beijing time, the US dollar index is currently at 97.48.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.