Despite weak data, the US dollar staged a strong comeback. Have you discovered the culprit behind this?

2026-02-04 21:49:11

As the world's main reserve currency, the US dollar rose against all major G10 currencies on Monday. The short-term rebound was particularly prominent due to a combination of market factors. The upcoming US employment data and Treasury auction updates will further dominate the short-term trading rhythm of the US dollar index.

Multiple driving forces combined to support a stronger US dollar index.

The rebound in the US dollar index is not driven by a single factor, but is the result of the combined effects of policy expectations, economic data, and market capital flows.

Among them, the policy signals released by the nomination of candidates for Federal Reserve Chairman became the core driving force: After Trump announced that he intended to nominate Kevin Warsh to succeed Jerome Powell as Chairman of the Federal Reserve, the market generally predicted that Warsh would be more inclined to take a tough stance to combat inflationary pressures.

This potentially hawkish monetary policy stance directly undermined the "devaluation trade" logic that had previously supported the rise in precious metals, leading to a continued decline in gold and silver prices. As funds fled the metals market, they flowed into the US dollar in large quantities, providing key support for the strengthening of the US dollar index.

Monex Inc. forex trader Andrew Hazlett analyzed that the reversal of the metal rally was essentially due to the market weeding out overly leveraged and weak speculative funds, while the US dollar, as a direct beneficiary, effectively absorbed this part of the safe-haven and hedging demand.

In addition, the unexpectedly strong performance of US manufacturing data further strengthened the economic fundamentals of the US dollar.

Meanwhile, the progress of US-Iran negotiations led to lower oil prices, causing G10 currencies such as the Swiss franc and Norwegian krone, which have both safe-haven and oil-related attributes, to weaken. This indirectly highlighted the relative strength of the US dollar, and the US dollar index also rose in tandem with the yield on US Treasury bonds.

Position structure optimization and short covering boosted the rebound.

Market positioning adjustments also significantly contributed to the rebound of the US dollar index.

Previously, shorting the US dollar was one of the most popular macro trading strategies last month, but the dollar's rapid rebound from its near four-year low caught some short-selling investors off guard.

The market is currently in a phase of concentrated liquidation of speculative and short-selling dollar positions that began in mid-January, a process that has significantly eased downward pressure on the dollar.

Wells Fargo strategist Eric Nelson said the phenomenon is essentially a reflection of the market returning to normal after the January dollar sell-off frenzy.

However, it should be noted that although extreme short positions have clearly declined, option pricing as a whole remains pessimistic about the US dollar – the premium for hedging against the risk of a dollar decline hit a record high on January 27.

In addition, the amplified effect of month-end fund flows and the need for technical corrections have provided additional momentum for the dollar's rebound. However, the sustainability of the short-term rebound still needs further verification from subsequent data.

Employment Data Preview: ADP report fell short of expectations, impacting short-term trends. Released US employment data will be the core focus of the next phase of US dollar index trading.

TD Securities' global strategy team pointed out that both the ADP employment data and the ISM services PMI, two key indicators, may fall short of market consensus expectations. The currently released ADP figure significantly missed expectations of 48,000, with the actual figure being 22,000. However, the US dollar showed a phenomenon of not falling despite the negative news.

With the delayed non-farm payrolls (NFP) report becoming the market's core focus, the weaker-than-expected ADP data caused the US Treasury yield curve to exhibit a mild bull market steepening pattern, meaning that short-term Treasury yields fell faster than long-term Treasury yields, resulting in a steeper yield curve. This change in the curve will slightly suppress the US dollar index by narrowing short-term interest rate differentials.

Meanwhile, further analysis shows that the ISM services data will undergo a mean reversion process, with the employment and new orders sub-items expected to decline.

This change may trigger a reassessment of the strength of the US economic recovery in the market, thereby adjusting the pricing of expectations for Federal Reserve policy and indirectly affecting the trading logic of the US dollar index.

Government bond auctions remain stable, focusing on forward-looking guidance signals.

In addition to the employment data, the quarterly refinancing operation that the U.S. Treasury will launch early Thursday morning will also have an indirect impact on the dollar index.

TD Securities predicts that the auction size of treasury bonds of various maturities will remain at the original level, and the official has made it clear that the auction size will remain stable in the "next few quarters".

The market's core focus will be on whether forward guidance signals an adjustment. Supply and demand dynamics in government bond auctions and changes in the yield curve, along with employment data, will form the core driving logic for the short-term US dollar index.

If the auction falls short of expectations, short-term Treasury yields may rise, attracting funds to boost the dollar index.

Institutional investors are divided on whether to buy or sell; traders need to focus on two core themes.

From an institutional perspective, there is currently a clear divergence of opinion in the market regarding the long-term trend of the US dollar index.

Goldman Sachs, Manulife Investment Management, and Euromonitor Investment Management, among other institutions, maintain their long-term bearish view on the US dollar, believing that the policy uncertainty of the Trump administration and the US deficit problem will continue to suppress the dollar. Furthermore, the recent significant increase in foreign exchange volatility and the persistence of policy uncertainty will hinder the dollar from recovering its losses.

However, Bloomberg macro strategists point out that as policy risks ease, traders will refocus their attention on economic fundamentals, which may support the dollar's continued rebound in the short term.

Summary and Technical Analysis:

For US dollar index traders, the current focus should be on two key themes: first, the release of employment data (ISM Services PMI and subsequent NFP); data that falls short of expectations may trigger short-term carry trade adjustments, thereby affecting the strength of the US dollar.

Secondly, the changes in the shape of the yield curve and the auction of treasury bonds are factors. The steep rise in the yield curve during the bull market may provide temporary support for the US dollar. Recently, influenced by expectations that Warsh may affect the scale of the Fed's bond purchases, the yield on the 10-year US Treasury bond has continued to climb, which has provided significant support for the US dollar. At the same time, due to the huge fluctuations in gold prices, safe-haven funds in the market are currently tending to enter the US dollar and US Treasury bonds.

At the same time, we need to be wary of the risk of exhaustion of momentum after the market short positions are closed, as well as the limit of rebound under the long-term bearish logic of institutions. Against the backdrop of increased short-term volatility, we need to closely track the marginal changes in policy signals and capital flows in order to seize precise trading opportunities.

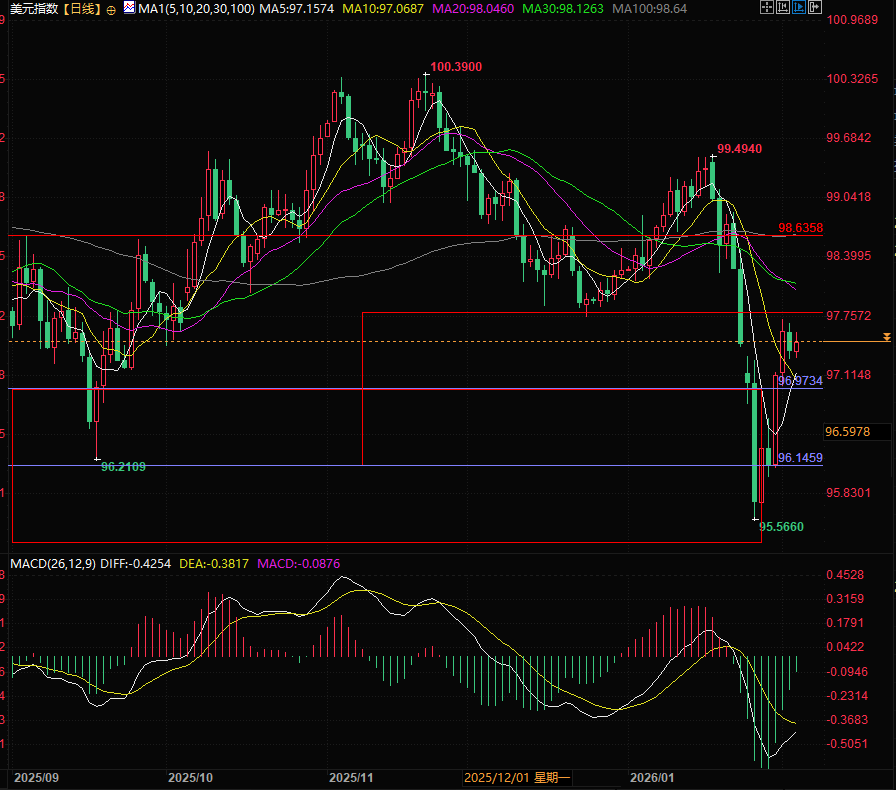

Technically, the US dollar index is not falling despite negative factors. It is above the trading range and far from the upper edge of the range. It is also above and far from the 5-day and 10-day moving averages. All of these indicate strong bullish momentum in the US dollar index. It is highly likely that it will continue to rise after a brief period of fluctuation. As a result, gold and silver may be under temporary pressure.

(US Dollar Index Daily Chart, Source: FX678)

At 21:47 Beijing time, the US dollar index is currently at 97.48.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.