ING: Gold and silver markets are seeing position rebalancing, not a trend reversal.

2026-02-05 02:04:52

Following the historic sell-off, bargain hunters have emerged again.

Historic sell-off

The speed and magnitude of this round of precious metal sell-off are unprecedented. Last Friday, gold recorded its biggest single-day drop since 2013, while silver saw its largest single-day decline on record. Following Friday's sharp falls in gold and silver, the market continued its weakness on Monday as investors closed out their previously overcrowded long positions.

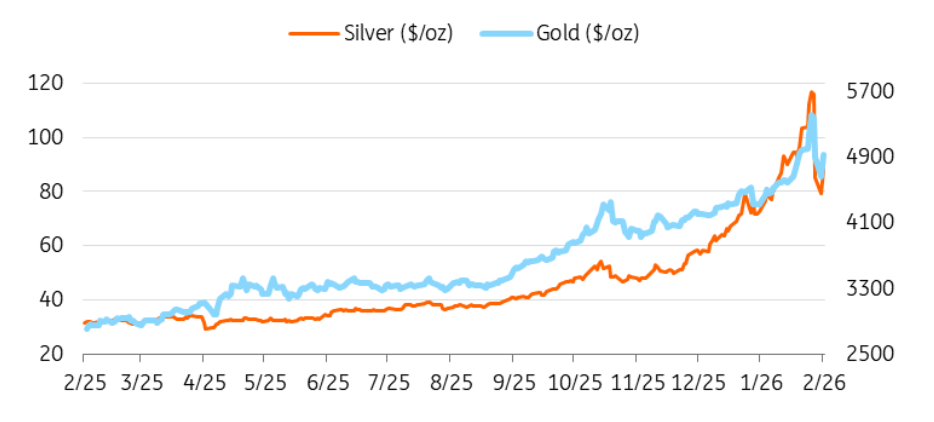

This sell-off came after precious metals had just experienced an epic three-month rally: gold surged from $4,000 to over $5,500 per ounce, and silver soared from around $50 to nearly $120 per ounce. This rally was primarily driven by speculative buying from China—from retail traders to large equity funds, all flocking to commodities, with the influx of funds pushing prices to extreme highs until the abrupt reversal last week.

The immediate trigger for last Friday's market reversal was President Trump's proposed nomination of Kevin Warsh as the next Federal Reserve Chairman. The market viewed Warsh as the most hawkish candidate, and this news propelled the dollar sharply higher, prompting investors who had bet on a weaker dollar to take profits.

As market positions become overcrowded and volatility rises, exchanges and brokers are raising margin requirements, a signal that the market is already overextended.

This round of price declines was mainly driven by the liquidation of crowded speculative positions and passive forced liquidation, rather than by a deterioration in the macroeconomy or the fundamentals of precious metals.

Gold and silver prices rebounded strongly on Tuesday as market risk aversion eased: spot gold rose more than 6%, and silver rose about 8%, recovering some of its previous losses. This rebound indicates that the previous sell-off contained oversold components, and momentum trading and leveraged funds further amplified the decline.

In the medium to long term, this correction has facilitated a reallocation of positions and squeezed out excessive speculative bubbles in the market. However, it also serves as a reminder that precious metals remain highly sensitive to changes in liquidity, position adjustments, and shifts in overall risk sentiment.

The rebound in precious metals occurred in tandem with the overall recovery in global financial markets, while the weakening dollar gave back some of the gains accumulated at the beginning of the sell-off.

The US dollar remains a key influencing factor.

The negative correlation between precious metals and the US dollar has re-emerged, making gold and silver prices particularly sensitive to short-term exchange rate fluctuations. Looking ahead, the US dollar will remain the core driver of short-term price movements, and precious metals are likely to move inversely to the dollar.

"Varied Gold"

Silver is often referred to as a "stronger version of gold": its price fluctuations are typically much larger percentages than gold. The smaller silver market, coupled with its dual investment and industrial demand, amplifies both its price increases and decreases—a characteristic vividly demonstrated in the recent sell-off and subsequent rebound.

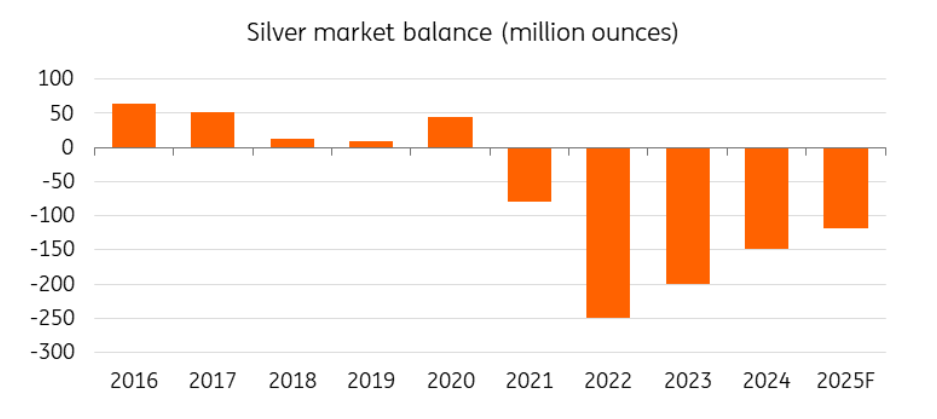

While short-term volatility for silver is expected to remain high, its long-term fundamentals have not changed substantially. Industrial demand related to electrification and a persistently tight physical supply continue to support silver prices. At the same time, silver's higher volatility also means it will be more sensitive to market sentiment and position changes than gold.

However, for silver to embark on a more sustainable rebound, the outflow of funds from ETFs needs to stabilize first. Silver ETF holdings have declined for eight consecutive days, while ETF demand remains the core driver of silver prices.

The silver market remains in a state of supply shortage.

(Data source: World Silver Institute, ING Research Department)

The fundamentals remain strong.

For gold, this round of correction does not reflect a change in the core macroeconomic logic. In the medium to long term, safe-haven demand, continued gold purchases by central banks, and the outlook for real interest rates will continue to support gold prices.

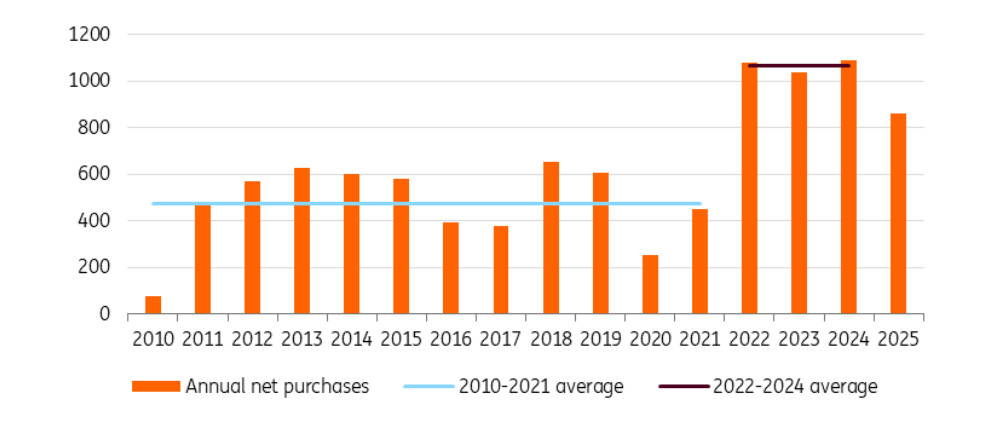

While short-term drivers have fueled this surge, the foundation of gold's multi-year bull market remains the sustained buying by global central banks. The central bank gold-buying spree began after the outbreak of the Russia-Ukraine conflict in 2022, prompting countries to reassess the safety of their foreign exchange reserves and diversify their asset allocation strategies. Since then, official demand for gold has become a stable and continuous support for the gold market.

Although central bank gold purchases slowed slightly last year, institutions worldwide remained net buyers of gold. Given current price levels and the recent correction, central banks are expected to resume their gold purchases. Central bank gold purchases are strategic and long-term in nature, largely unaffected by short-term price fluctuations, thus providing structural support for the medium- to long-term trend of gold prices.

It should be noted that the short-term trend of gold prices will still be dominated by macroeconomic data, monetary policy expectations and dollar fluctuations, rather than continuing the previous one-sided surge.

Even with gold prices at historic highs, central bank demand for gold remains strong.

(Data source: World Gold Council, ING Research Department)

Market Outlook

In the short term, the market continues to adjust positions, and precious metal volatility is likely to remain high. Assuming no substantial changes in macroeconomic fundamentals, we believe this round of selling is a corrective adjustment rather than a structural trend reversal. However, the pace and sustainability of any subsequent rebound in gold prices will depend on the dollar's performance, interest rate expectations, and changes in overall market risk sentiment.

Precious metals are more likely to trend upwards in a more stable, non-linear fashion rather than repeating the explosive surge of the past few months.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.