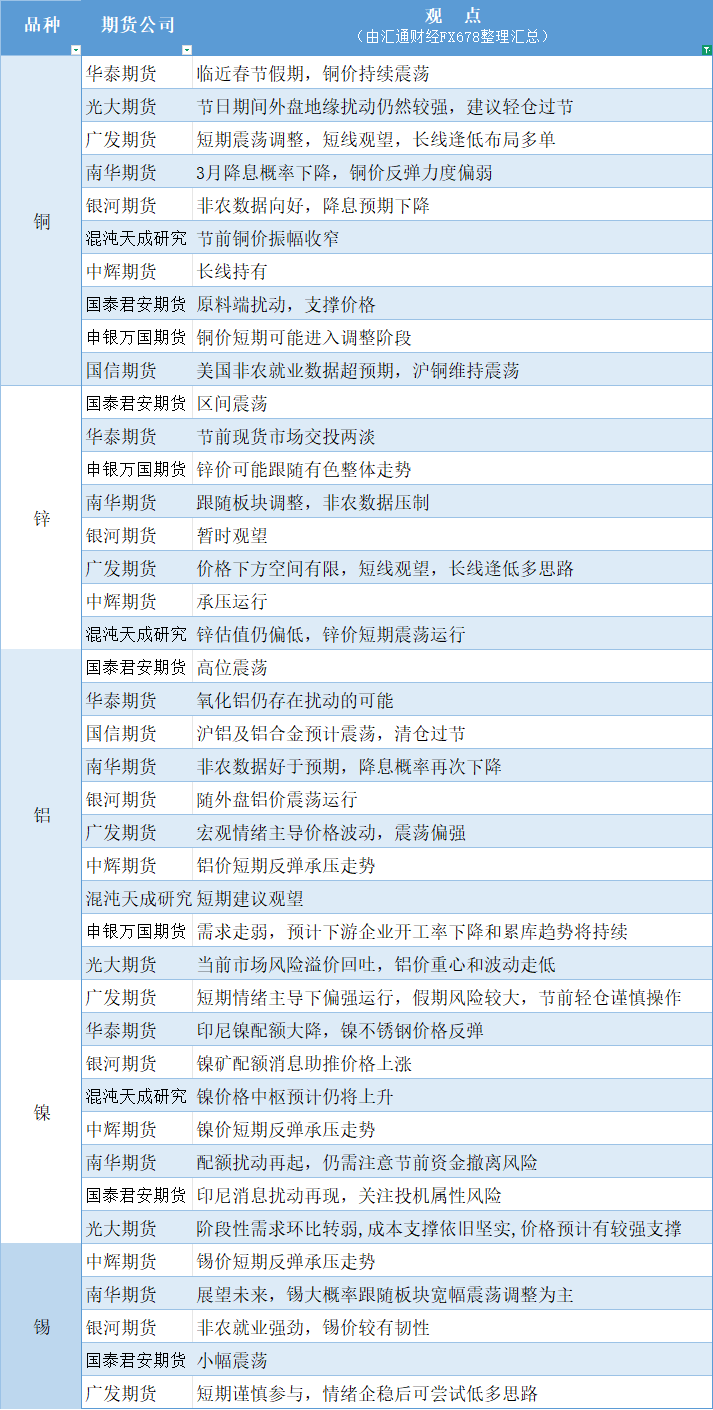

A summary chart of futures company viewpoints: February 12th, non-ferrous metals (copper, zinc, aluminum, nickel, tin, etc.)

2026-02-12 12:49:01

Copper: The probability of an interest rate cut in March has decreased, and the rebound in copper prices is weak. Geopolitical disturbances in overseas markets will remain strong during the holiday. It is recommended to maintain a light position over the holiday. Zinc: The downside potential for prices is limited. It is advisable to wait and see in the short term, while the long-term strategy is to buy on dips. Zinc prices may follow the overall trend of non-ferrous metals. Aluminum: Demand is weakening. It is expected that the operating rate of downstream enterprises will continue to decline and the trend of inventory accumulation will continue. Shanghai aluminum and aluminum alloys are expected to fluctuate. Clear positions over the holiday. Nickel: It is trending slightly stronger in the short term due to sentiment. However, there are significant risks during the holiday. It is recommended to maintain a light position and operate cautiously before the holiday. The short-term rebound in nickel prices will be under pressure. Tin: Tin is likely to follow the sector and mainly fluctuate and adjust.

This chart was specially created and compiled by FX678 and is copyrighted.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.