Gold prices experienced a flash crash after initially stabilizing: Expectations of a Fed rate cut cooled, and geopolitical support was met with a liquidity shock.

2026-02-13 01:52:26

US employment data reinforces the Federal Reserve's stance of "holding rates steady for an extended period".

Data released Wednesday by the U.S. Bureau of Labor Statistics (BLS) showed an unexpected rebound in U.S. job growth. Nonfarm payrolls (NFP) increased by 130,000 in January, far exceeding the expected 70,000 and marking the strongest monthly increase since December 2024. Meanwhile, the unemployment rate edged down to 4.3% from 4.4%.

Strong labor market data has reduced the scope for monetary policy easing in the short term, further solidifying market expectations that the Federal Reserve will likely keep interest rates unchanged in the next few meetings.

Because of the fact that gold does not generate interest, this expectation has put continuous downward pressure on gold prices.

However, the dollar and Treasury yields failed to receive sustained buying support after the data release, providing a brief respite for gold prices. The US Dollar Index (DXY), which tracks the dollar against a basket of six major currencies, is currently trading around 96.96, hovering near a one-week low.

Traders also digested the latest remarks from Federal Reserve officials. Kansas City Fed President Jeffrey Schmid stated that further rate cuts could lead to persistently high inflation; given that inflation remains close to 3%, maintaining a restrictive monetary policy remains the appropriate option.

In addition, Cleveland Fed President Beth Hammark stated that the current federal funds rate is essentially neutral, and it is reasonable for the Fed to hold rates steady; current interest rates have not significantly suppressed the economy, and there is no need for policy adjustments at this stage.

Despite this, the market still expects the Federal Reserve to cut interest rates by nearly 50 basis points this year. The CME FedWatch Tool shows that the market anticipates the first rate cut most likely to occur in June or July. Market focus has now shifted to the US Consumer Price Index (CPI) to be released on Friday.

Geopolitical risks weakened support, and a liquidity crisis dominated the market.

On the other hand, escalating tensions between the US and Iran and high geopolitical risks should have provided support for gold prices and cushioned downward pressure. The Wall Street Journal reported on Wednesday that the US is preparing to deploy a second carrier strike group to the Middle East, and the military is ready to take military action in case negotiations on Iran's nuclear program break down.

However, this safe-haven support was completely shattered by a sudden liquidity crisis. Financial analyst Adam Button stated that the sudden plunge in gold prices was of unknown cause. This move triggered a broad-based rise in the US dollar. The decline in gold prices and the strengthening of the dollar were likely driven by overall risk aversion. US stocks opened roughly flat before subsequently falling sharply.

Regarding the trigger for the plunge, analysts believe: "I think the trigger was the 12% drop in Microsoft's stock price in one day. Since then, we've seen continuous concerns about industry turmoil. The software industry has been consistently impacted, but now the logistics and transportation industries are also being affected. It's possible that someone who works as a software engineer was forced to sell their gold positions."

The plunge in gold prices has also fueled speculation about a leaked CPI report, a drop that could occur after the release of a major report, though analysts are generally skeptical. Whatever the driving factors behind the move, it has exacerbated anxieties that "nothing is safe."

Against this backdrop, the short-term outlook for gold prices has become extremely fragile, the previous balance between bulls and bears has been broken, and market sentiment has turned extremely cautious.

Technical Analysis

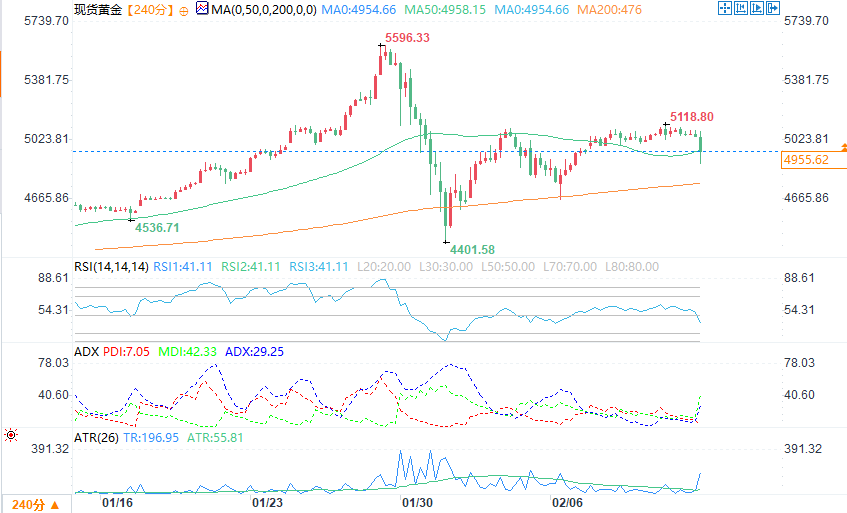

(4-hour chart of spot silver source: EasyForex)

From a technical perspective, after the recent pullback from its highs, the short-term momentum of gold prices has clearly reversed, indicating that gold is entering a new round of downward adjustment.

The Relative Strength Index (RSI) has fallen rapidly from the previous neutral range to 41.57, indicating that short-term bearish forces are in control and bearish sentiment has increased. The Average Directional Movement Index (ADX) has risen to 29.25, and the +DI (7.05) is far lower than the -MDI (42.33), indicating that the current downward trend is gradually strengthening. The Average True Range (ATR) remains at 55.81, meaning that price volatility is still at a high level and market uncertainty has increased.

On the 4-hour chart, spot gold is testing support at the 50-period moving average (4958.24). The next key support level is around $4850, followed by the 200-period moving average (4956.476). A break below this level could open up further downside potential.

On the upside, gold needs to reclaim the $5,000 level to effectively alleviate the current bearish sentiment. However, the overall upward trend in gold prices has been severely threatened, and the short-term outlook remains bearish.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.