One chart: Baltic Dry Index boosts shipping rates to a more than one-week high.

2026-02-12 22:41:01

The Baltic Dry Index (BDI) published by the London Baltic Exchange climbed to its highest level in over a week on Thursday (February 12), driven primarily by a broad increase in freight rates across all vessel types. This ended a prolonged period of sluggishness and injected a temporary boost into the global dry bulk shipping market. The BDI is an authoritative indicator of international dry bulk shipping prices, primarily reflecting the freight rates for transporting essential goods and industrial raw materials such as grain, coal, ore, and bauxite by bulk carriers. It is closely related to global economic conditions and raw material prices and is considered one of the leading indicators of global trade.

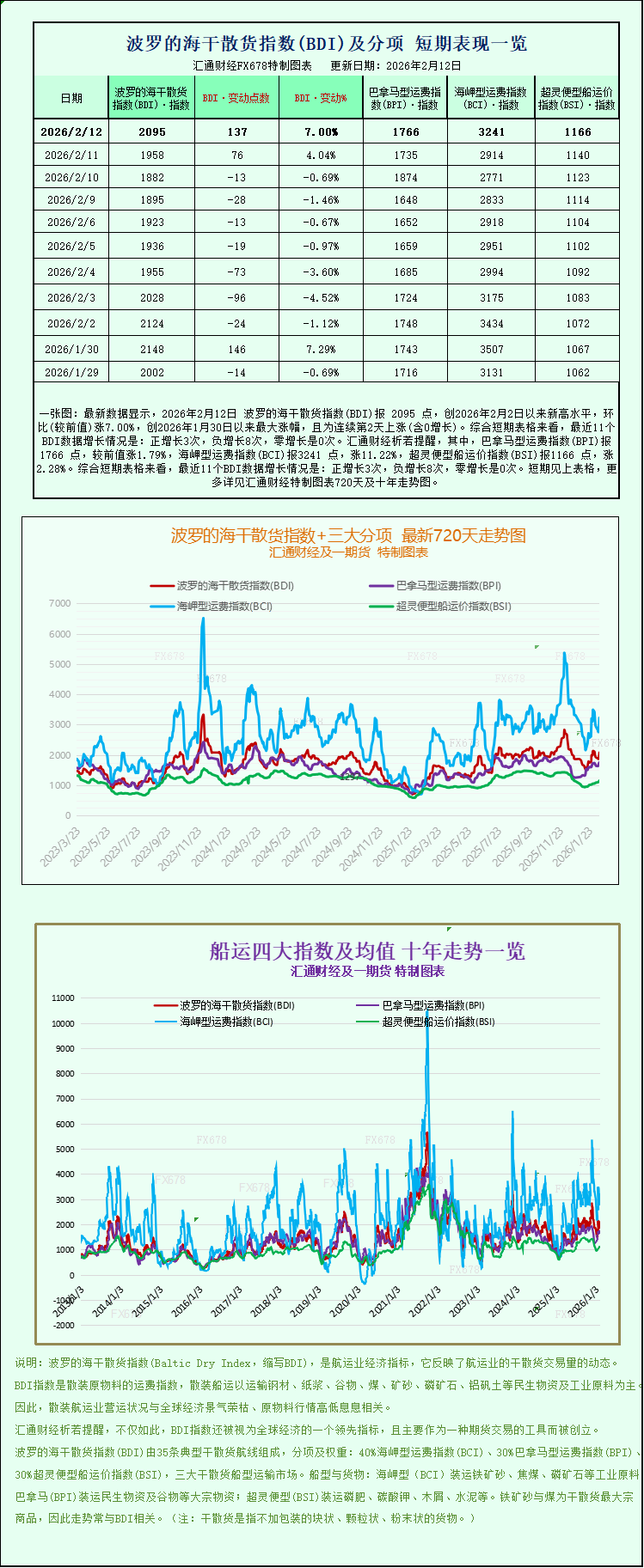

Specifically, the Baltic Dry Index, which tracks freight rates for the three core vessel types—Capesize, Panamax, and Supramax—rose 137 points, or 7%, to close at 2095, continuing Wednesday's upward trend. On Wednesday, the index ended a seven-day losing streak and rebounded. Looking back at recent trends, the index had plunged to its lowest point in over two weeks on Tuesday, putting pressure on market sentiment. The consecutive rebounds within just two trading days highlight the current recovery momentum in the dry bulk shipping market. As a core indicator of the global dry bulk shipping market, the Baltic Dry Index is calculated by weighting the freight rate indices of the three vessel types equally, and its fluctuations directly reflect changes in supply and demand in the global dry bulk shipping market.

Looking at different vessel types, all sub-markets showed varying degrees of upward movement, with the Capesize market performing the most impressively. The Capesize freight rate index surged 327 points, a significant increase of 11.2%, closing at 3241 points, becoming the core driving force behind the main index's rise. Capesize vessels are among the largest tonnage vessels in the dry bulk shipping market, typically used to transport bulk cargoes of 150,000 tons or more, primarily core industrial raw materials such as iron ore and coal. They are key transport carriers in the global steel and energy industry supply chains, and their freight rate fluctuations are directly linked to global industrial demand. Correspondingly, the average daily earnings of Capesize vessels also climbed, increasing by $2,964 on the day, ultimately reaching $25,893, resulting in a significant improvement in shipowner profitability and reflecting the current strong demand for large dry bulk carrier capacity.

However, it's worth noting that in stark contrast to the sharp rise in Capesize shipping rates, iron ore futures prices declined on the same day. The core reason for this divergence lies in the recent continued decline in automobile sales in China, the world's largest steel consumer. Simultaneously, released consumption data fell short of market expectations, further confirming the weak demand in China's steel industry. This, in turn, suppressed demand for iron ore, a core steelmaking raw material, leading to downward pressure on iron ore futures prices. According to relevant market analysis, since February 2026, the main iron ore futures contract I2605 has fallen by 8.5% cumulatively, with an average daily fluctuation exceeding 1%. Affected by multiple factors such as divergent macroeconomic expectations and intensified supply-demand imbalances in the industrial chain, it is expected to maintain a weak and volatile pattern in the short term, which may also constrain the continued rise in Capesize shipping rates.

The Panamax market also performed steadily, providing important support for the recovery of the dry bulk shipping market. The Panamax freight rate index rose 31 points, or 1.8%, to close at 1766 points, continuing its recent moderate upward trend. Panamax vessels are medium-sized dry bulk carriers, typically between 60,000 and 70,000 tons, mainly used for transporting bulk commodities such as coal and grain. Their routes cover major global food exporting and importing countries, as well as coal producing and consuming countries, making them a vital transportation link connecting the global agricultural and energy industries. Their freight rate trends are closely related to the activity of global food and energy trade. Correspondingly, the average daily earnings of Panamax vessels increased by $282 to $15,897, although the increase was not as large as that of Capesize vessels, it still achieved a steady rise, reflecting the good recovery momentum of the medium-sized dry bulk carrier market.

Regarding the current trends in the dry bulk shipping market, Filipe Gouveia, Shipping Analysis Manager at the Baltic International Maritime Council (BIMCO), provided a professional interpretation. He stated, "During the current seasonal off-season due to weak Chinese import demand, the rebound in grain freight volume has effectively driven up freight rates for other small and medium-sized dry bulk vessels besides Capesizes." Dry bulk shipping demand exhibits a significant calendar effect, with January and February typically being the off-season. This is mainly due to steel mill shutdowns during the Chinese New Year suppressing iron ore shipping demand, while tropical cyclones in the Southern Hemisphere summer hinder ship operations. The counter-trend growth in grain freight volume, however, has become a significant bright spot during this off-season.

Guviera further added, "The Panamax market, in particular, performed exceptionally well. During this period, the Baltic Panamax Freight Index rose by an average of 69% year-on-year, far exceeding market expectations. In terms of cargo composition, grain cargo typically accounts for about one-third of Panamax vessel turnover, and recently, global grain shipments have increased by 21% year-on-year. This strong demand directly supports the continued rise in Panamax freight rates." Grain transportation demand exhibits a clear mismatch between production and demand and seasonal concentration. The recent increase in grain shipments from major global grain-producing countries has become the core driver of Panamax demand, highlighting the important role of grain trade in the dry bulk shipping market.

Besides the Capesize and Panamax vessel markets, the small dry bulk carrier market also showed a steady upward trend, with the market recovery momentum spreading across the board. The Supramax freight rate index rose 25 points, or 2.2%, to close at 1166 points, achieving a moderate rebound. Supramax vessels are small dry bulk carriers with relatively small tonnage and strong adaptability. They can call at most small and medium-sized ports worldwide and are mainly used to transport small batches of dry bulk cargo, covering a wider range of cargo types. The rise in their freight rates further confirms the overall recovery of demand in the current dry bulk shipping market, rather than a localized recovery in a single vessel type, and also reflects the continued improvement in the supply and demand pattern of the global dry bulk shipping market.

Overall, the comprehensive rise in the Baltic Dry Index this Thursday signifies that the global dry bulk shipping market has initially emerged from its previous slump and entered a phase of recovery. The synchronized increases across various vessel segments also demonstrate the comprehensive nature of the recovery momentum. However, the decline in iron ore futures prices and weak demand from China's steel industry still bring some uncertainty to the market's future trend. Meanwhile, factors such as the aging of the global dry bulk fleet and changes in the supply and demand structure may also affect the continued upward trend in freight rates. The future market trend will still require close monitoring of key factors such as changes in China's import demand, the activity level of global commodity trade, and the impact of international geopolitics on shipping routes.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.