Vale: Fourth Quarter 2025 and Full Year 2025 Financial Results

2026-02-13 10:40:15

Performance Highlights

All business segments achieved strong operating and cost performance, and all guidance targets for 2025 have been met.

Strong sales performance is expected in the fourth quarter of 2025 and throughout 2025. Sales of iron ore, copper, and nickel increased by 5% (4 million tons), 8% (8,000 tons), and 5% (3,000 tons) year-on-year in the fourth quarter of 2025, respectively, and by 3% (8 million tons), 12% (41,000 tons), and 11% (18,000 tons) year-on-year in 2025, respectively.

The average actual price of iron ore fines was US$95.4/ton, up 1% month-on-month and 3% year-on-year. The actual price of copper was US$11,003/ton, up 12% month-on-month and 20% year-on-year. The actual price of nickel was US$15,015/ton, down 3% month-on-month and 7% year-on-year.

In 2025, the cash cost of iron ore C1 was US$21.3/ton, a 2% decrease year-on-year, marking the second consecutive year of cost reduction. In the fourth quarter of 2025, the C1 cash cost was also US$21.3/ton, a 13% increase year-on-year, in line with guidance. The total cost of iron ore in 2025 was US$54.2/ton, a 3% decrease year-on-year; in the fourth quarter of 2025, the total cost of iron ore was US$54.3/ton, a 10% increase year-on-year.

In the fourth quarter of 2025, total copper costs were negative $881 per tonne; total nickel costs were $9,001 per tonne, a 35% decrease year-over-year. This was primarily driven by strong revenue from associated products and improved operating performance in both business segments. For the full year 2025, total copper costs were $603 per tonne and total nickel costs were $12,158 per tonne, marking the second consecutive year of cost reduction.

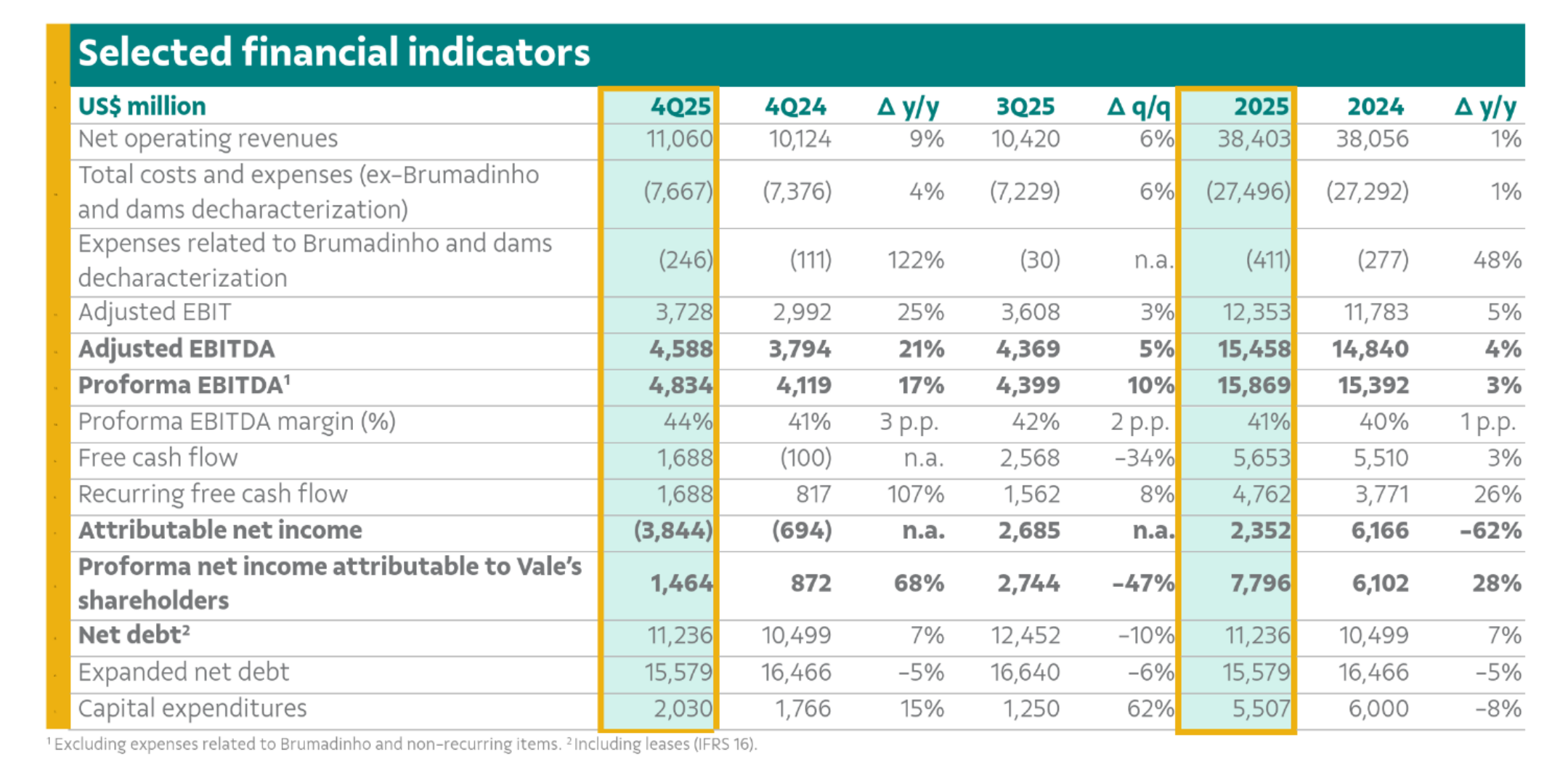

Formal EBITDA (earnings before interest, taxes, depreciation, and amortization) was US$4.8 billion, up 17% year-over-year and 10% quarter-over-quarter, reflecting increased contributions from Vale's base metals business.

Capital expenditures for the fourth quarter of 2025 were $2 billion, in line with the full-year capital expenditure guidance of $5.5 billion.

Recurring free cash flow was $1.7 billion, up $900 million year-over-year, driven by growth in formal EBITDA and a decrease in net finance costs.

Net liabilities totaled $15.6 billion at the end of the quarter, a decrease of $1 billion from the previous quarter, driven by stronger free cash flow and provisions adjustments related to Samarco.

According to the company's dividend policy, it will pay $1.8 billion in dividends and capital interest in March; in addition, it paid $1 billion in special returns in January.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.