Despite overwhelmingly positive data, the public is crying out for a recession! Is the US economy facing a "boom-and-bust" recession?

2026-02-19 11:57:02

Economic output continued to soar, consumer spending was robust, and the post-pandemic recession that many had anticipated never materialized. However, many felt terrible about their finances, debt levels were at record highs, and most Americans believed the country was in the midst of an economic slowdown.

"The economy is performing very well according to traditional indicators, but ordinary people say they don't feel it," said Stoller, an antitrust advocate and research director at the Project for Economic Freedom, a nonpartisan think tank.

What is the meaning behind the name?

This concept is thematically similar to the "momentum recession" popular in 2022, which was used to explain the disconnect between strong economic data and negative consumer sentiment after the pandemic. It can also be compared to the "K-shaped economy," a term that describes the stark differences that Americans in different income brackets may experience.

Stoller stated that his "boom-and-bust" framework aims to guide people beyond subjective feelings and focus on the substantial financial difficulties faced by those outside the top tier of the American population . Stoller said that once this context is understood, it becomes easier to see why many Americans feel that the national economic engine they helped drive has not propelled them forward.

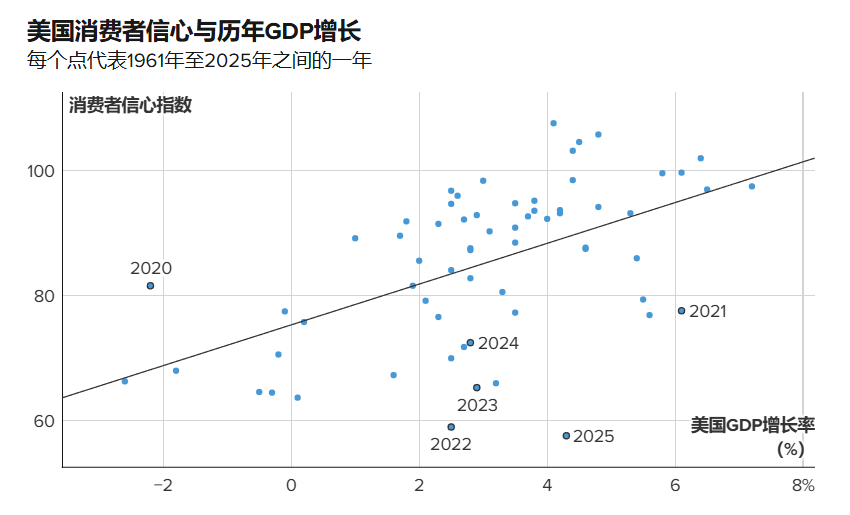

Stoller argues that, on the surface, the "boom-bust" theory helps explain why recent data shows that U.S. GDP growth has not led to an improvement in consumer sentiment, a significant departure from the typical trend observed over the past sixty years.

"I've never seen anything like this before," said Diane Swonk, chief economist at KPMG. "I've been in this business for 40 years and I've never seen anything like this in all that time."

Inflation does not apply to everyone.

Stoller and economists point out that the key to this difference lies in the varying impact of inflation on different groups. Data shows that consumers face significantly different price increases due to factors such as income level and geographical location .

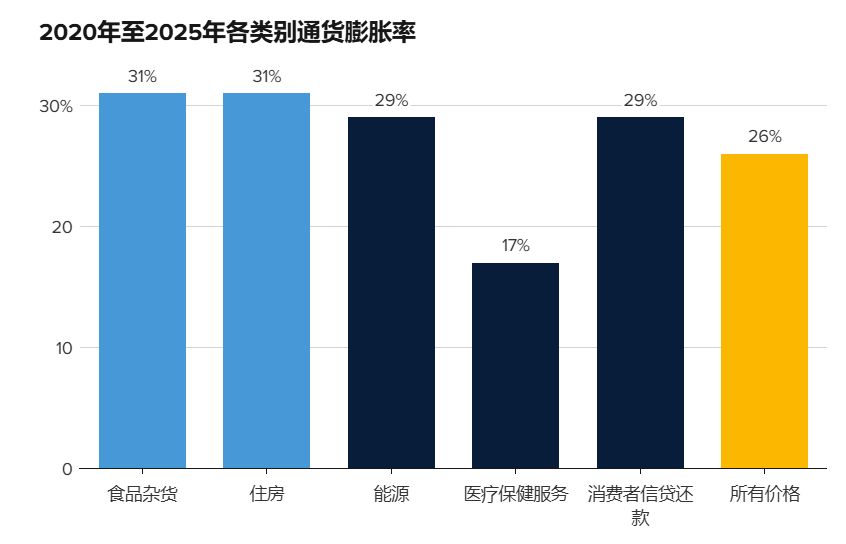

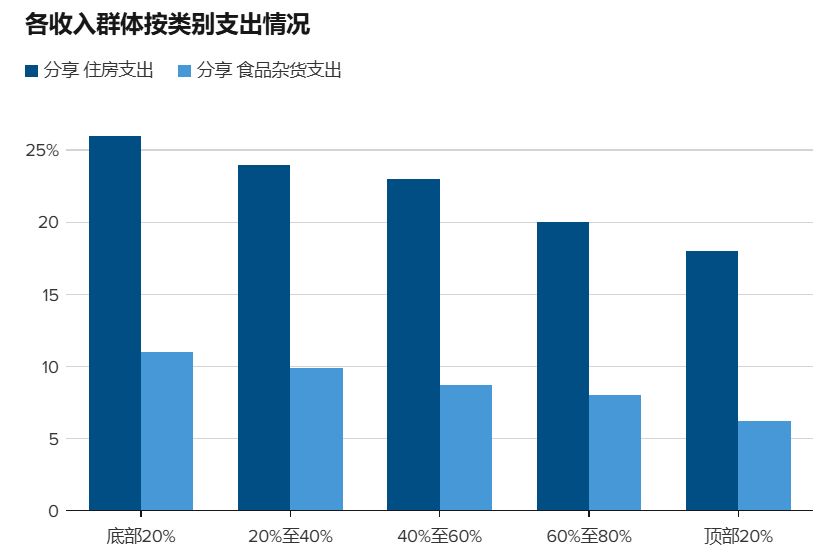

Morgan Stanley research shows that between 2020 and 2025, inflation on groceries and housing will be the highest among all essential goods tracked. The bank also found that in 2024, these two categories of spending will account for an unusually high proportion of consumption by low-income groups.

Morgan Stanley economist Heather Berger points out that low-income groups have historically experienced higher inflation rates than the wealthy . When overall price increases exceed the Federal Reserve's 2% target—as has been the case in recent years—this inflation gap will widen further, and this cannot be simply attributed to the post-pandemic phenomenon. The Atlanta Fed's 2026 report shows that food price increases will still be about 9 percentage points above the average.

From the second quarter of 2006 to the third quarter of 2020, grocery price increases in less developed regions were significantly higher than in wealthier regions. Heather points out that increasing the number of supermarkets in underserved communities can promote market competition, thereby suppressing prices and helping to mitigate inflation disparities. From the second quarter of 2006 to the third quarter of 2020, food price increases in poorer regions consistently outpaced those in wealthier regions. Heather points out that increasing the number of grocery stores in underserved communities can promote competition and suppress prices, thereby helping to mitigate inflation disparities .

Stoller stated, "If you consider monopolies as a systemic feature of the American economy, and price discrimination as a systemic feature of the American economy, then it's not difficult to draw the conclusion that happy people pay different prices than sad people."

President Donald Trump has pushed forward several initiatives aimed at lowering housing prices this year. Last month, Trump claimed the U.S. had “virtually no” inflation, although the latest data shows inflation is above the 2% annual level that monetary policymakers consider healthy.

Economists and investors are closely watching the progress of affordability initiatives ahead of the November midterm elections.

Elizabeth Lunt, a senior economist at a financial education platform, points out that households' financial buffer is significantly weaker today compared to the period of pandemic stimulus in the early 2020s. Credit card debt has surpassed historical peaks, reaching $1.28 trillion by the fourth quarter of 2025, according to data released last week by the Federal Reserve Bank of New York.

Recruiting recession

Since the pandemic triggered inflation, high prices in the United States have been a persistent problem, and recently, consumers lacking financial security have turned their main concerns to the job market.

Economists describe the current labor market environment as "jobless growth." Federal Reserve Chairman Jerome Powell called it an environment of low hiring and low layoffs .

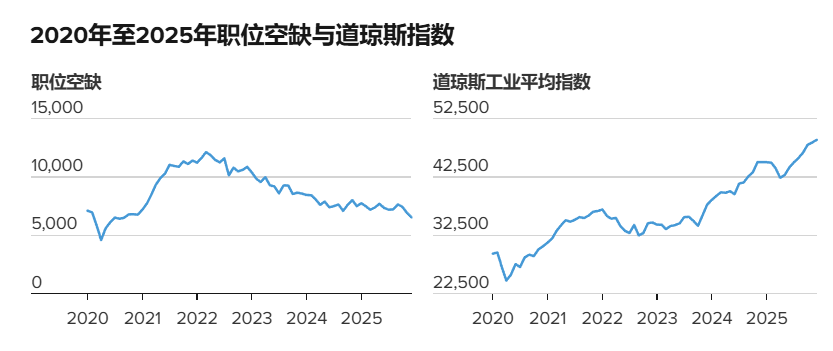

Data shows that job openings fell to their lowest level since 2020 in December. Economists point out that the continued appreciation of these assets, as higher-income earners are more likely to hold stocks, will boost economic confidence and stimulate consumer spending. Meanwhile, as the labor market tightens, anxiety is sweeping across other groups in the United States.

"If you own assets that are really valuable, then you'll feel supported, but if you don't own any stocks at all, then the stock market is meaningless to you," said Joanne Hsu, director of the University of Michigan's consumer survey.

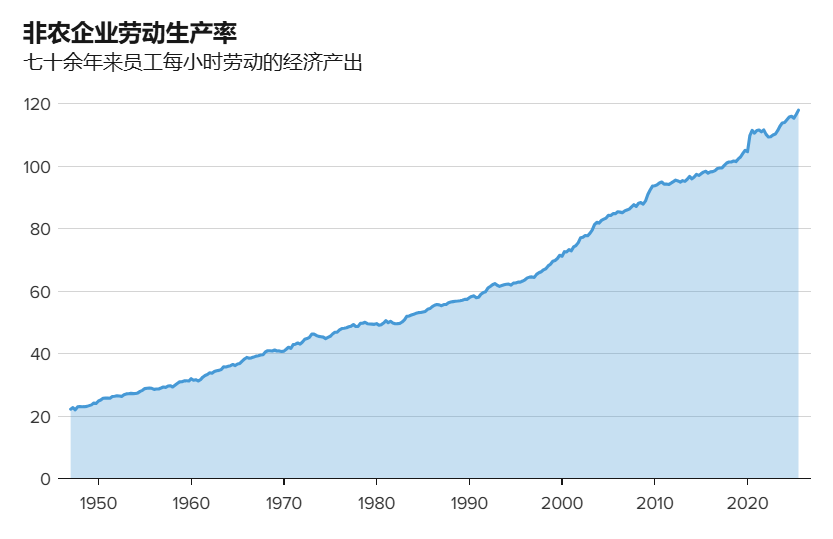

Federal statistics show that by 2025, U.S. workers' hourly economic output had rebounded from the pandemic-induced slump, reaching a record high. However, this could be bad news for employees: this increase could be seen as a signal that artificial intelligence is significantly boosting productivity, potentially encouraging companies to downsize.

Nike, Amazon, and UPS all announced massive layoffs in 2026. According to consulting firm data, the number of layoffs surged by more than 200% from December 2025 to January 2026.

The so-called labor share—the proportion of economic output that flows to workers in the form of wages—is projected to fall to a new low in 2025. Even worse, the gap between corporate profits and employee compensation as a percentage of GDP is expected to widen to its largest on record. The University of Michigan's consumer confidence index survey indicates that the index will approach a historic low in 2025.

Despite subdued market sentiment, strong consumer spending is driving the economy to grow at a faster-than-expected pace, with growth projected at 4.3% in the third quarter of 2025. Moody's Analytics indicates that total spending is now more reliant on the consumption of the top 20% of U.S. earners than ever before. Fourth-quarter GDP data is scheduled for release this Friday (February 20th).

Last week's nonfarm payrolls report for January exceeded economists' expectations, offering hope for a stabilizing job market. However, the overall growth was primarily driven by the healthcare sector, which alone accounted for more than half of the net increase.

Multiple experiences can be real at the same time.

A Guardian/Harris poll conducted in December 2025 showed that nearly three-fifths of Americans believe the U.S. economy is currently in recession—a recession broadly defined as several consecutive quarters of negative GDP growth. This figure is 11% higher than a similar survey conducted in early 2025.

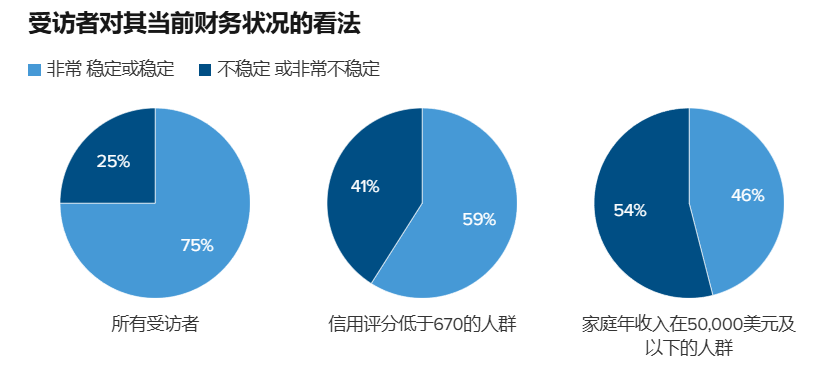

A survey by Snap Finance shows that those at the bottom of the financial food chain have a much worse economic outlook.

According to data released Wednesday, only about a quarter of respondents described their current financial situation as “unstable” or “very unstable.” However, this figure jumps to 41% among those with credit scores below 670, and rises to 54% among those with household incomes below $50,000. Snap Finance conducted the survey of over 1,400 people in December 2025.

This helps explain why public skepticism towards government economic data is growing. YouGoV found that as of August 2025, fewer Americans trust federal economic reports than distrust them, a reversal from a few months earlier. Trump fired former Bureau of Labor Statistics Commissioner Erika McEntarfer in August, implying that the agency had manipulated labor market data under her leadership.

But NerdWallet's Renter cautions against dismissing these reports as unnecessary simply because they are aggregated data and may not reflect personal feelings. She argues that these national datasets help ensure, for example, that economic grants are allocated equitably.

Renter said, “Multiple experiences can be real at the same time, and the economy may perform quite well, while millions of people feel quite uncomfortable in it.”

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.