Goldman Sachs: How U.S. fiscal concerns impact bonds, currencies, and stocks

2025-07-31 14:40:10

Goldman Sachs Research has a more cautious outlook for the U.S. economy against the backdrop of rising tariffs: our economists estimate that the average effective tariff rate will rise by about 14 percentage points in 2025, another 3 percentage points next year, and close to 20% by 2026.

How will tariffs affect the U.S. economy?

Chief Economist Jan Hatzius said on the "Break of the Game" podcast that U.S. gross domestic product (GDP) is expected to grow by about 1% year-on-year in the fourth quarter. The risk of a recession is about 30%, double the historical average.

"The economy is going to continue to struggle along, and the pace of growth is going to be quite slow," Hatzius said. The podcast was hosted by Tony Pasquariello, global head of hedge fund coverage in the Global Banking & Markets group.

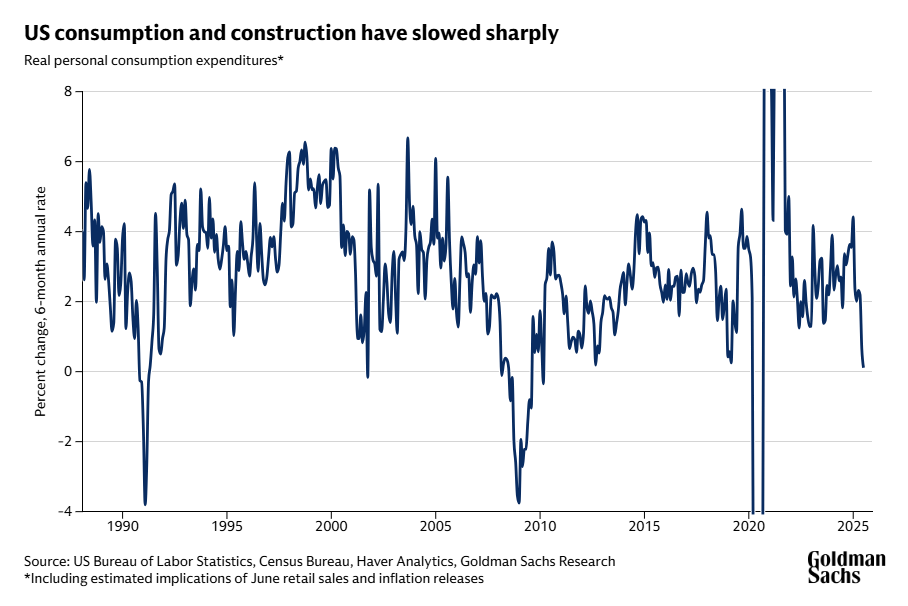

While import taxes have had little impact on prices so far, Hatzius expects core inflation to rise by about one percentage point this year, to over 3%. Rising inflation will weigh on consumer spending. "Consumer spending has softened and stagnated, which is unusual outside of a recession," Hatzius said.

Figure: U.S. consumption and construction have slowed sharply

How will the US deficit affect the national debt and the dollar?

While there are signs that investors are beginning to accept higher tariffs, the deficit issue has become a bigger focus.

“We talk about deficits all the time, but we’re more leveraged in terms of net debt than we’ve ever been in our lifetimes,” said Rob Kaplan, vice chairman of Goldman Sachs and former president and CEO of the Dallas Fed. He noted that the U.S. budget deficit of about $2 trillion, or about 6-7% of GDP, is historically high in non-recessionary times.

"When you're at full employment or close to full employment, you typically deleverage, and deficits explode in recessions," Kaplan said.

Kaplan said deficit concerns are starting to impact the prices of long-term U.S. government bonds. Investors are demanding a higher return for holding long-term government securities, known as the term premium. While Treasuries have long been a global safe haven, long-term bonds haven't rallied this year in response to lower economic growth forecasts.

“The question is: Is 10-year bonds and longer still a safe haven? It hasn’t been in recent months,” Kaplan said.

Hatzius said he had been "more optimistic" about the U.S. fiscal outlook in the past. For example, after the 2008 financial crisis, large budget deficits were accompanied by high unemployment. At the time, interest rates were well below actual (inflation-adjusted) trend GDP growth, helping to accommodate larger deficits.

"The situation has changed significantly now," he said. The economy is clearly no longer operating at low employment, and real interest rates are much higher. The interest rate on 10-year Treasury Inflation-Protected Securities (TIPS) is roughly in line with the US economy's trend growth rate. "That means we can only afford much smaller deficits," Hatzius said, noting that to stabilize the growth of the debt-to-GDP ratio, the deficit would need to be several percentage points lower than it is now.

Ashok Varadhan, co-head of Goldman Sachs' global banking and markets group, said U.S. government bond yields have risen enough to attract private investors, unlike the period from the global financial crisis to the COVID-19 pandemic when real (inflation-adjusted) interest rates were negative.

"Government bonds are no longer expensive. Sovereign debt is at a level that should attract private capital and serve as an asset class that provides diversification," Varadhan said.

Overall, Varadan expects the Treasury yield curve to steepen: As the Fed lowers its policy rate, short-term Treasury yields are likely to fall relative to long-term bonds. “The question is whether the data supports a small or large easing,” he said.

Due to fiscal concerns, many investors have become more bearish on the US dollar, and Goldman Sachs Research predicts further depreciation. However, Varadhan noted that the US isn't the only developed market with unusually large budget deficits. Goldman Sachs Research estimates that the US budget deficit this year is approximately 6% of GDP, while France's is 5.5% and the UK's is 3.6%. Varadhan suggested that assets like gold and Bitcoin could rise relative to fiat currencies.

Outlook for the US Stock Market Against the Horizon of Rising Deficits

Kaplan noted that while higher deficits could create challenges for long-term Treasury yields, net stimulus could boost GDP growth in the short term. This, combined with heavy investments in artificial intelligence, may explain why overall corporate earnings are expected to remain resilient.

Kaplan said AI's ability to boost productivity will be crucial in the coming years. Many countries have aging populations and higher-than-usual debt-to-GDP ratios, making innovation and productivity gains even more crucial.

Varadhan said he is "very bullish" on the stock market despite its record highs. The U.S. economy is benefiting from the tailwinds of deregulation, and the key will be to assess whether the U.S. can adjust trade fairly and continue to attract the best and most capable talent into its workforce.

"Companies have not even entered the first innings of implementing AI. Once companies implement it, they will reap productivity dividends," Varadhan said.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.