The U.S. July services PMI is close to the boom-bust line, and the drag effect of tariffs is prominent.

2025-08-06 09:58:42

Since returning to the White House in January 2025, the Trump administration has continued to escalate tariffs. As of July, the average tariff rate on US imports had surged from 2%-3% at the beginning of the year to 18.3%, the highest level since 1934.

Tariffs on China have been significantly increased. After adding the "fentanyl tax" and "reciprocal tariffs", the comprehensive tariff rate on Chinese goods exported to the United States has reached 145%, a record high.

The United States continues to expand its global tariff scope, imposing tariffs ranging from 10% to 41% on more than 60 economies, including Canada, Brazil, and India. Among them, Canada's automobile tariff has increased from 25% to 35%, and Brazil's agricultural product tariff has reached 50%.

Starting August 7th, new tariffs ranging from 10% to 41% were fully implemented, affecting key sectors such as consumer goods, industrial equipment, and pharmaceuticals. These policies directly led to a 16% narrowing of the US trade deficit to $60.2 billion in June, while the trade deficit with China shrank 70% to $9.5 billion over five months. However, total imports fell to $337.5 billion (the lowest level since mid-pandemic), highlighting the inhibitory effect of tariffs on cross-border commodity flows.

The new tariff environment has potential impact on the service industry

Businesses are facing additional tariffs on imported raw materials, such as medical equipment and construction materials, and are being forced to postpone projects or squeeze profits. Healthcare providers are facing increased equipment procurement costs, forcing them to "postpone other projects to adjust to the cost changes."

Tariffs have led to the restructuring of the global logistics chain. The supplier delivery index has been above 50 for seven consecutive months in the first seven months of 2025, indicating that supplier delivery time has been extended, which may inflate the ISM service industry index, but the actual economic momentum has been concealed.

Companies are facing both layoffs and recruitment difficulties. On the one hand, tariffs are driving up operating costs, forcing companies to reduce employment (for example, the employment index has contracted to 46.4, the fourth time in five months). On the other hand, skilled positions are difficult to fill due to talent shortages, creating a distorted situation of "unemployment and vacancies coexisting."

Actual data on the impact on the service industry in July

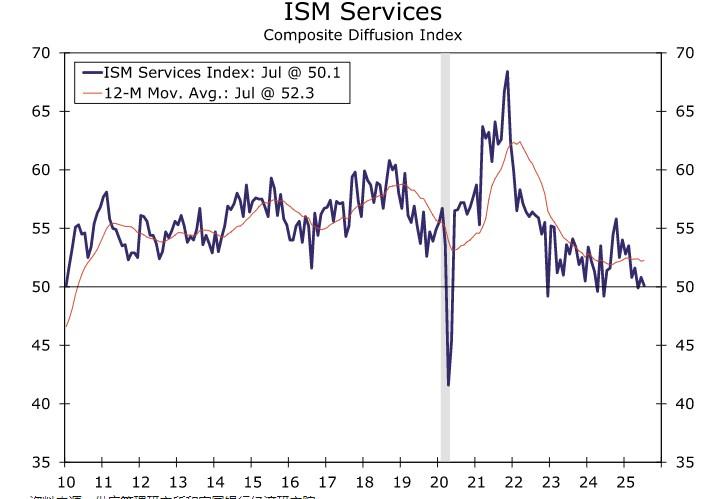

The ISM services index fell from 50.8 in June to 50.1, which is the critical point from expansion to contraction. It is the third lowest reading since the outbreak in 2020 and is only slightly above the boom-bust line.

The employment index fell to 46.4, the third lowest since the outbreak. There was a wave of layoffs in industries such as construction and medical care, but recruitment difficulties still exist, and "it is difficult to fill positions after losing service technicians."

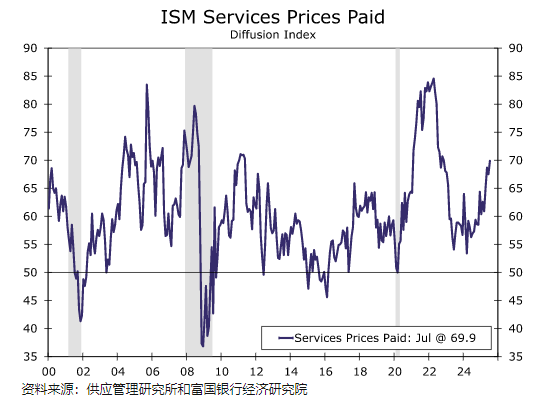

The price paid index, reflecting changes in prices paid by service sector firms for inputs, surged to 69.9, its highest level since late 2022. A reading above 50 indicates rising prices, with higher readings indicating greater inflationary pressure.

In the tourism industry, the number of international tourists decreased by 12% year-on-year, summer bookings decreased by 10%, and the profitability of small and medium-sized tourism enterprises dropped from 41% to 32%. Port transportation stagnated, with one-third of the Port of Los Angeles' operations suspended, and rising logistics costs dragged down the supply chain.

Tariffs may become the core driving force

The July ISM index showed that the service industry only maintained "creeping growth", with the three core sub-items of business activities, new orders and employment all hitting new lows.

High tariffs have already triggered the risk of stagflation—a phenomenon in which inflation in the service sector coexists with shrinking employment. A Yale University study indicates that if tariffs persist, the probability of a US recession in 2025 will exceed 50%. Corporate financial reports indicate that General Motors has lost $1.1 billion due to tariffs, and Caterpillar projects losses of $1.5 billion by 2025. Tariffs are impacting the service sector through both cost transmission and demand suppression.

The "double-edged sword" effect of Trump's tariff policy has spread from the trade field to the service industry, which accounts for two-thirds of the US economy.

While short-term data suggests a narrowing trade deficit and GDP growth, deeper challenges such as surging business costs, a deteriorating job market, and supply chain distortions are eroding the economy's foundations. If tariffs persist, the US economy could face a long-term dilemma of high inflation and low growth.

US Dollar Index

In the short term, the market is strengthening expectations that the Federal Reserve will maintain high interest rates, driven by tariffs and the high inflation rate. The interest rate differential is supporting the dollar's volatility and strength. However, the manufacturing PMI has fallen to 48%, and the services PMI is approaching the boom-bust line. Coupled with Yale University's forecast of a recession probability exceeding 50%, the risk of a long-term recession may trigger expectations of interest rate cuts, potentially limiting the dollar's potential for recovery.

gold

High inflation (price paid index of 69.9) and recession risks create a "stagflation" combination, benefiting gold as both a safe-haven asset and an anti-inflation tool. Gold prices are expected to continue to fluctuate at high levels.

Other currencies

USD/EUR: Eurozone manufacturing PMI tends to recover (Germany 50.6), limiting the rebound space.

USD/JPY: Risk aversion may push up the yen in the short term, but the Bank of Japan's loose monetary policy will suppress the rise and it will remain under pressure in the medium and long term.

commodity

Crude oil: Supply and demand are strong in the near term and weak in the long term, but the risk of a US economic recession suppresses demand expectations, and the long-term trend is bearish.

Industrial metals: Copper tariffs have led to supply chain disruptions and rising costs, which, coupled with declining demand, have put pressure on domestic prices in the United States.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.