Bond market warning! Credit bonds are facing a frenzy of short selling. What kind of storm is hidden beneath the new highs of US stocks?

2025-08-11 16:49:10

In interviews and client research, global asset managers and some large banks warned that credit bond pricing already reflects an economic outlook this year that is much stronger than official forecasts.

"We have largely moved to a defensive stance on developed market credit," said Mike Riddell, lead portfolio manager of bond strategy at Fidelity International. "We have zero exposure to cash bonds and are short high yield.

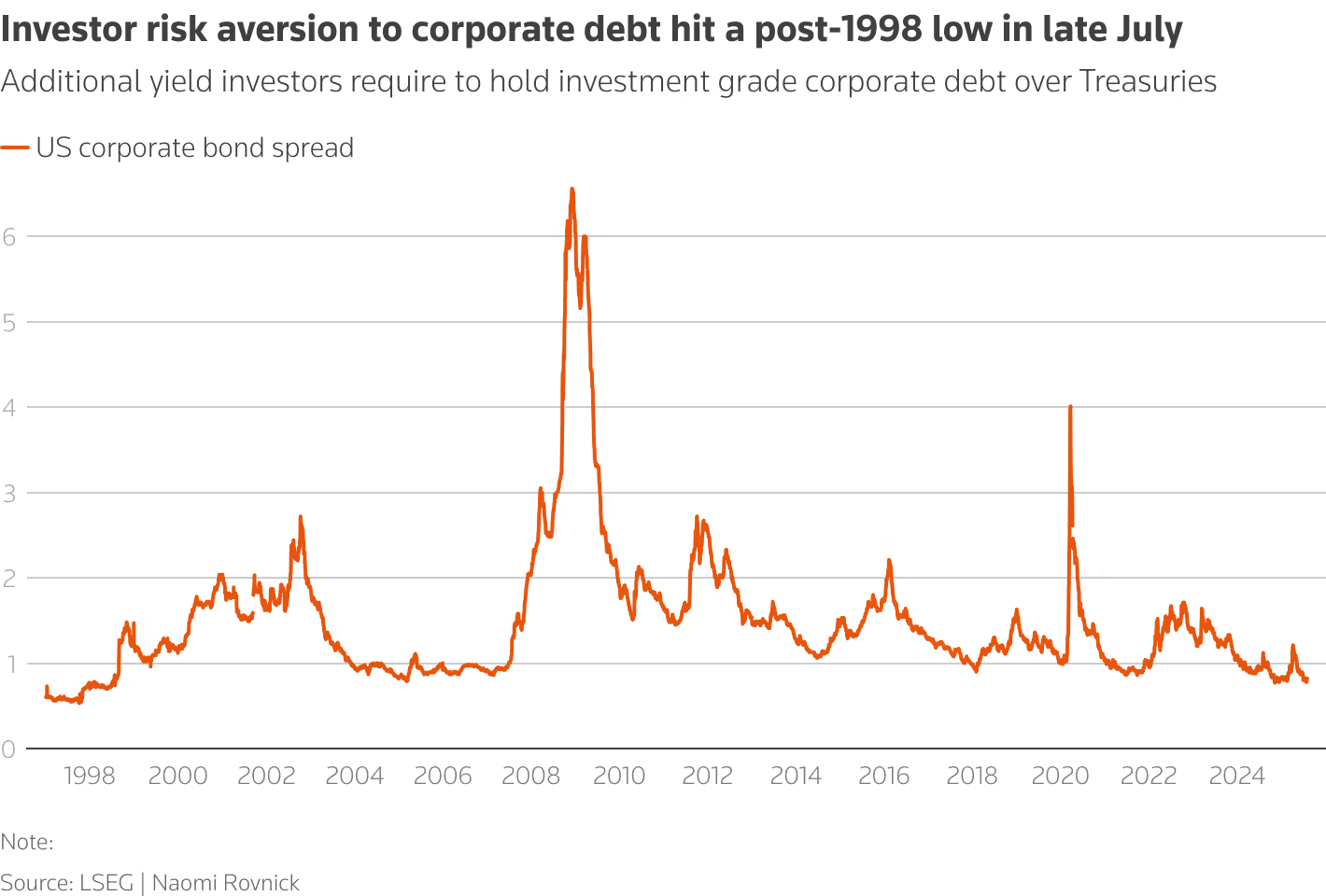

Credit spreads, a key measure of corporate bond valuations, fell to just one basis point above their 1998 low on July 29, a Reuters analysis showed.

Global stock markets are rallying, with European shares set for their biggest weekly gain since late April and Wall Street nearing record highs, but investors and analysts say a decline in risk appetite for credit bonds is the strongest evidence yet that the rally is overdone.

Investors' risk appetite for corporate bonds fell to its lowest level since 1998 at the end of July.

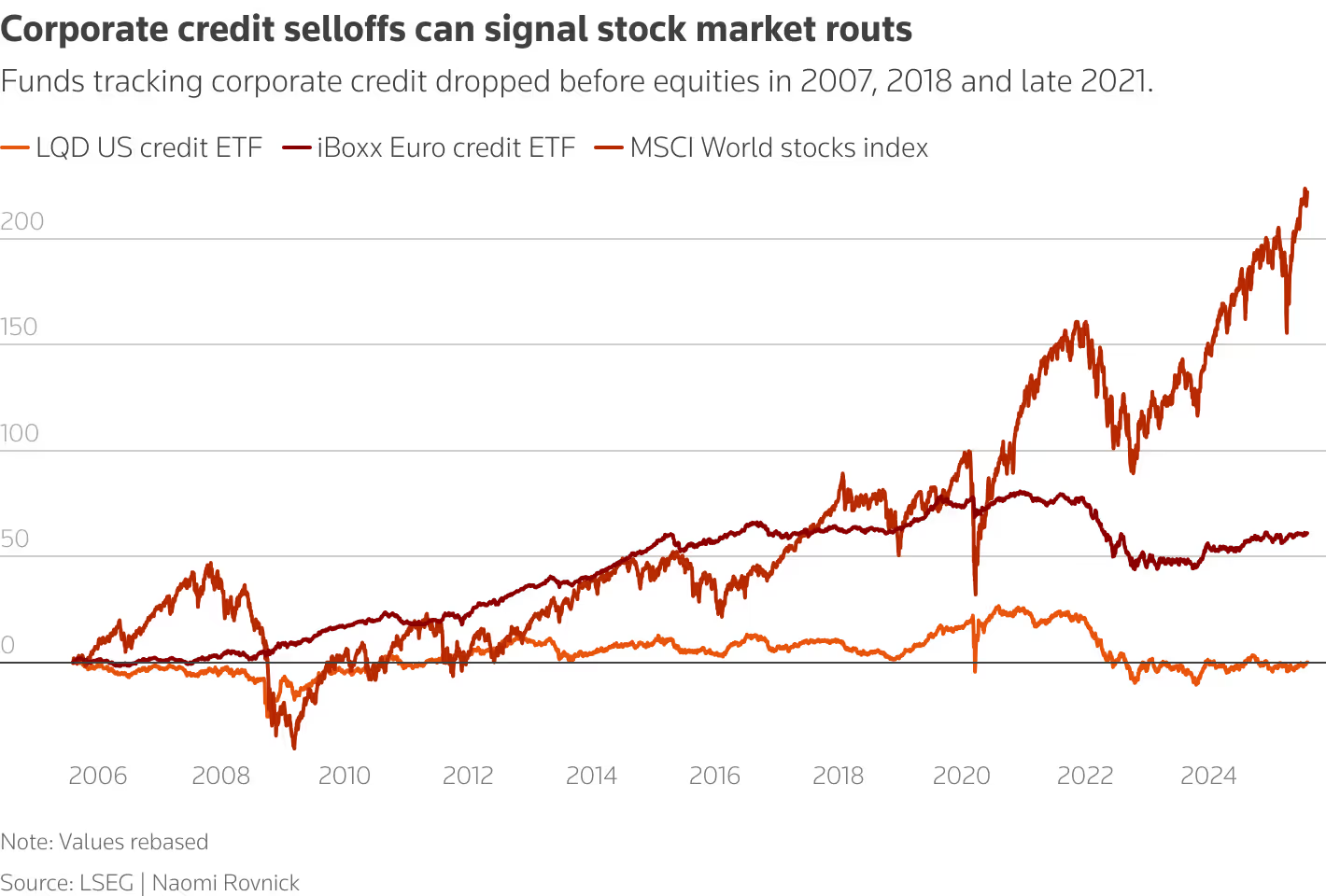

Credit bonds outperform other markets

A popular investment tracking high-rated corporate bonds led a period of decline in global stocks before the Sino-U.S. trade war triggered an economic downturn in 2018, the chaotic interest rate hikes in 2022, and a similar shock in late 2023.

Stuart Kaiser, head of U.S. options strategy at Citigroup, said that in the past few weeks, the bank's derivatives trading desk has begun to see a surge in demand from asset management clients for products that short the iShares index or the junk bond index HYG. He also said, "This may indicate that macro investors have some view on the future direction, or suggest that they are hedging against the rise of risky assets." "The fact that people are hedging credit risk suggests that they believe there will be a reasonable correction in the stock market over the next three months."

The picture shows a sell-off in corporate credit bonds, which may indicate that the stock market is about to crash.

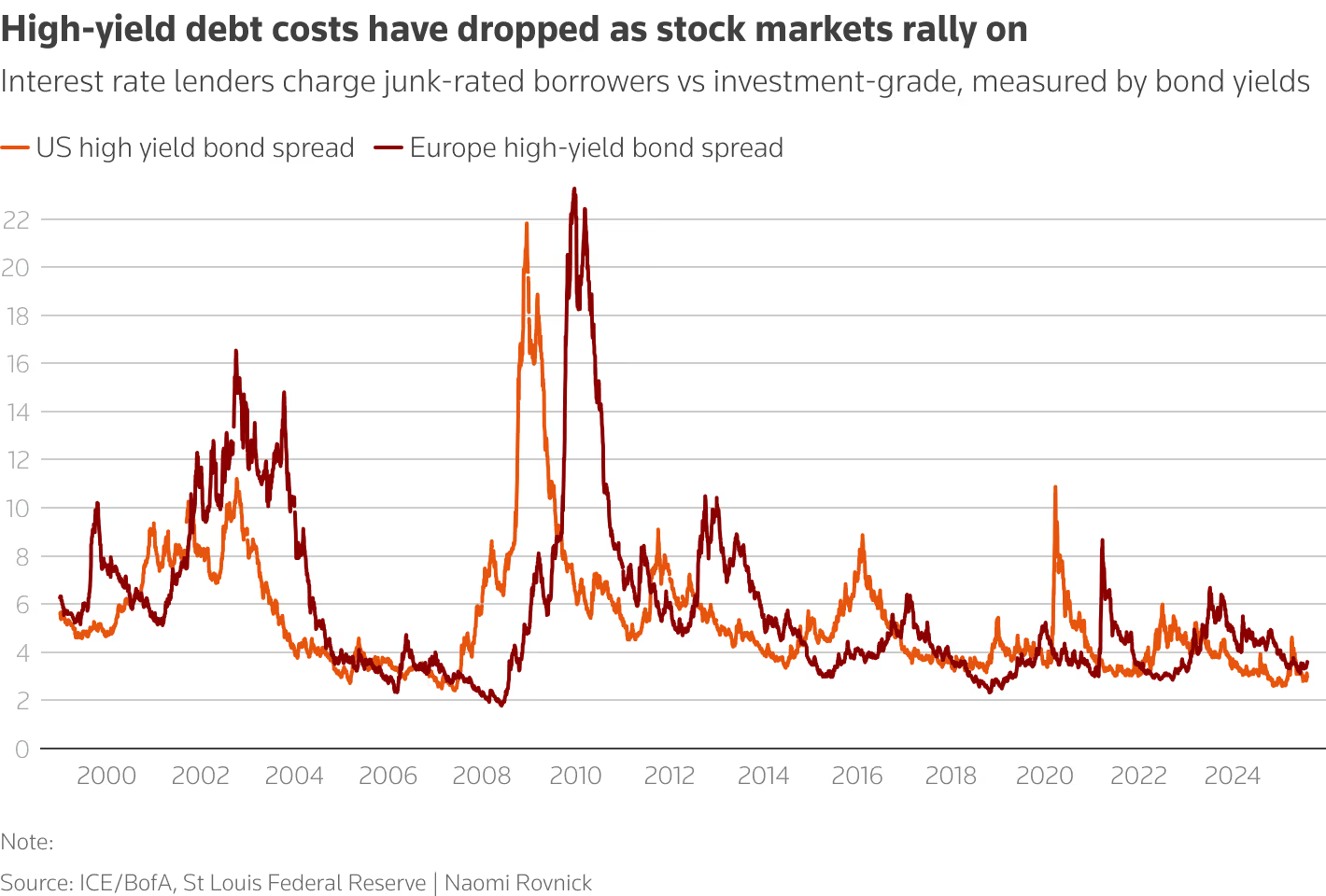

Guy Stear, head of developed market strategy at Amundi Investment Institute, said high-yield bonds, dominated by borrowers from growth sectors, are at greatest risk of a correction, potentially impacting the stock market. He said he expects rising tariff-related costs and cash flow issues to drive a sharp rise in high-yield refinancing costs and default rates as early as October, raising concerns about employment, investment, and growth. "When credit markets eventually come under pressure, so will equities," he said.

The figure shows that the cost of high-yield bonds has fallen while the stock market is still rising.

Overall, current credit spreads reflect global economic growth expectations close to 5%, well above current levels, UBS strategist Matthew Mish said in a client note.

The International Monetary Fund (IMF) predicts that the global economy will grow by 3% this year.

“Investment-grade bond pricing reflects a scenario where economic growth will be just right, neither too hot nor too cold,” said Van Luu, head of global fixed income and currency strategy at Russell Investments. He believes this pricing is inaccurate, so he has adopted an underweight strategy on credit bonds.

The IMF predicts a 40% chance of a U.S. recession, and if the dollar depreciates, risks to other major economies will also rise.

“Many risk assets are pricing in higher growth prospects than we anticipate,” UBS’s Mish wrote in a client note this week. “The credit market, however, is an exception.”

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.